Simple Comprehensive Income Equation

Comprehensive income is the variation in a companys net assets from non-owner sources during a specific period.

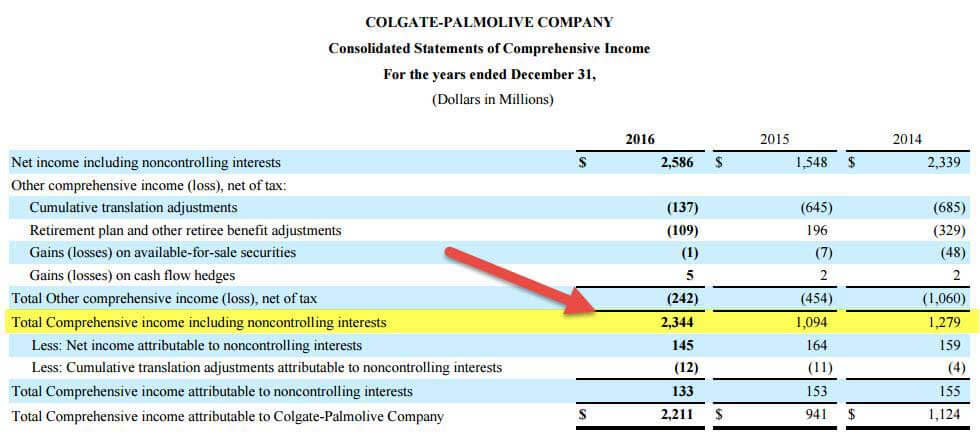

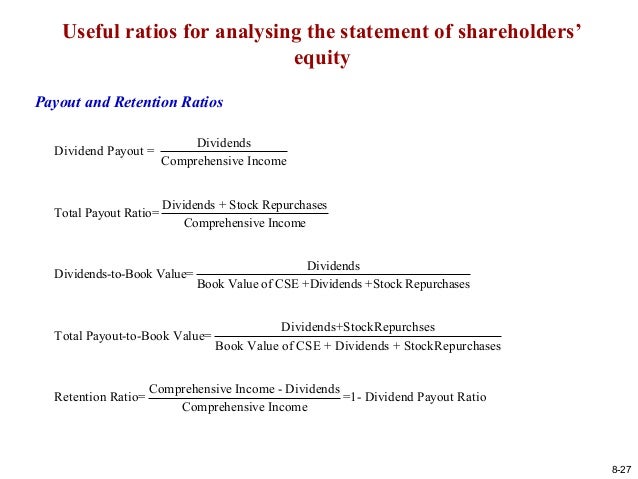

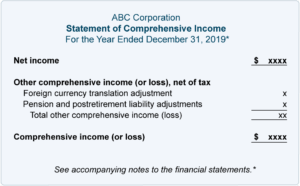

Comprehensive income equation. Income statement formulas are ratios you can calculate using the information found on a companys income statement. OCI represents the balance between net income and comprehensive income. Total comprehensive income is therefore equal to net income other comprehensive income 50 million 25 million 75 million.

Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Comprehensive Income Gross Profit Margin Operating Expenses - Other Income items - Discontinued Operations add if savings subtract if loss. It summarizes all the sources of revenue and expenses including taxes and interest charges.

One of the most important components of the statement of comprehensive income is the income statement. Gains and Losses on items that are not allowed to flow from the income statement are included in the Statement of Comprehensive Income. This video explains how to use financial information to complete a statement of comprehensive income.

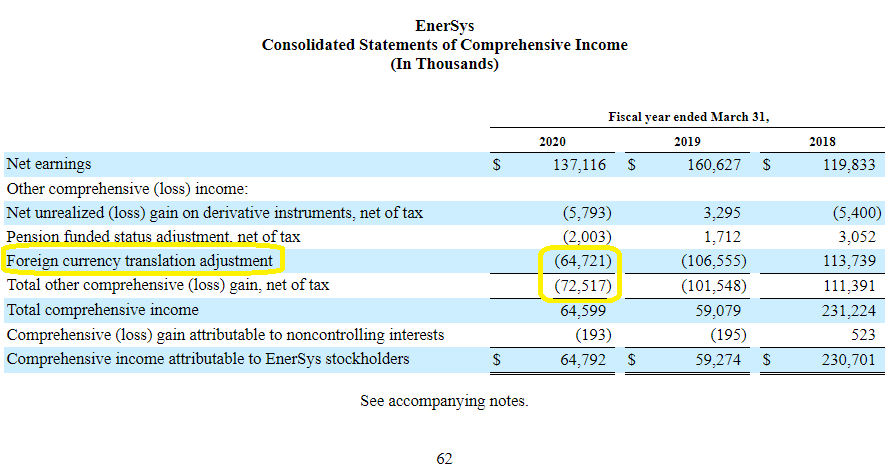

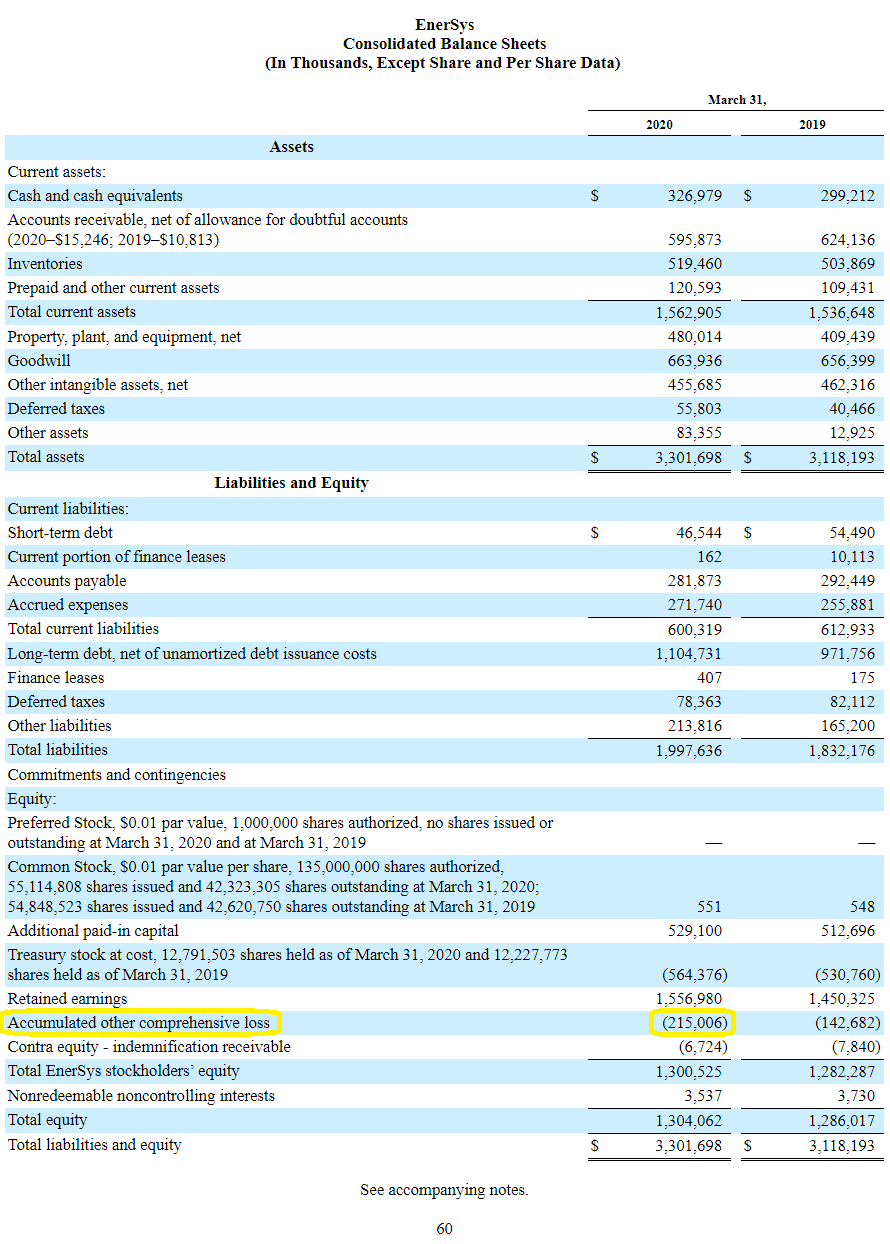

Net income or net earnings from the companys income statement Other comprehensive income which consists of positive andor negative amounts for foreign currency translation and hedges and a few other items. The statement of comprehensive income covers the same period of time as the income statement and consists of two major sections. There is a formula to calculate comprehensive income.

Gross Profit Margin Revenue COGS. When you are making these calculations it can help to have an easy-to-reference summary sheet on hand. Comprehensive Income Net Income Other Comprehensive Income OCI.

A common example of OCI is a portfolio of bonds that have not yet matured and consequently havent been redeemed. Comprehensive Income Formula Use the following comprehensive income formula. Interest is found in the income statement but.