Smart Debit Side Of Balance Sheet

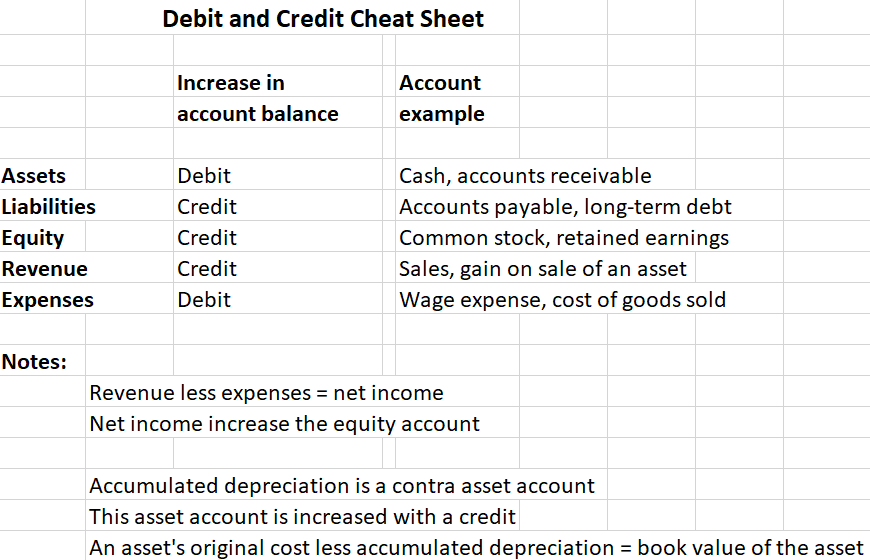

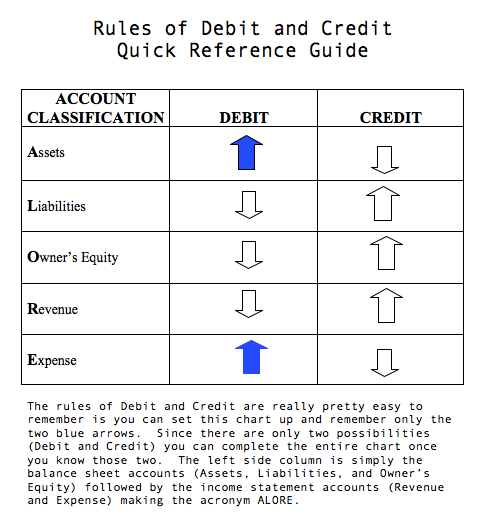

Whether a debit or credit can either increase or decrease an overall account balance is determined by the account type that is receiving the credit or debit transaction.

Debit side of balance sheet. Include the balance for each. The term debit refers to the left side of an account and credit refers to the right.

Ledger accounts are maintained in respect of every component of the financial statements. When the company sells an item from its.

Debits must always be on the left side or left column and credits must always be on the right side or right column. Classification of Assets and Liabilities.

In fundamental accounting debits are balanced by credits. With that in mind we can easily determine that the second account paid-in capital will be credited for 100 euros. Borrower debit side of a balance sheet 借方 jie4 fang1 bed sheet envelope for a padded coverlet.

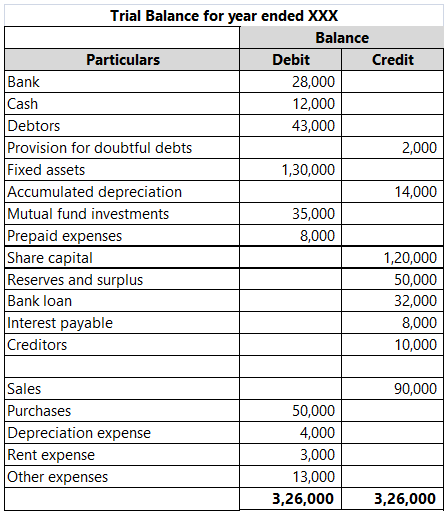

Debit entries are made on the left side of the ledger account whereas Credit entries are made to the right side. Items that appear on the debit side of trial balance Generally assets and expenses have a positive balance so they are placed on the debit side of trial balance. This means an increase in these accounts increases shareholders equity.

The debit falls on the positive side of a balance sheet account and on the negative side of a result item. Accounts that normally have a debit balance include assets expenses and losses. Refer to the image below Debit Side Indirect Expenses Credit Side Indirect Incomes Net Profit is transferred to the Capital Account and shown on the Liability side of a balance sheet.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)