Ideal Due From Account On Balance Sheet

The two sides must balancehence the name balance sheet.

Due from account on balance sheet. A separate note receivable account should be created and named Due from Shareholder to separate this type of receivable from other receivables from the ordinary course of business. When a shareholder takes a loan from the company the loan is recorded as a note receivable on the balance sheet and the cash account is decreased by the amount of the loan. Income statement or otherwise called PL profit and loss accounts are accounts related to expense and revenue items.

The balance sheet method also known as the percentage of accounts receivable method estimates bad debt expenses based on the balance in accounts receivable. With the account form it is easy to compare the totals. Balance sheet accounts are also referred to as permanent or real accounts because at the end of the accounting year the balances in these accounts.

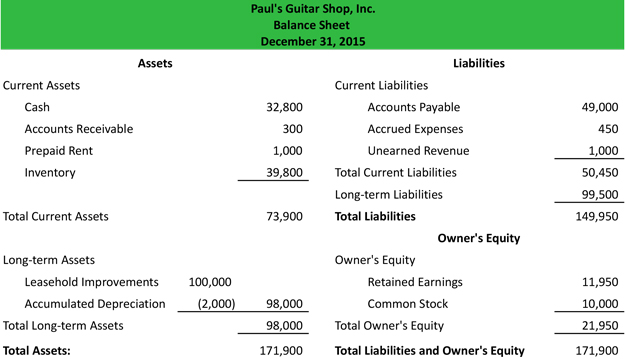

Example of a balance sheet using the account form In the account form shown above its presentation mirrors the accounting equation. The method looks at the balance of accounts receivable at the end of the period and assumes that a. It shows figures for.

The funds can be currently due or due at a point in. A due to account is a liability account typically found inside the general ledger that indicates the amount of funds payable to another party. The balance sheet equation.

This accounting equation is the key to the balance sheet. In the current assets section due to shareholder amounts may artificially inflate current assets if you plan to convert them to bonuses dividends or management fees at year-end at which time they become expenses of the business. The balance sheet forms part of your statutory annual accounts.

A due from account tracks assets owed to a company and is not used for the tracking. Assets Liabilities Owners Equity. Account Code Account Title BALANCE SHEET ACCOUNTS ASSETS CURRENT ASSETS CASH Cash on Hand 101 Cash in Vault 102 Cash - Collecting Officers.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)