Fine Beautiful Equity Method Cash Flow Statement

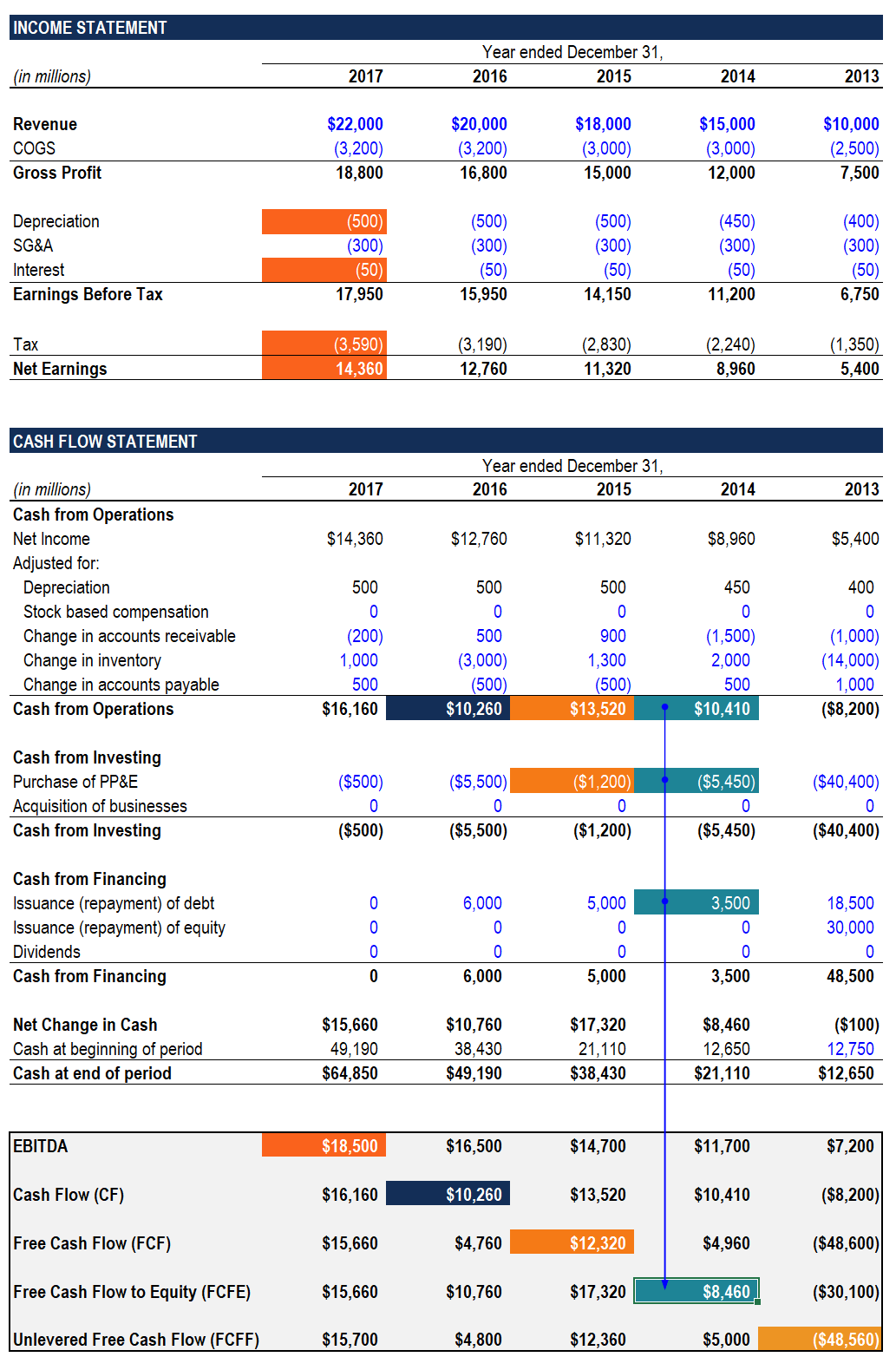

Changes in stockholders equity can lead to cash inflows or outflows depending on the specific activity.

Equity method cash flow statement. Stockholders Equity 1915000 1660000 Total Liab SE. The subsequent financing accounts cash for example must go down by the purchase amount. A statement of cash flows uses information from the income statement and balance sheet to identify how a company receives and uses cash.

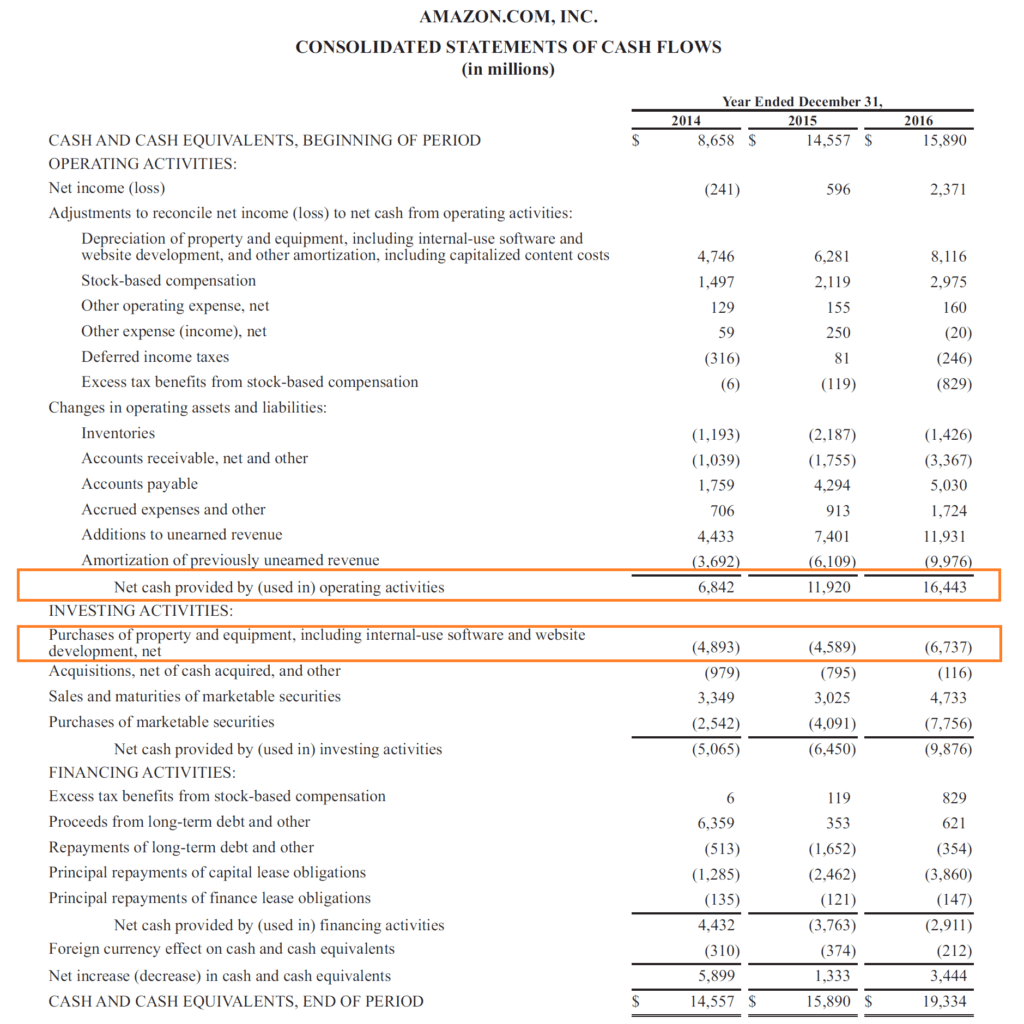

Where proportionate consolidation is used the cash flow statement should include the venturers share of the cash flows of the investee IAS 737. The statement of cash flows is prepared by following these steps. An addition to net income in the operating activities section.

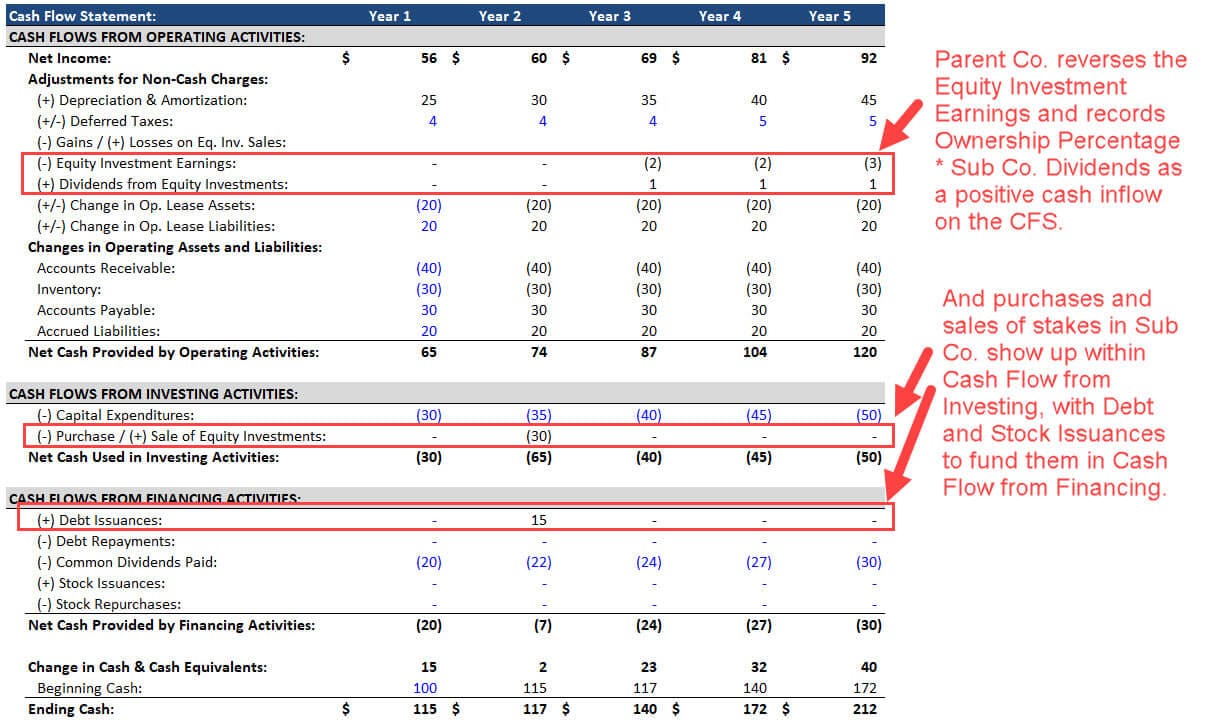

This video shows the effect of an Equity Method investment on the Statement of Cash Flows. And record Debt or Stock issuances for additional purchases in Cash Flow from Financing. When the investor recognizes a share of the investees Net Income.

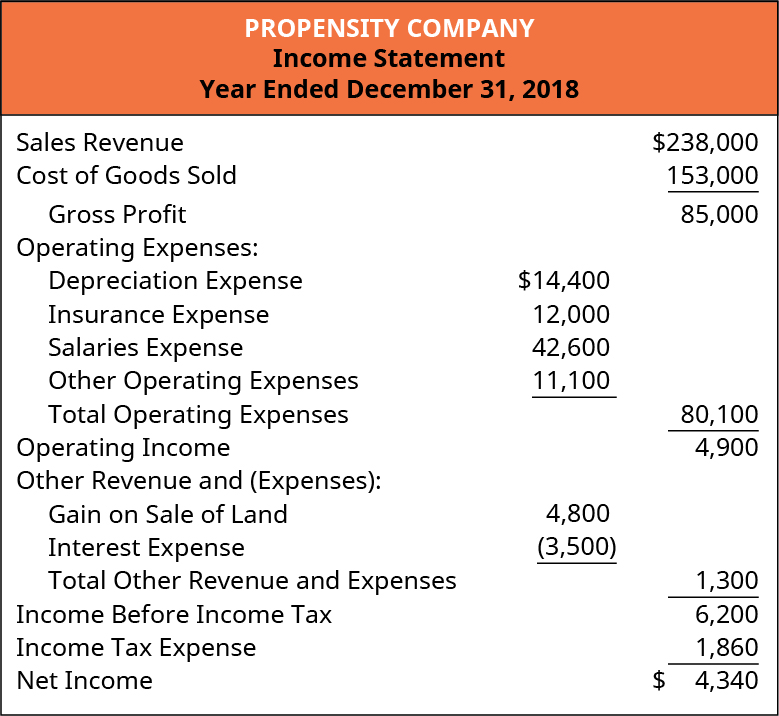

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. It is used when the investor holds significant influence. Cash Flow Issue Summary of Amendments Distributions Received from Equity Method Investees When a reporting entity applies the equity method it should make an accounting policy election to classify distributions received from equity method investees using either of the following approaches.

Begin with net income from the income statement. Using the indirect method operating net cash flow is calculated as follows. Investor Influence The level of investor influence a company holds in an investment transaction determines the method of accounting for said private investment.

The cash flow statement measures how well a. Cash Flow Statement Direct Method. A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)