Spectacular Ias 36 Standard

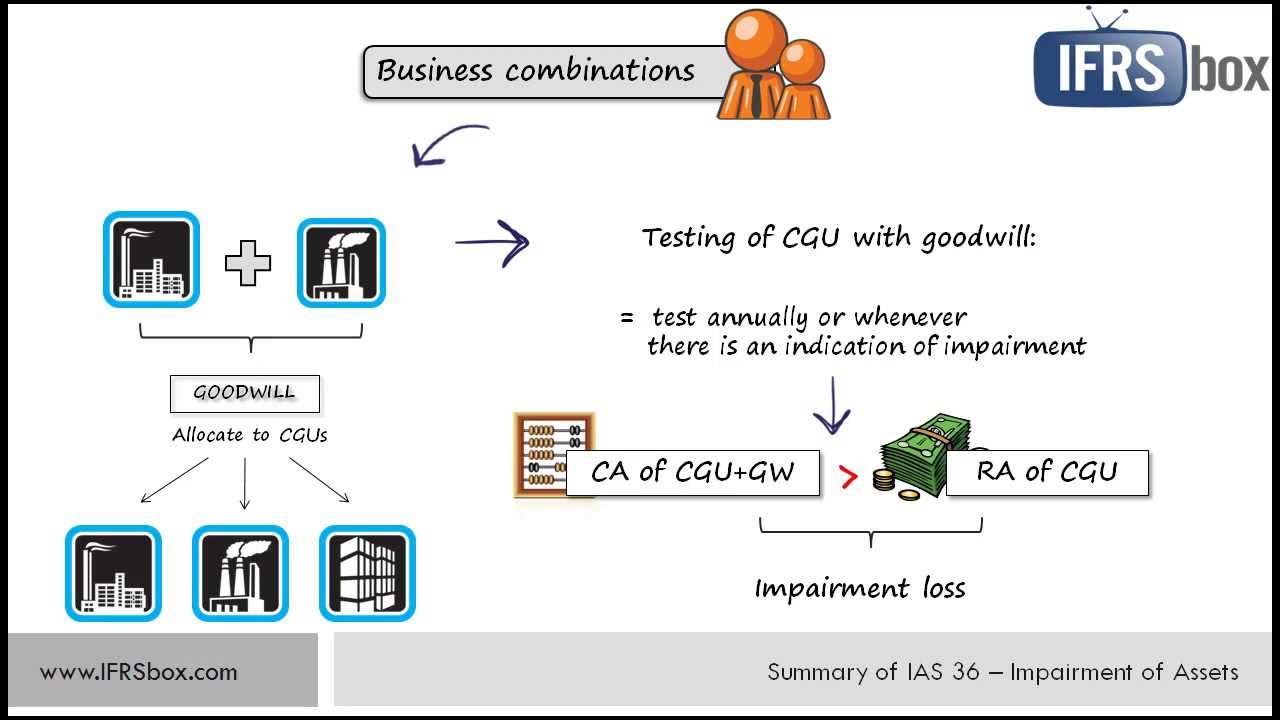

A on acquisition to goodwill and intangible assets acquired in business.

Ias 36 standard. The amount of economic benefits is the recoverable amount as per IAS 36 terminology. Financial instruments and inventories and IAS 36 is therefore predominately applicable to property plant and equipment. BASIS FOR CONCLUSIONS ON IAS 36 available on the AASB website Australian Accounting Standard AASB 136 Impairment of Assets as amended is set out in paragraphs 1 137 and Appendix A.

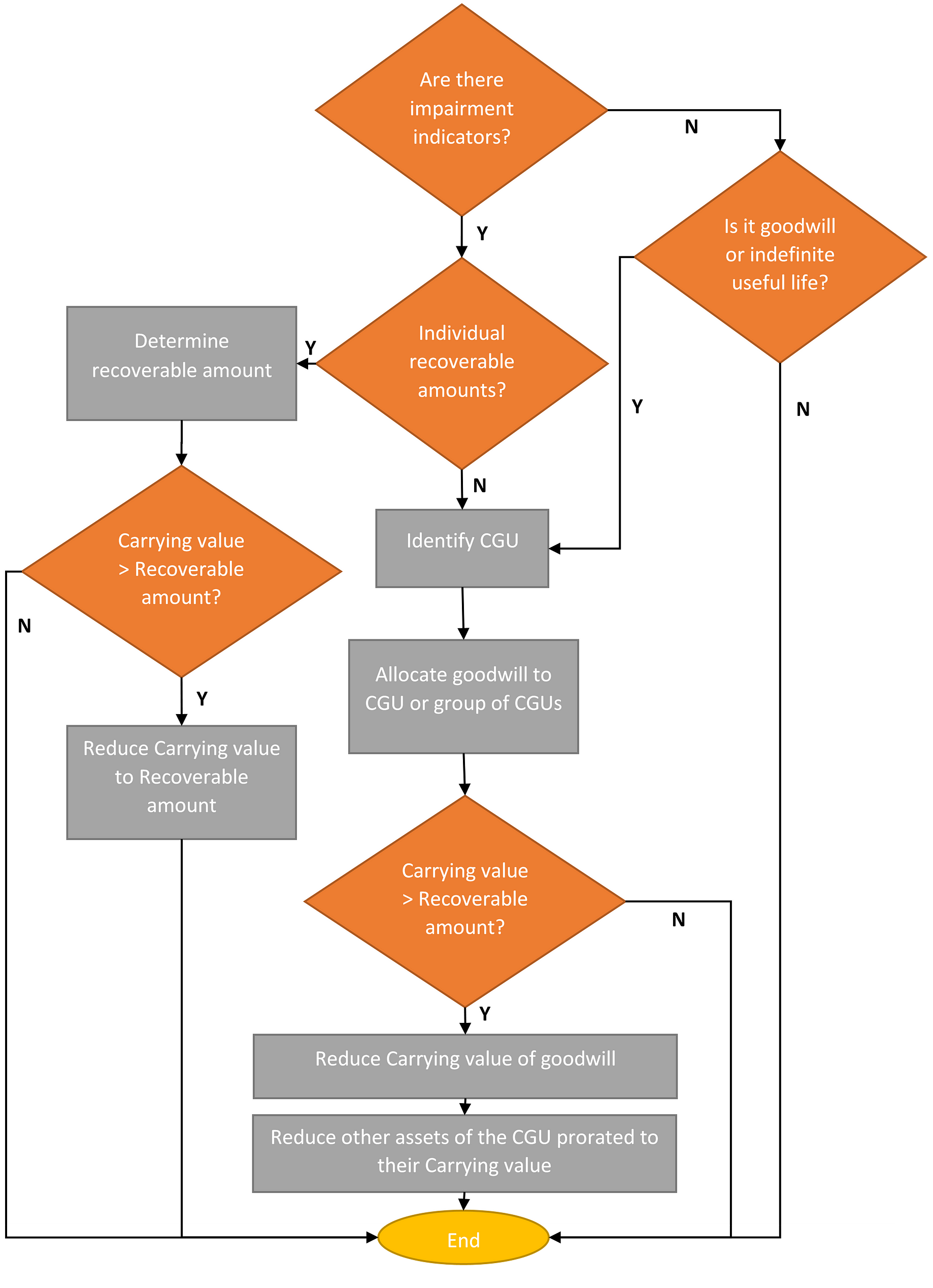

IAS 36 should be read in the context of its objective and the Basis for Conclusions the Preface to. A guide to applying IAS 36 in practice International Accounting Standard 36 Impairment of Assets IAS 36 the Standard is not new. INTRODUCTION IAS 36 Impairment of Assets sets out requirements for impairment which cover a range of assets and groups of assets termed cash generating units or CGUs.

An asset is carried at more than its recoverable amount if its carrying amount exceeds the amount to. AASB 136 is to be read in the. Fair value less costs of disposal and.

If an assets recoverable amount is less than its carrying value then the asset is impaired and IAS 36 requires that an. That standard consolidated all the requirements on how to assess for recoverability of an asset. Under IAS 36 the carrying amount of assets in the statement of financial position should not be higher than the economic benefits expected to be derived from them.

Introduction to IAS 36 - Impairment of Assets 1 International Accounting Standard 36 Impairment of Assets IAS 36 replaces IAS 36 Impairment of Assets issued in 1998 and should be applied. A guide to applying IAS 36 in practice i Impairment of Assets International Accounting Standard 36 Impairment of Assets IAS 36 the Standard is not new. NZ IAS 36 Impairment of Assets For-profit Requires an entity to recognise an impairment loss if its assets are carried at more than their recoverable amount specifies when an entity should reverse an impairment loss and prescribes disclosures.

In fact the Standard was first issued in 1998 and later revised in 2004 and 2008 as part of the International Accounting Standards Boards IASBs work on. Recoverable amount is the amount that an entity could recover through use or sale of an asset. Recoverable amount is the higher of an assets IAS 366.