Fabulous Impairment Cash Flow Statement

However it directly affects the income statement and balance sheet directly.

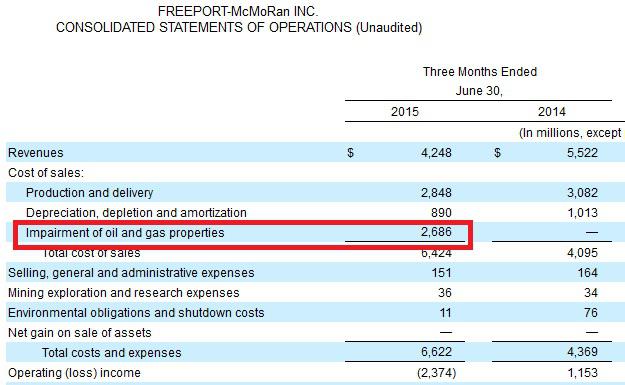

Impairment cash flow statement. Impairment of Assets under IFRS. The only change to cash flow would be if there were a tax impact but that would generally not be the case as impairments are generally not tax-deductible. Merchandise deterioration may come from adverse operating events as varied as fire bad weather a shipping process gone awry and goods decay.

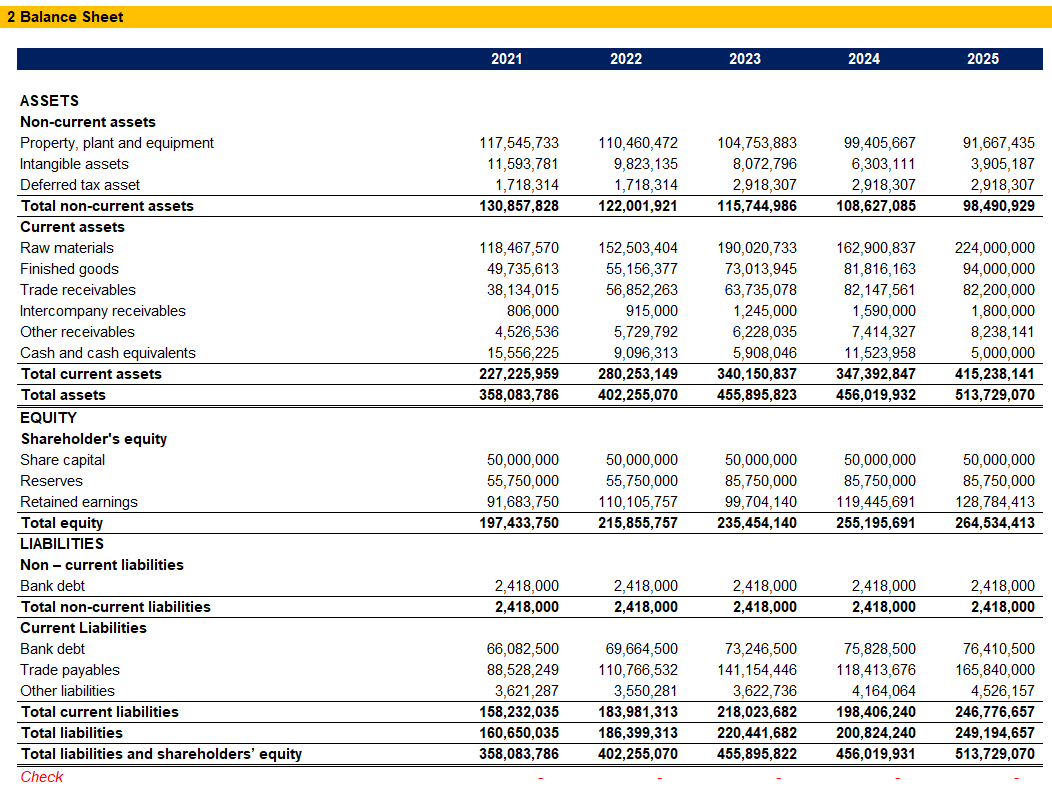

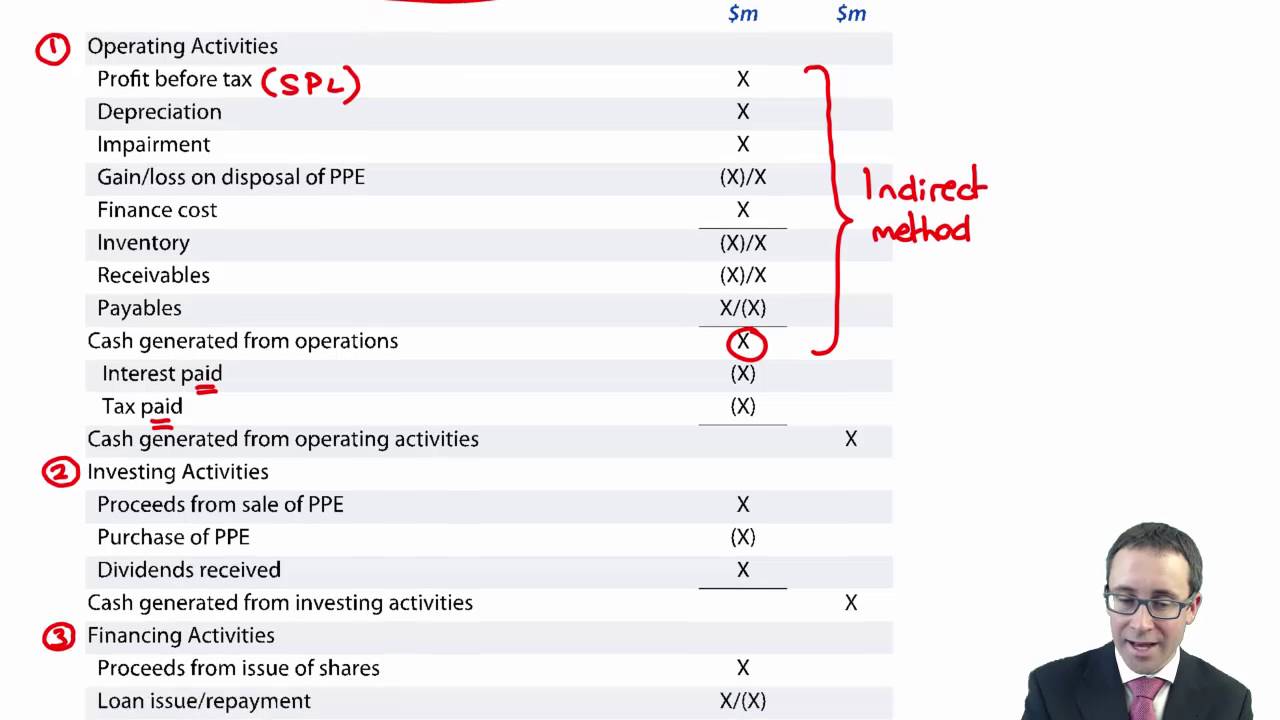

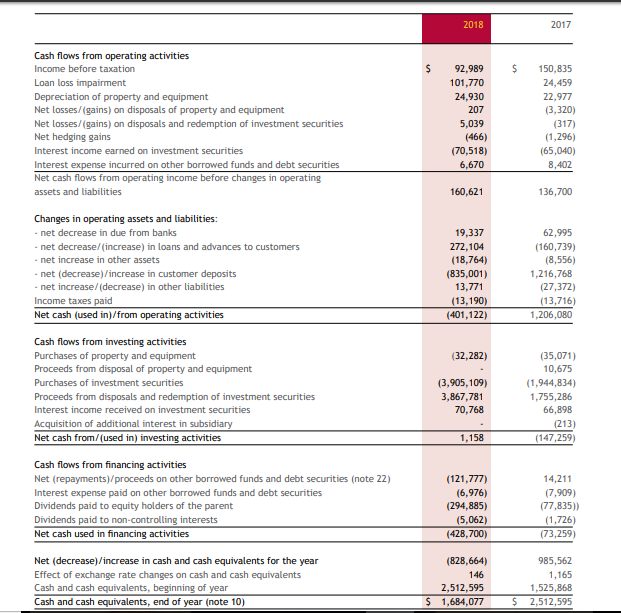

Impairment losses are non-cash expenses like depreciation so in the cash flow statement they will be added back when reconciling operating profit to cash generated from operating activities just like depreciation again. If an asset is revalued upwards or impaired this may be recorded in the statement of comprehensive income depending on the treatment under IAS 36 Impairment of Assets. Statement of Cash Flows also known as Cash Flow Statement presents the movement in cash flows over the period as classified under operating investing and financing activities.

The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. When cash flow statement is prepared the amount of impairment ie. The cash flow statement also.

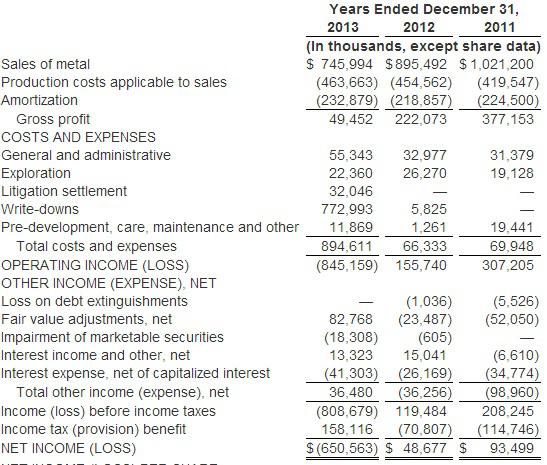

An impairment loss makes it into the total operating expenses section of an income statement and thus decreases corporate net income. Businesses recognize impairment when the financial statement carrying amount of a long-lived asset or asset group exceeds its fair value and is not recoverable. How do you record an impairment loss.

Follow IAS 17 cash flow classification and continue modelling the cash flows as before treating the lease payments including interest as a cash outflow in the determination of the 5free cash flow to the firm. If the impairment or reversal of impairment affects the net profit before tax figure it should be adjusted as if it never happened when preparing the statement of cash flows. In accounting impairment describes a permanent reduction in the value of a companys asset typically a fixed asset or an intangible asset.

In the statement of cash flows they report 22136 million of cash gains attributed to apparently positive goodwill impairment in the value of companies they acquired. Assets are generally subject to an impairment. The company did not buy or sell any bitcoin during the second quarter but recorded bitcoin-related impairment of 23 million.

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)