Breathtaking Negative Cash Flow From Financing Activities Cost Accounting Formulas With Examples

The cash flow statement records the cash-ins and cash-outs of a business in a certain period.

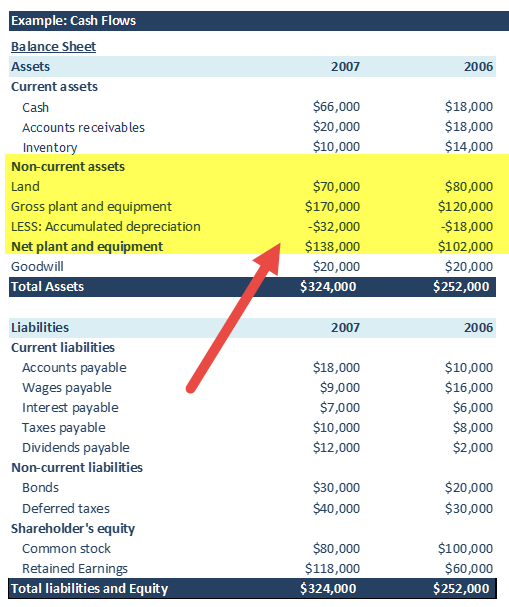

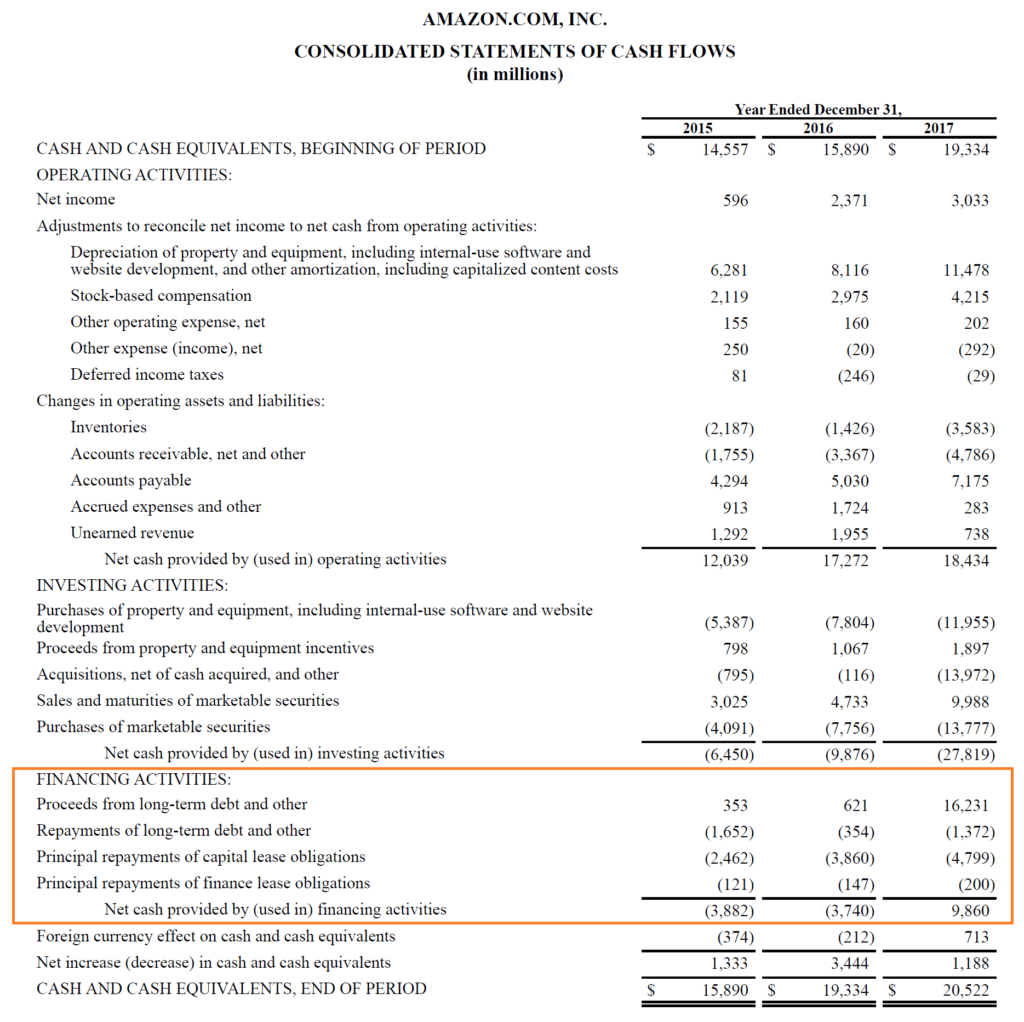

Negative cash flow from financing activities cost accounting formulas with examples. The cash flow statement consists of the cash flow from operating investing and financing activities. A definition of cash budget with examples. Let us have a look at how this section of the cash flow statement Cash Flow Statement Statement of Cash flow is a statement in financial accounting which reports the details about the cash generated and the cash outflow of the company during a particular accounting period under consideration from the different activities ie operating activities investing activities and financing activities.

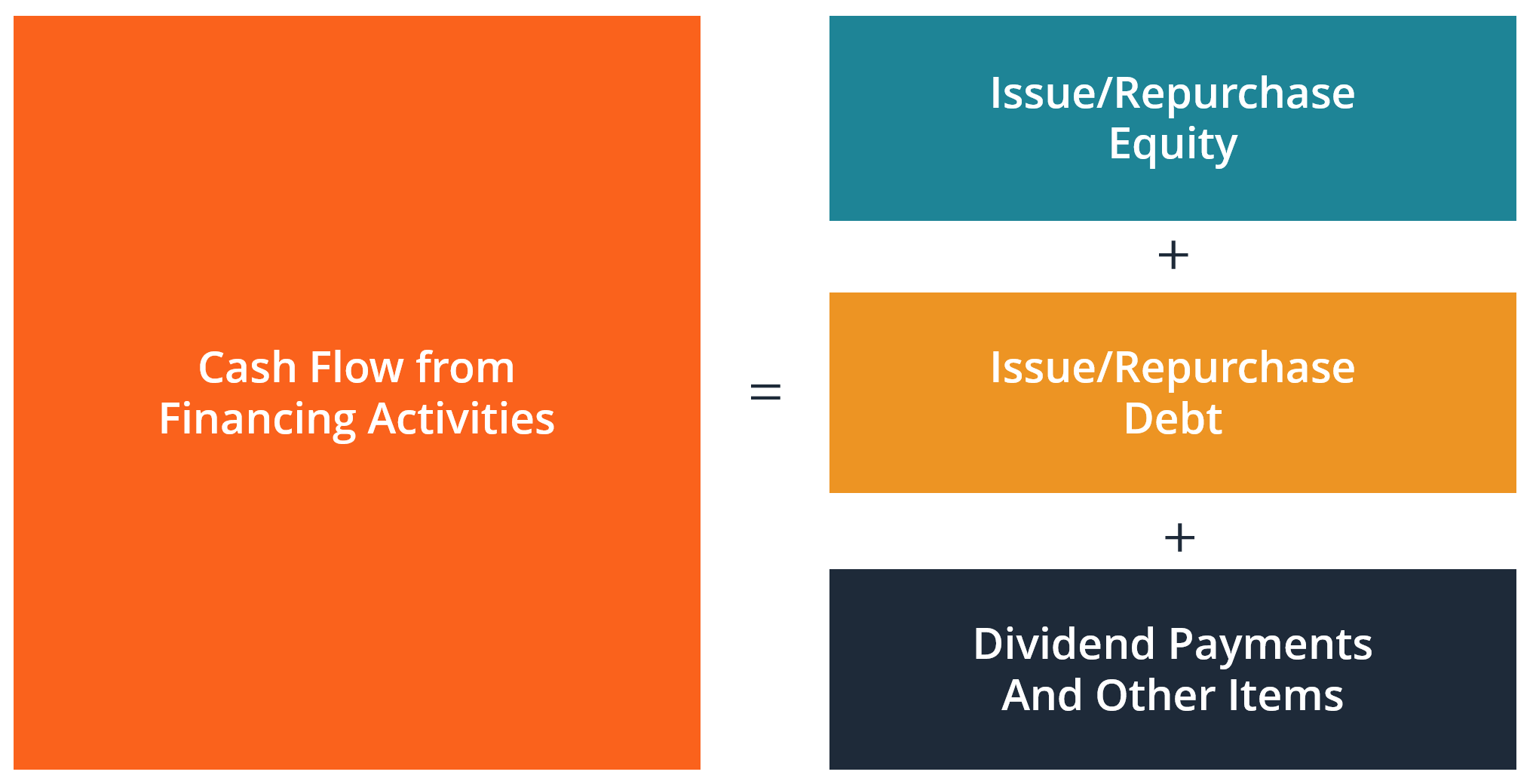

The net cash flow formula helps reveal if a business is performing well or in danger of going bankrupt. Cash flow from financing activities is a section of the cash flow statement which gives an overview of all cash entering and leaving the business over a set periodThe cash flow from financing activities section in particular relates to the cash activities that deal with debt and equity. Repeated periods of positive net cash flow are a good sign that your business is ready to expand whereas repeated periods of negative net cash flow can be a sign that your business is struggling.

Cash flows mean the inflows and the outflows of cash and cash equivalents. The investors and creditors for non-trading liabilities such as long-term loans bonds payable etc. A cash budget is an estimate of cash flows for a period that is used to manage cash and avoid liquidity problemsThis involves estimates of revenue costs and financing activities as they occur at points in time.

These activities involve the flow of cash and cash equivalents between the company and its sources of finance ie. By cash we mean cash on hand and demand deposits. Free cash flow formula.

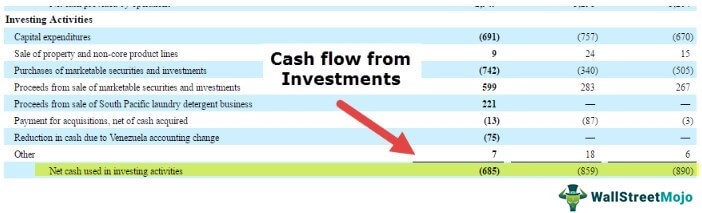

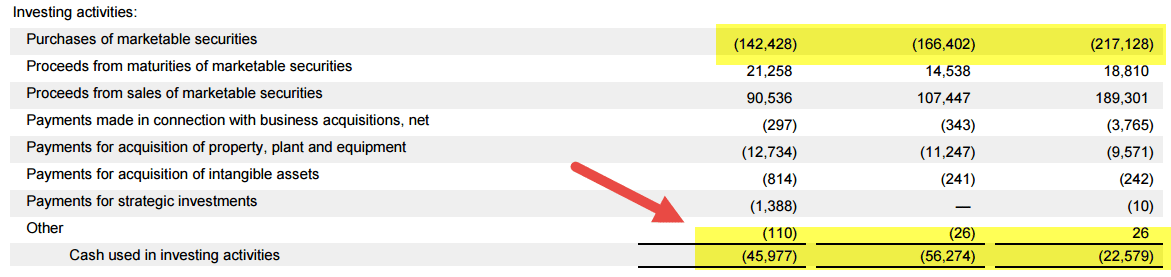

One of the most common and important cash flow formulas is free cash flow or FCF. The net cash used in investing activities was calculated by subtracting the positive cash flow of 1395 Million with the negative cash flow of 25431 Million. Examples of common cash.

Cash Flow for Month Ending July 31 2019 is 500 once we crunch all the numbers. A negative figure indicates when the company has paid out capital such as retiring or paying off long-term debt or making a dividend payment to shareholders. International Accounting Standard 7 IAS 7 defines financing activities as the activities that result in changes in the size and composition of the contributed equity and borrowings of the entity.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)