Simple Partnership Financial Statements Deferred Tax Asset Example

Avoiding pitfalls business combinations and consolidated accounts 28 Section 6.

Partnership financial statements deferred tax asset example. The Partnership adopted ASU 2009-13 for sales entered into or materially modified in the year beginning January 1 2011 and management has determined that ASU 2009-13 had no material effect on the Partnerships financial statements or existing revenue recognition policies. A deferred tax asset moves a portion of the tax expense to future periods to better match tax expense with accounting income. Within financial statements non-current assets with a limited economic life are subject to depreciation.

Arise from different taxpaying entities. Unrelieved tax losses and other deferred tax assets see below. Other financial assets at fair value through profit or loss 160 25.

Finance leases 169 30. Avoiding pitfalls share-based payments 33. For example suppose a company earned IDR1000 in sales revenue.

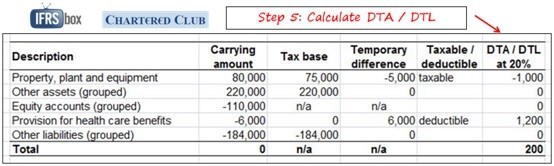

Deferred income tax assets and liabilities are computed annually for differences between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in. Entities should discuss the nature of those transactions and their current and future financial statement effects. Here are the figures and related deferred tax assuming that the deferred tax asset recovery takes place over 5 years and is assessed to be probable each period.

Jurisdictional netting of deferred tax assets or liabilities. The tax associated with intra-entity asset transfers should be accounted for under ASC 740-10-25-3e and ASC 810-10-45-8. The main exceptions are.

Here are some transactions that generate deferred tax asset and liability balances. Deferred tax assets and liabilities are financial items on a companys balance sheet. The company tax rate remained constant at 28.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)