Divine Reserves In Balance Sheet Meaning

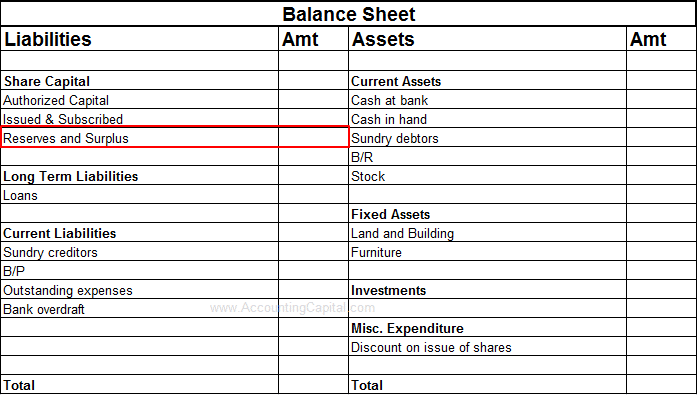

Types of Reserves and Surplus on Balance Sheet.

Reserves in balance sheet meaning. Liability side of the balance sheet shows reserves means the profit which company has earn from the date of incorporation top latest updated balance sheet. Depending on the sector or industry of the business that can be a mistake. If you see the reserves and surplus of the balance sheet will get to know about the.

Distributable Reserves this refers predominantly to retained earnings. This figure is increased every year with that amount in the income statement that is not spent on costs and expenses and dividends. The reserve which belongs to equity shareholders or where it is marked for any purpose is equity reserves.

Lets assume Company XYZ has to recall one of its products and issue refunds to customers. The Feds assets include various Treasuries and mortgage-backed securities. It expects customer returns to trickle in over the next six months.

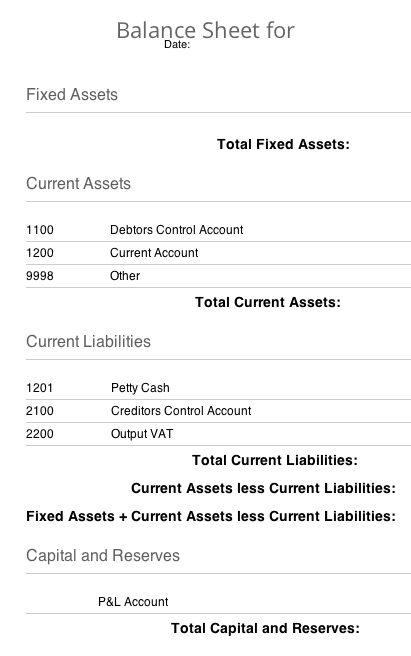

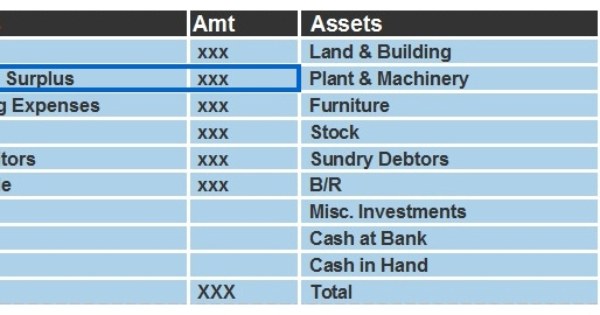

It appears on the liabilities side of position statement Balance Sheet under the head Reserves and Surplus. As these reserves dont actually belong to. A balance sheet example is shown below.

Reserves always have a credit balance. Reserves refer to a component of shareholders equity the amount kept apart for estimated claims or creation of contra asset accounts for bad debts. Reserves such as share premium as well as asset revaluation reserve.

How Do Balance Sheet Reserves Work. Share capital represents the amount invested into the business when it was first started. Reserves are considered on the liability side of a balance sheet because they are sums of money that have been set aside to be paid out at a future date.

/ExxonOilreservesPDF-f07628dcc0c04b21a67b1fe1f0d06a4f.jpg)

/ExxonOilreservesPDF-f07628dcc0c04b21a67b1fe1f0d06a4f.jpg)