Awesome Cash Flow Add Back Depreciation

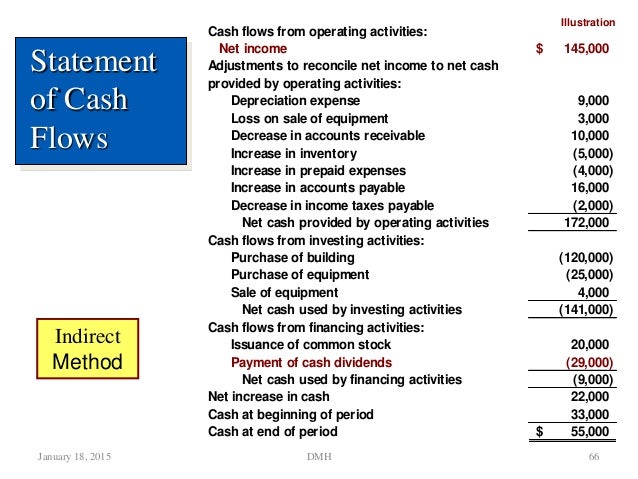

But accounting depreciation and amortisation charges are not cash flows.

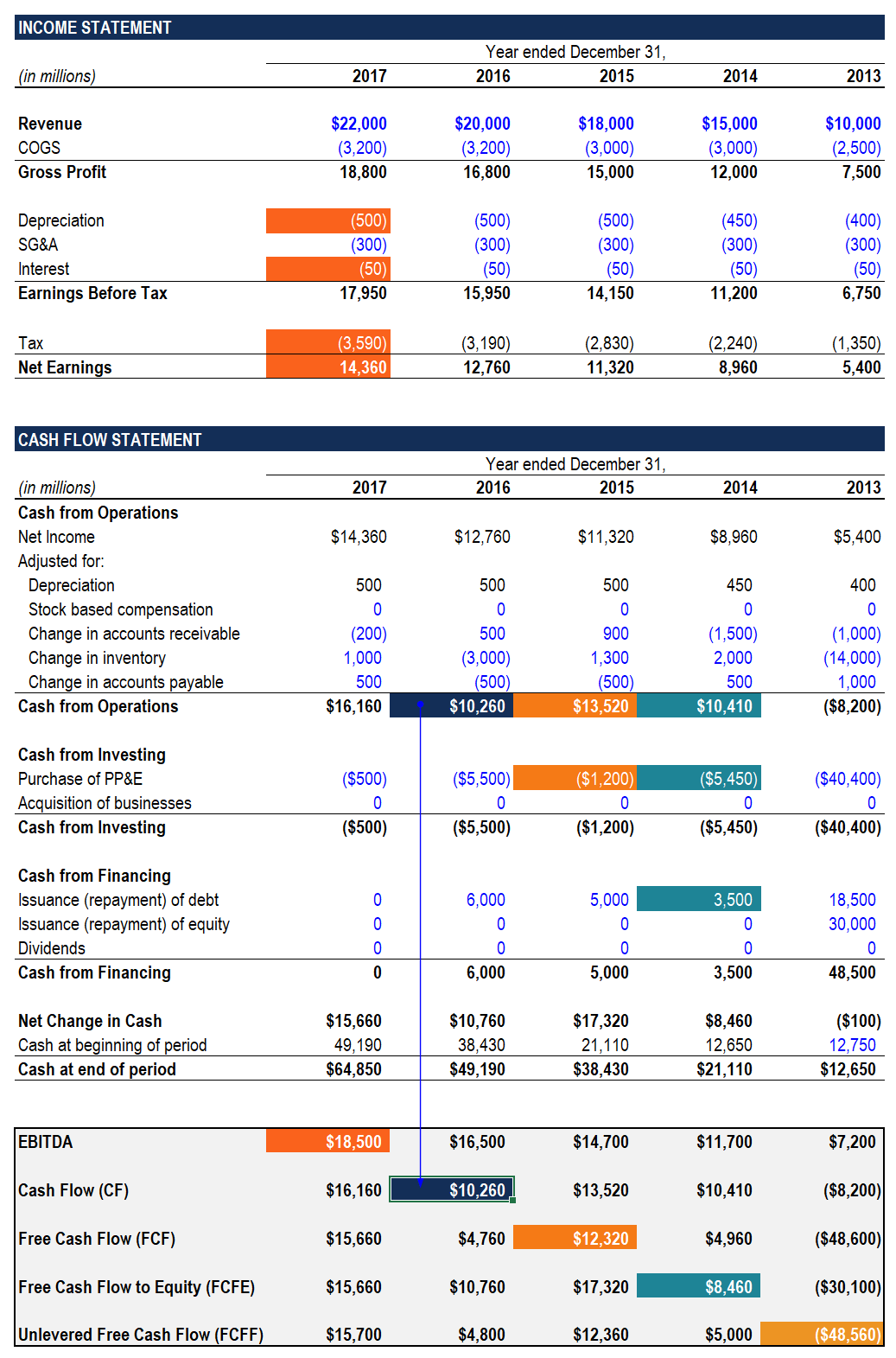

Cash flow add back depreciation. Depreciation is simply the systematic reduction in the value of a. A company buys a 1 million piece of hardware that is depreciated o. Like EBITDA depreciation and amortization are added back to cash from operations.

Due to this depreciation does not impact the cash. However all other non-cash items like stock-based compensation unrealized gainslosses or write-downs are also added back. Net income is then used as a starting point in calculating a companys operating cash flow.

Depreciation is an expense but an expense that never involves cash. When valuing a business buyers will place a multiple on the businesss earnings before interest taxes depreciation and amortization EBITDA. An explanation of non-cash expense.

However depreciation is reversed for some other reason. If you have ongoing expenses that wont be included in your cash flow after a transaction these are called add backs. Why is depreciation added in cash flow.

Free cash flow is a metric used to assess and analyze companies that also uses depreciation as an add-back. So we need to add back the depreciation and amortisation as non. Thus depreciation affects cash flow by reducing the amount of cash a business must pay in income taxes.

That said as you discovered there is a possibility of depreciation flowing onto the Cost of Goods Sold schedule. You can find depreciation on your cash flow statement income statement and balance sheet. Depreciation is a non-cash expense which means that it needs to be added back to the cash flow statement in the operating activities section alongside other expenses such as amortization and depletion.