Top Notch Going Concern Note Disclosure

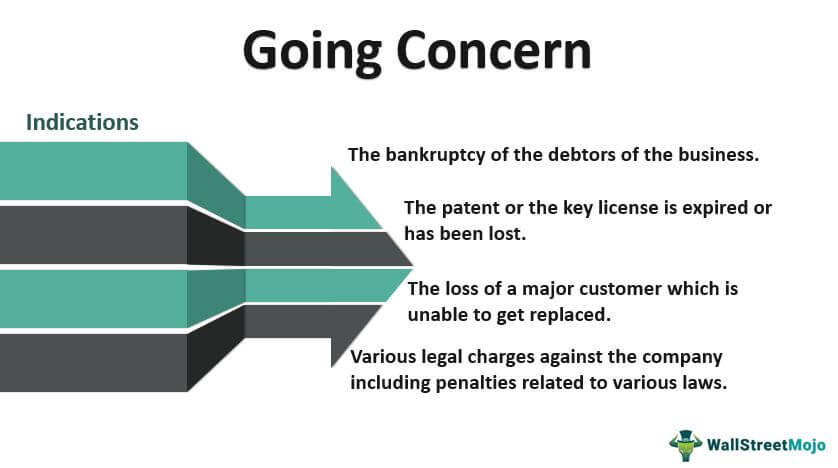

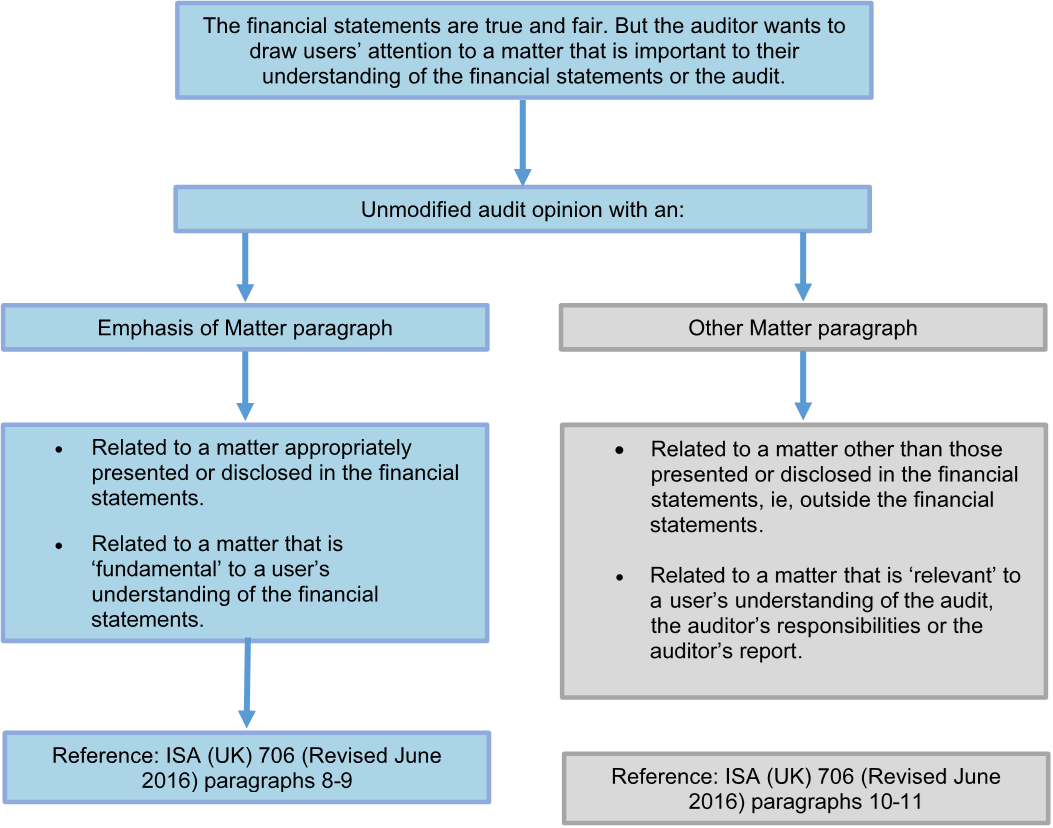

Use of the EoM going concern paragraph for entities that have had a business set back but for which uncertainty has not yet been demonstrated to be material.

Going concern note disclosure. As the regulations assume that a business will be a going concern there is only a requirement for specific disclosure when an alternative basis for the preparation of the financial statements is used. Iii The disclosures relating to going concern set out in paragraph 39This would require it to disclose material uncertainties that cast doubt on its ability to continue as a going concern and where relevant the fact that the going concern basis has not been used together with a note of the basis adopted. I plan to put the following in the accounting policy.

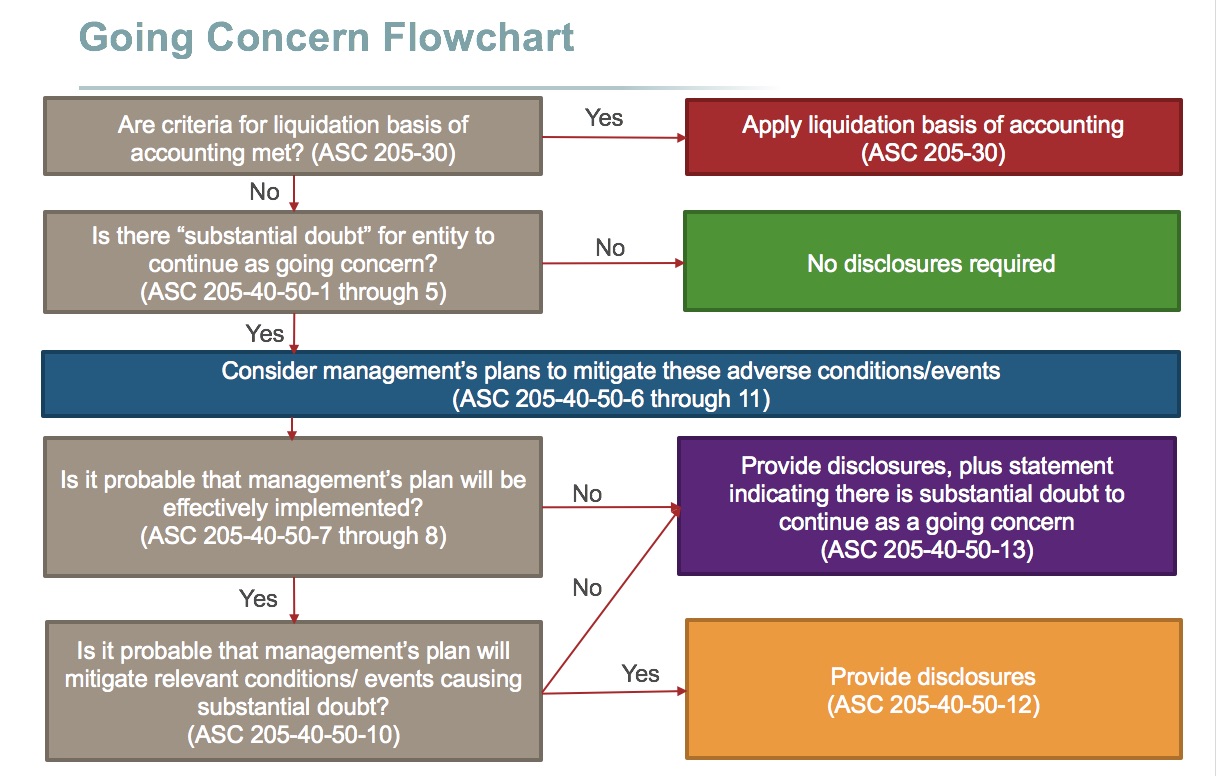

Update going concern disclosures. In August 2014 FASB released ASU 2014-15 Disclosure of Uncertainties about an Entitys Ability to Continue as a Going Concern Accounting Standards Codification ASC 205-40. Where significant judgements were involved in concluding that the going concern assumption is appropriate what are examples of information that may be included in the going concern disclosure.

A going concern or to provide related footnote disclosures. This is the latest article in a series of financial reporting and auditing in the shadow of COVID-19. Entities should therefore consider.

Disclosure is key Whether or not to prepare financial statements on a going concern basis is a binary decision but the circumstances in which entities prepare financial statements on a going concern basis will vary widely. Going concern disclosures and audit implications. These disclosures must be included until the conditions or events giving rise to the uncertainties are resolved.

Going concern note. Disclosures must be provided in the notes to financial statements in both annual and interim periods of managements plans and whether substantial doubt is or is not alleviated by the plans. The Coronavirus pandemic has had an impact on all businesses and some.

This is a major issue since a going concern problem can result in loans being pulled credit requests being declined and investors selling off their shares. This guidance applies even if those events would otherwise be non-adjusting. The financial statements on a going concern basis.