Stunning Cash Flow Statement Explain

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

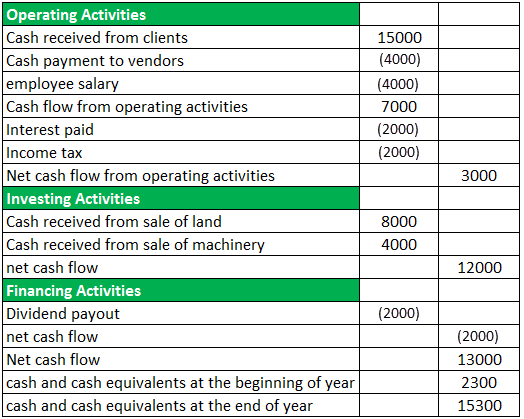

The SCF reports the cash inflows and cash outflows that occurred during the same time interval as the income statement.

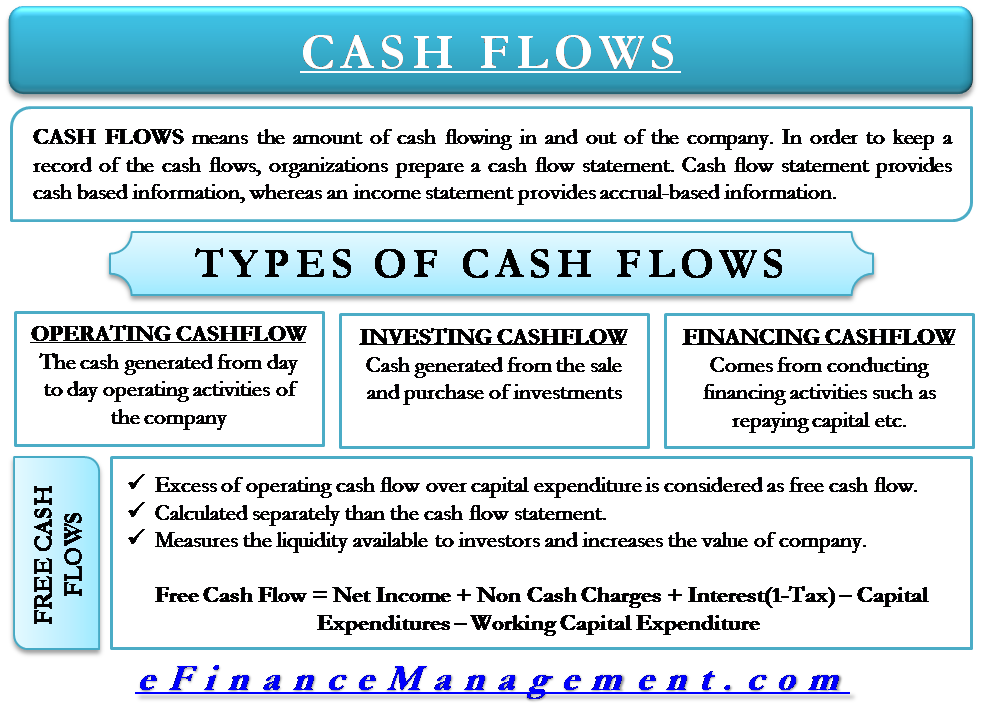

Cash flow statement explain. Cash flow statement tutorial. These inflows and outflows are further classified into operating investing and financing activities. What is a Cash Flow Statement.

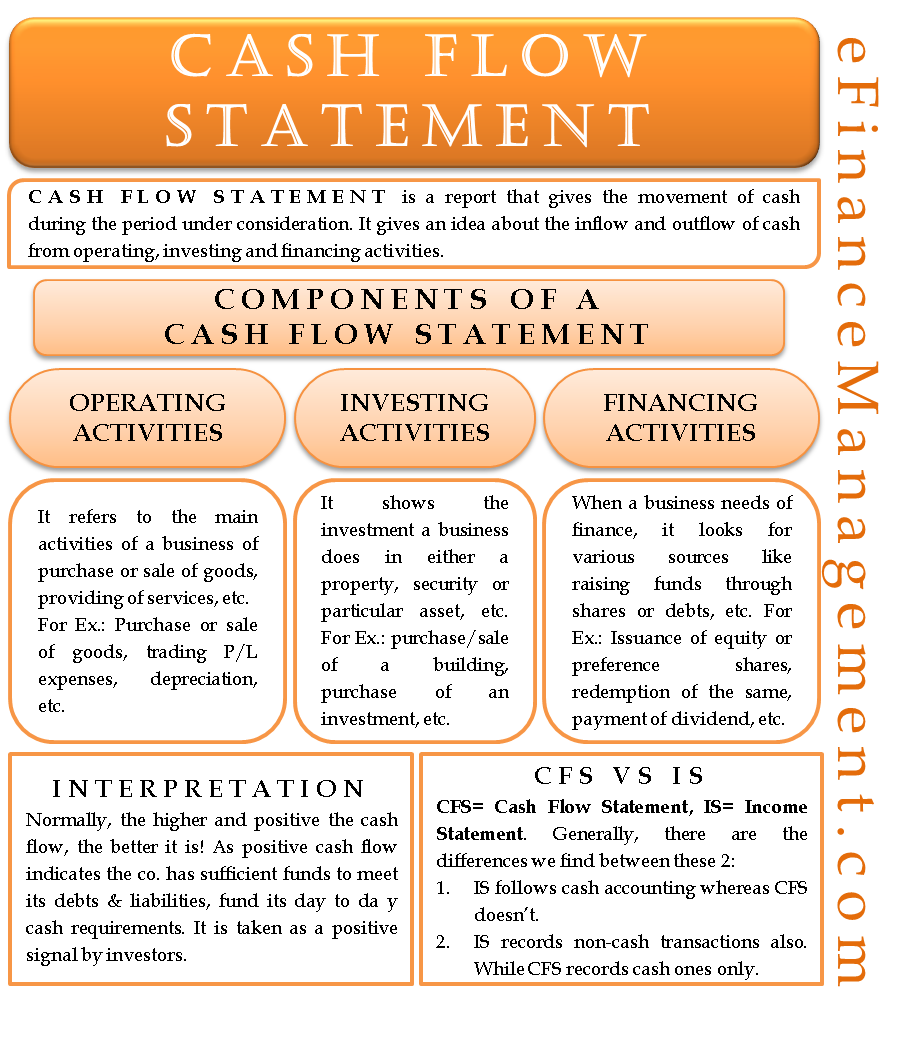

Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. For example one could be spending cash on computer. Cash Flow Statement is a report that gives the movement of cash during the period under consideration.

It gives an idea about the inflow and outflow of cash from operating investing and financing activities. Statement of cash flows is one of the four financial statements which shows the cash movement cash inflow and cash outflow of the business and the overall change of cash balance of the company during the accounting period which could be monthly quarterly or annually. The cash flow statement is required for a complete set of financial statements.

The cash flow statement measures how well a. Cash Flow from Investing Activities The second component is the cash flow from investing activities. The statement reflects both the cash inflow and the cash outflow for a specific period of time.

The time interval period of time covered in the SCF is shown in its heading. The cash flow statement basically shows how profitable the company is over a period of time months or years so this is a document investors carefully analyze when making. How do cash balance and cash flow relate to each other.

The statement includes detailed information about a businesss cash inflow and outflow meaning it keeps track of the amount of money that flows in and out as a result of business handling. How does a cash flow statement work. While income statements are excellent for showing you how much money youve spent and earned they dont necessarily tell you how much cash you have on hand for a specific period of time.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)