Beautiful Work Deferred Revenue Balance Sheet Classification

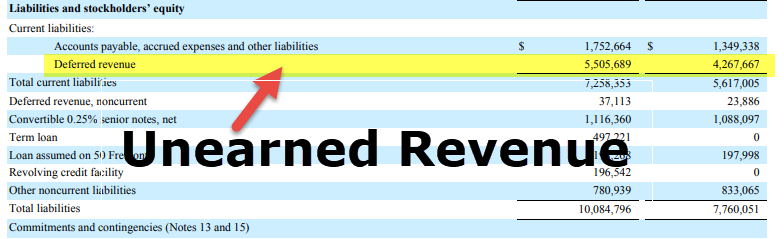

The revenue generated form these advance payments are classified as a liability rather than assets on a balance sheet.

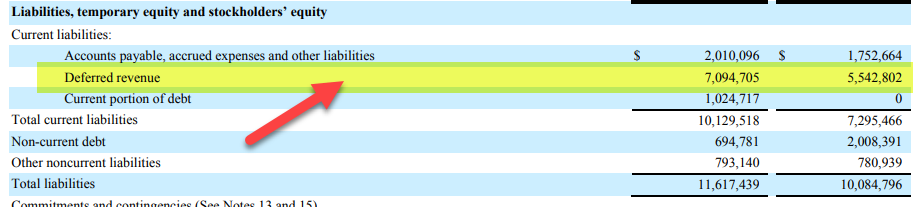

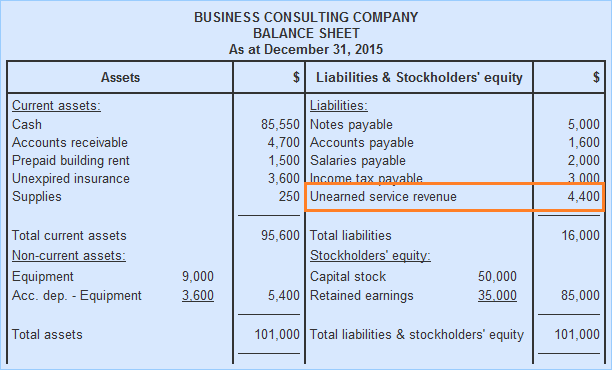

Deferred revenue balance sheet classification. This simplifies the presentation of deferred taxes by requiring all deferred tax assets and liabilities along with any related valuation allowance to be classified as noncurrent on the balance sheet. To Deferred Revenue Where the Deferred Revenue is presented in the Balance Sheet. Deferred Revenue also called Unearned Revenue is generated when a company receives payment for goods andor services that have not been delivered or completed.

Deferred revenue is a financial reporting number that appears on the balance sheet. The change in terminology simply reflects ASC 606s revenue model in which reclassification from a contract asset to a receivable is contingent on fulfilling performance obligations not on invoicing a client. If services will be performed or goods shipped within one year the deferred revenue is a current liability.

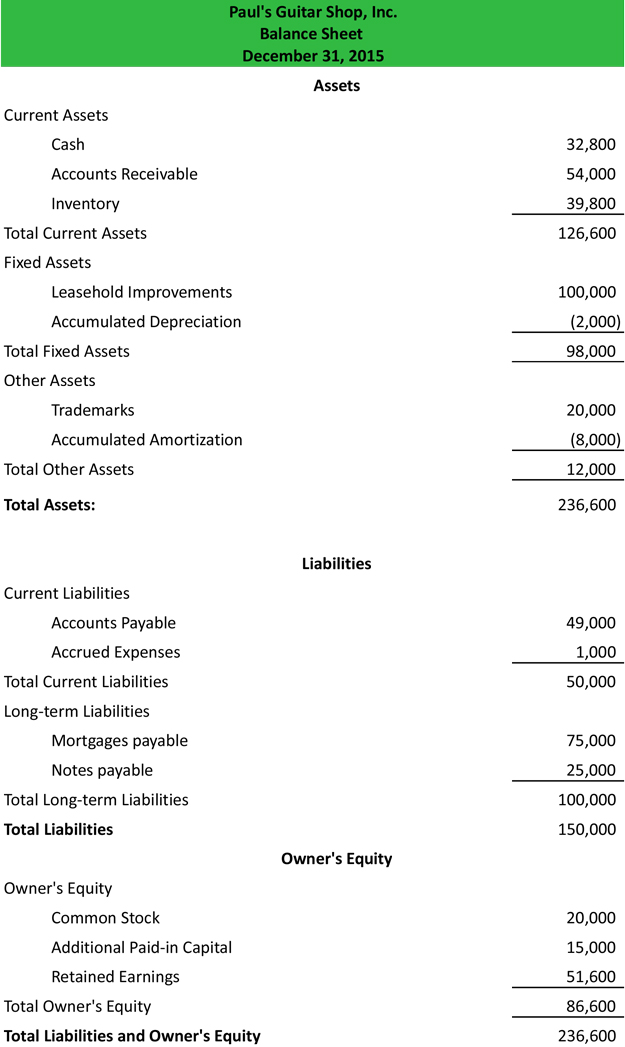

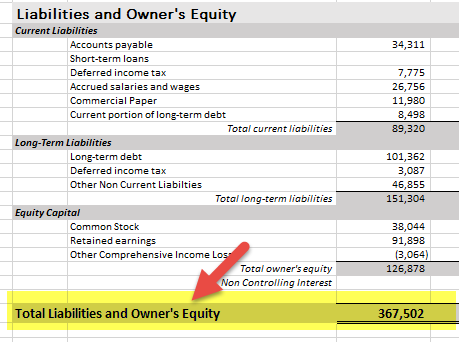

The sum of these classifications must match this formula known as the accounting equation. The most common classifications used within a classified balance sheet are as follows. Deferred revenue is a liability on a companys balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered.

It is shown under the Current Liabilities on the Liability side of the Balance Sheet. The deferred rents balance represents a deferred rent liability resulting from straight-lining lease expense for the companys office rent. Mostly this is a balance for the Short Duration less than 12 months.

20 2015 the Financial Accounting Standards Board FASB issued Accounting Standards Update ASU 2015-17 Balance Sheet Classification of Deferred Taxes. It can be classified as a long-term liability if performance is not expected within the next 12 months. Introduction of Deferred Revenue Deferred revenue is defined as the payments which are received in advance for products or services that have not been delivered or rendered yet.

Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance. Deferred revenue is a liability on a companys balance sheet that represents a prepayment by its customers for goods or services that have yet to be delivered. Fixed assets or Property Plant and Equipment Intangible assets.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)