Fantastic Comprehensive Income Calculation

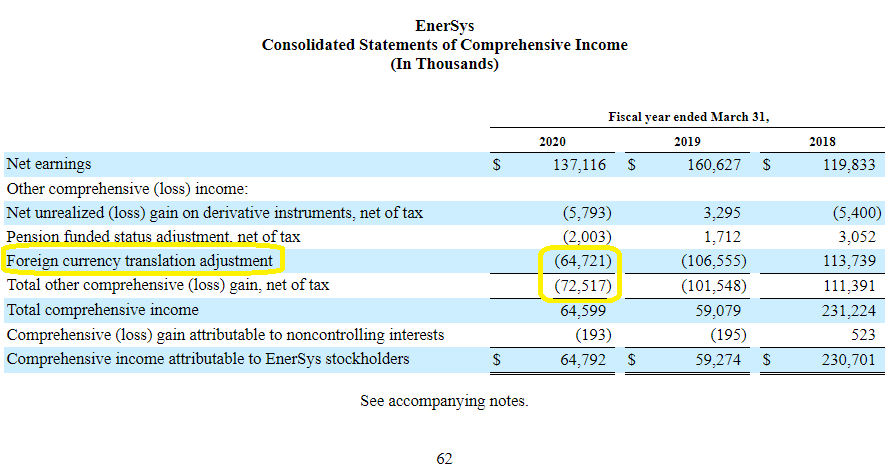

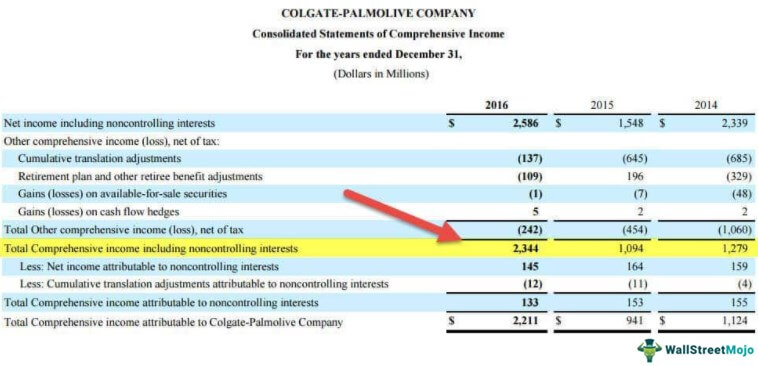

Comprehensive income is the total of net income and other items other comprehensive income which must find a way around the comprehensive income statement since they have not been realized counting items like an unrealized holding profit or loss from on hand sale securities and foreign currency translation profits and losses.

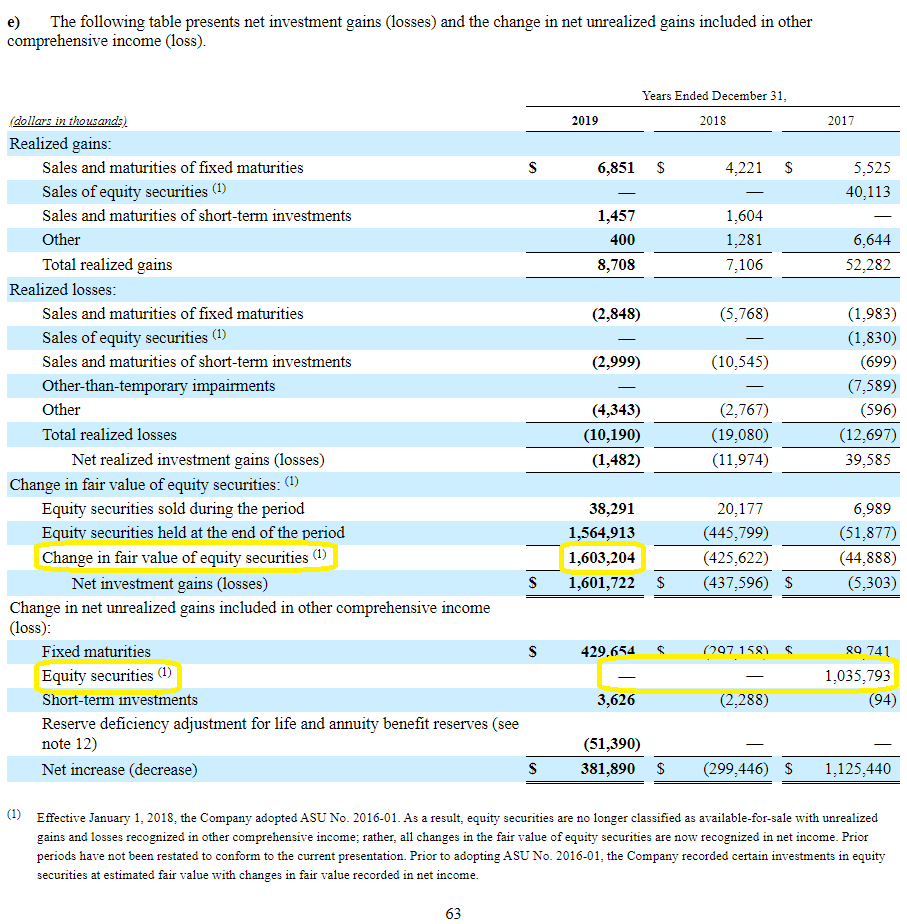

Comprehensive income calculation. Comprehensive income includes net income and unrealized income such as unrealized gains or losses on hedgederivative financial instruments and foreign currency transaction gains or losses. But dont depend solely on it. Based on accounting conventions certain items of revenue and expense are excluded from the net income calculation.

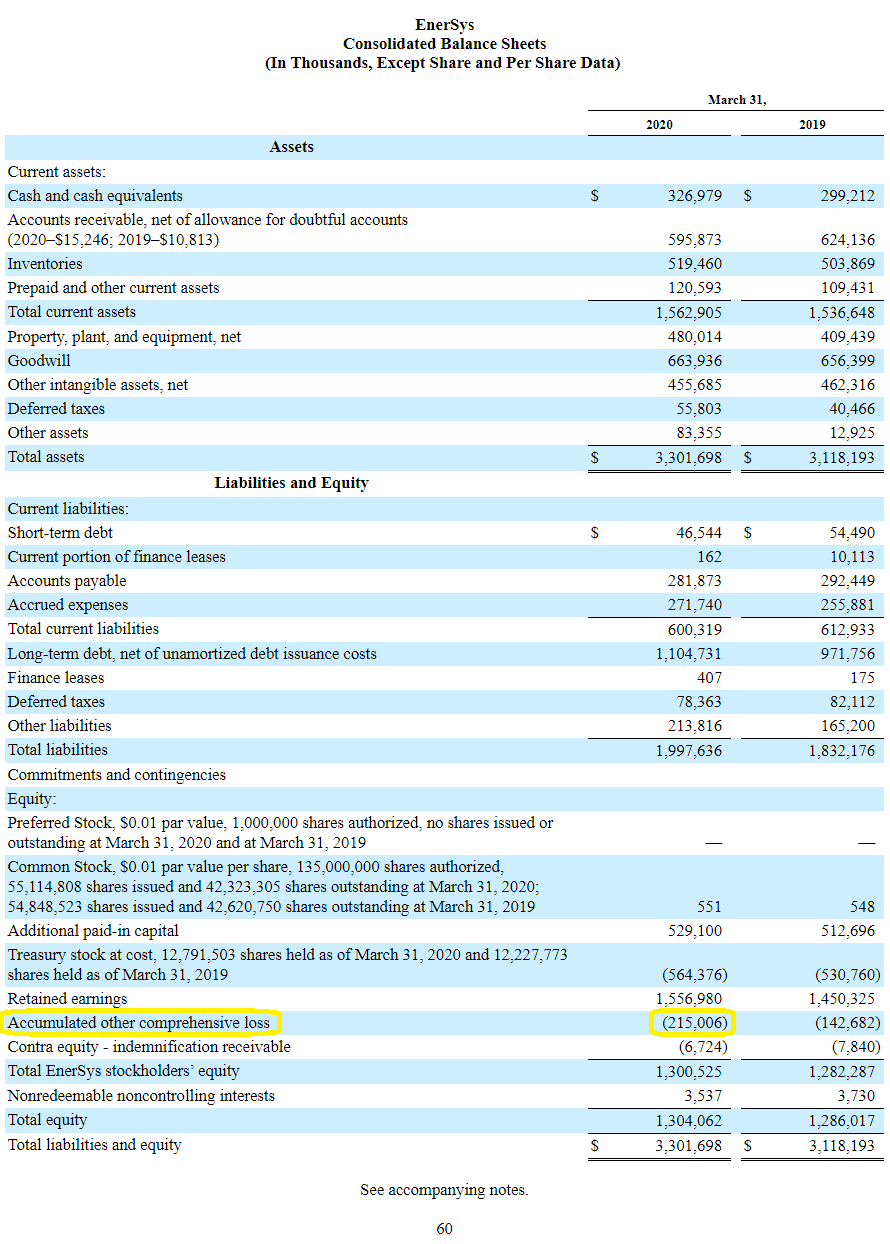

Accumulated other comprehensive income OCI includes unrealized gains and losses reported in the equity section of the balance sheet that are netted below retained earnings. Revenues expenses gains and losses that are reported as other comprehensive income are amounts that have not been realized yet. The statement of comprehensive income is a financial statement that summarizes both standard net income and other comprehensive income OCI.

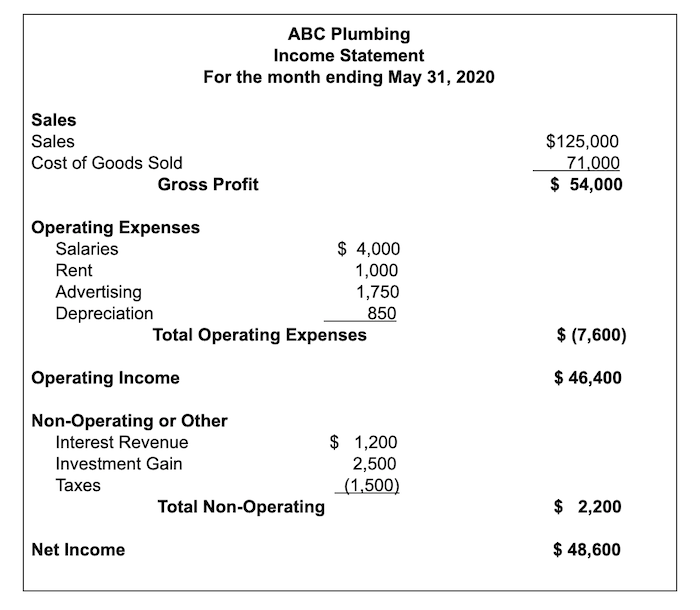

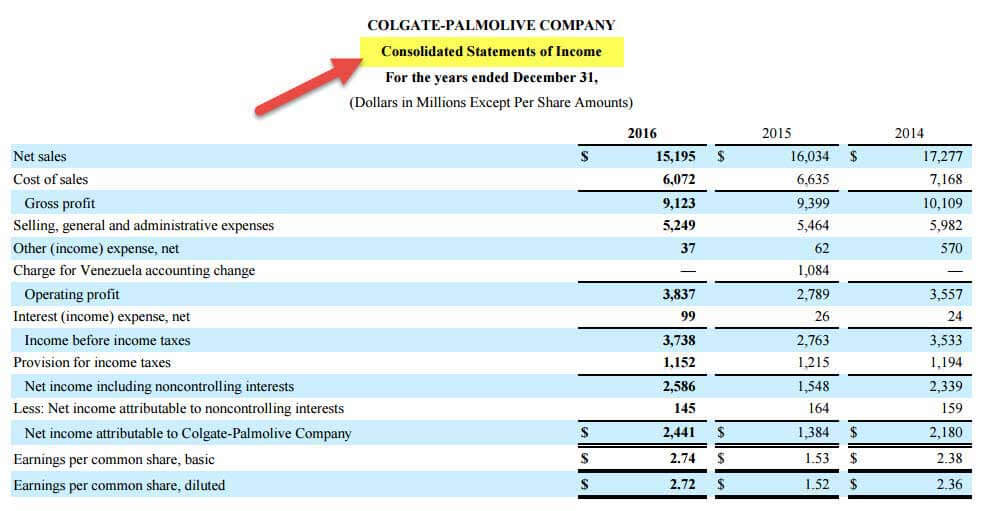

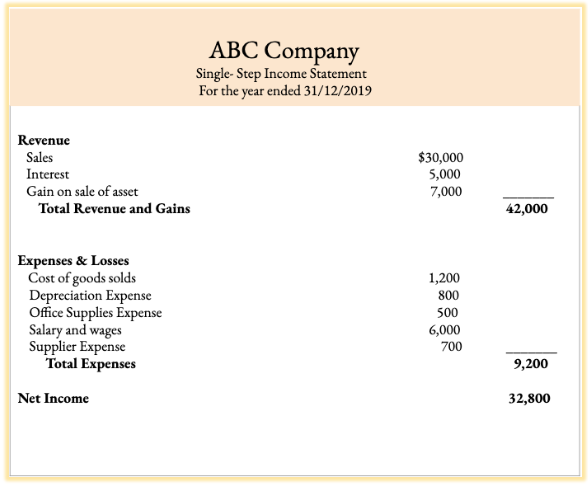

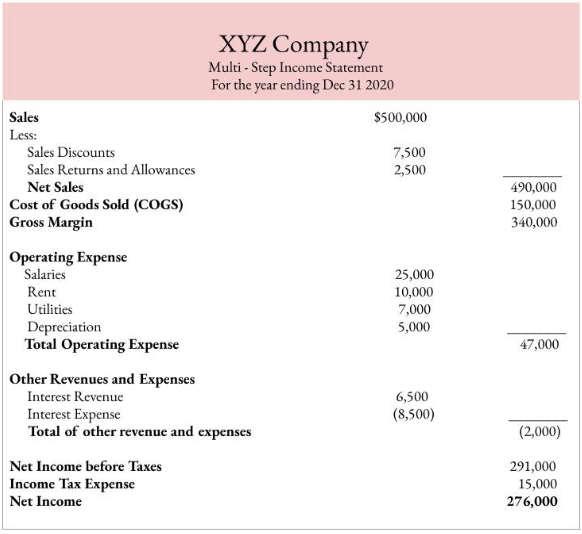

This video explains how to use financial information to complete a statement of comprehensive income. The net income is the result obtained by preparing an income statement. Comprehensive income is the change an entitys equity during a period that was not caused by investments from owners new stock issued and distributions to owners dividends paid.

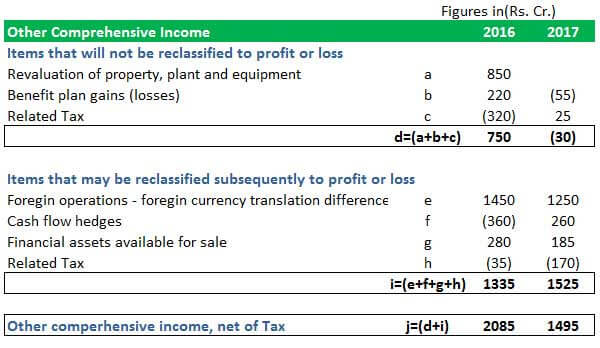

What is Other Comprehensive Income. These excluded items are referred to as other comprehensive income Under both IFRS and US GAAP there are four types of items that are treated as other comprehensive income. Comprehensive income is often listed on the financial statements to include all other revenues expenses gains and losses that affected stockholders equity account during a period.

Comprehensive Income Comprehensive income is equal to net income plus other comprehensive income. Several items fall into other comprehensive income including. There is a formula to calculate comprehensive income.

As a company creates income this changes its shareholders equity. Components of total comprehensive income. Net income or net loss the details of which are reported on the corporations income statement plus Other comprehensive income.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)