Outrageous Modified Accrual Basis Of Accounting Pdf

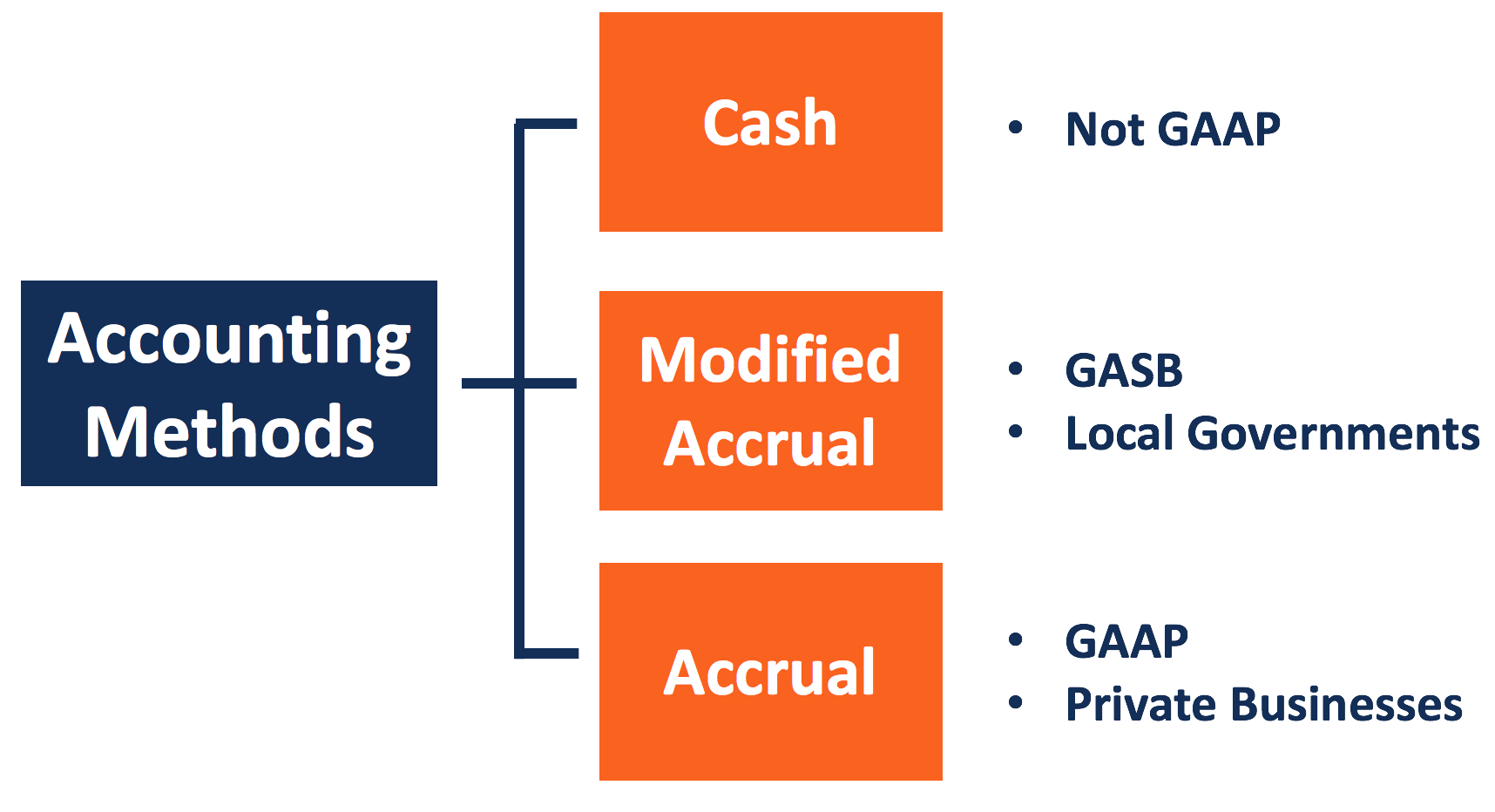

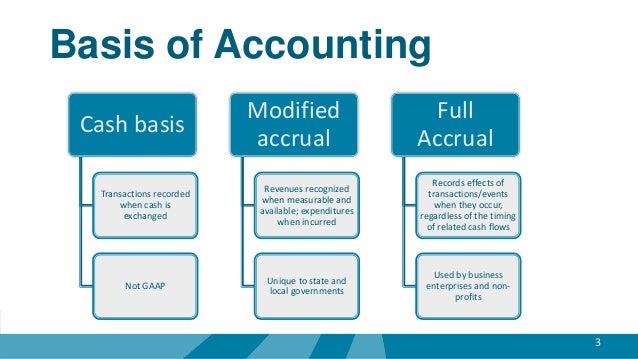

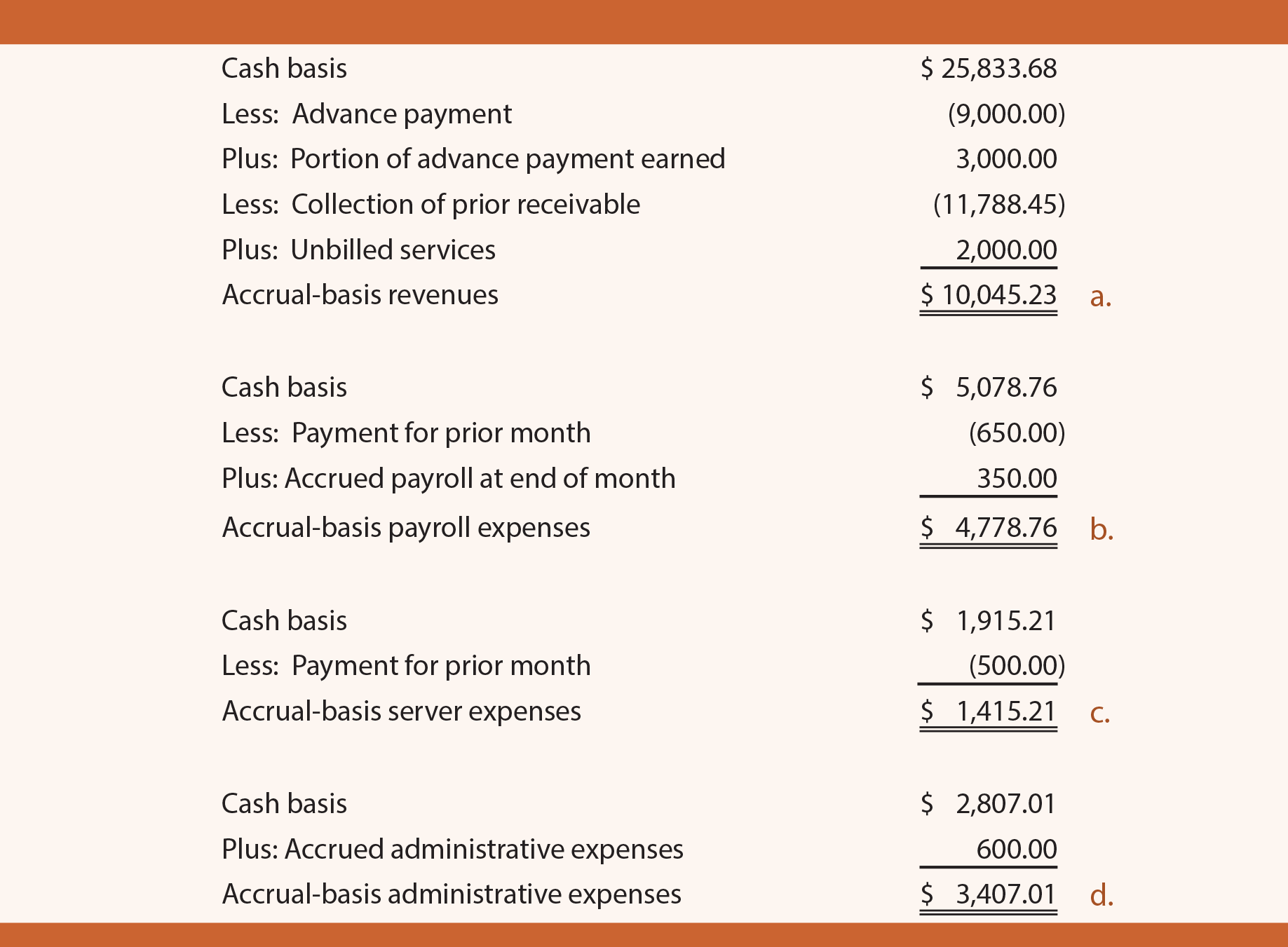

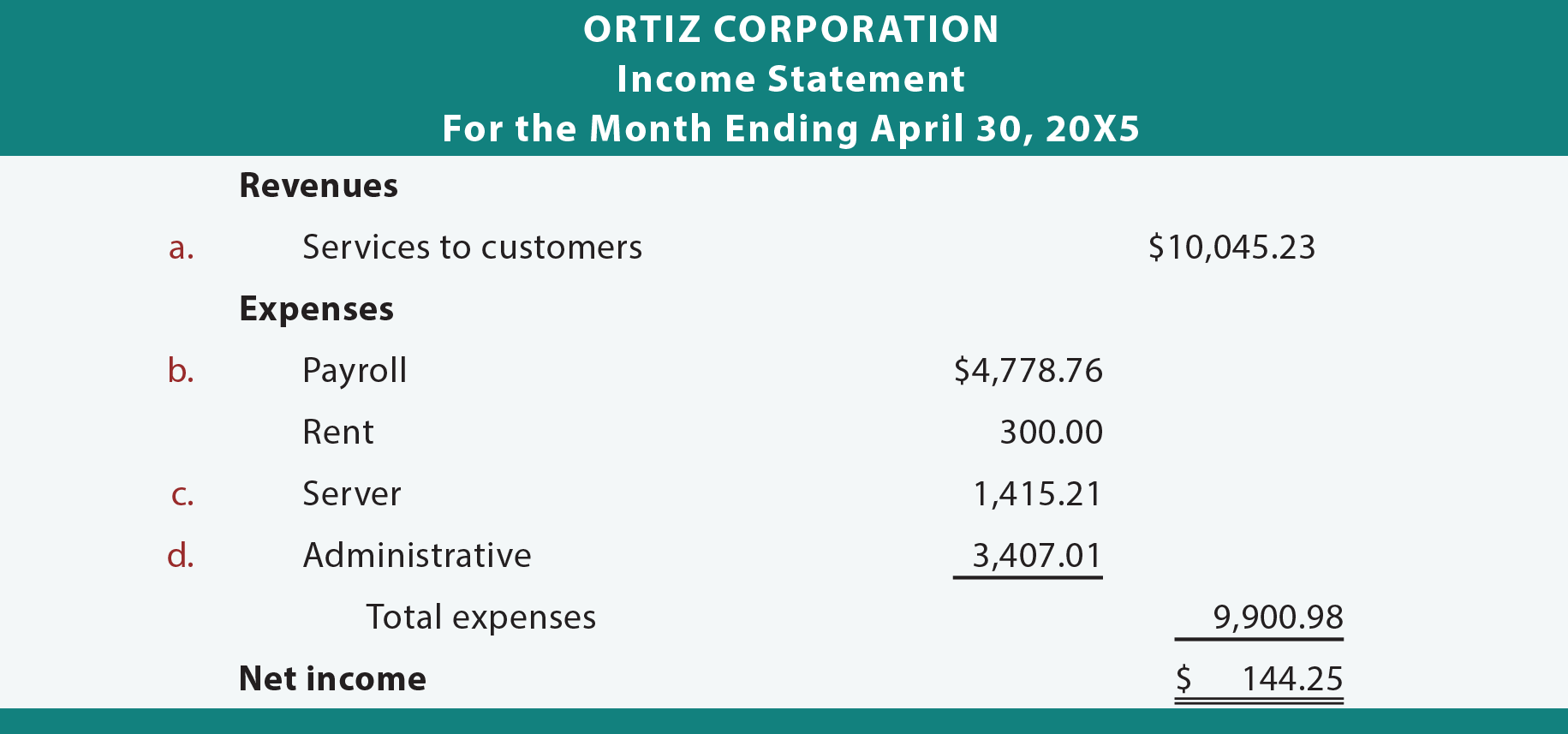

Under the cash basis you recognize a transaction when there is either incoming cash or outgoing cash.

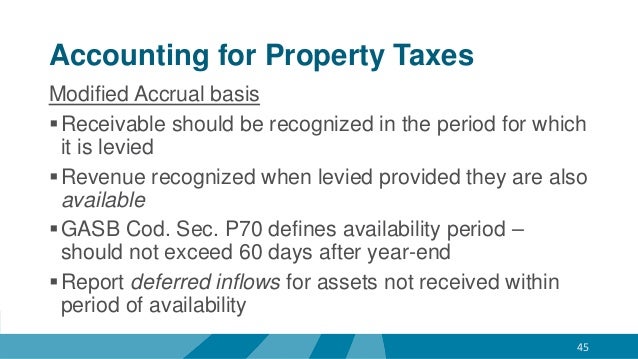

Modified accrual basis of accounting pdf. Modified accrual accounting refers to an accounting method that combines cash-basis accounting and accrual-basis accounting. However under the modified accrual basis GAAP provided modifications to the general rule in the areas of inventories and prepaid items. Thus the receipt of cash from a customer triggers the recordation of revenue while the payment of a supplier triggers the recordation of an asset or expense.

It follows the cash-basis method to record short-term events and follows the accrual method to record long-term events. Under accrual accounting expenditures are recognized as soon as a liability is incurred regardless of the timing of related cash flows. Modified accrual basis of accounting as the budgetary basis of accounting for the State of New Mexico.

At the same time the accrual basis recognizes the importance of reporting cash flows through. Accrual basis accounting recognizes financial reports that portray the effects of transactions and other events by grouping them into broad classes according to economic characteristics termed elements IFAC PSC 2000. The modified accrual accounting system attempts to incorporate both the cash and accrual system of accounting.

The first time adoption of IPSAS and accrual accounting is a complex issue that often requires detailed guidance. This Study identifies the nature and scope of many of the tasks required during this process. What is Modified Accrual Accounting.

Long-term liabilities Basis of Accounting cont Proprietary trust and agency funds government-wide reporting Accrual basis of accounting. Former Senate Committee on Finance Chairman Max. Use accrual basis of accounting when their average annual gross receipts exceed 10 million.

Wishing to report on the accrual basis of accounting in accordance with IPSASs. The IMF paper concludes that the revised IMF manual should advocate an accrual basis in order to address deficiencies of the existing modified cash basis and to enable a greater degree of harmonization with. Accruals recognize transactions and events when they occur rather than when cash is paid or received.