Ace Impairment Loss Entry

Marks answer is good.

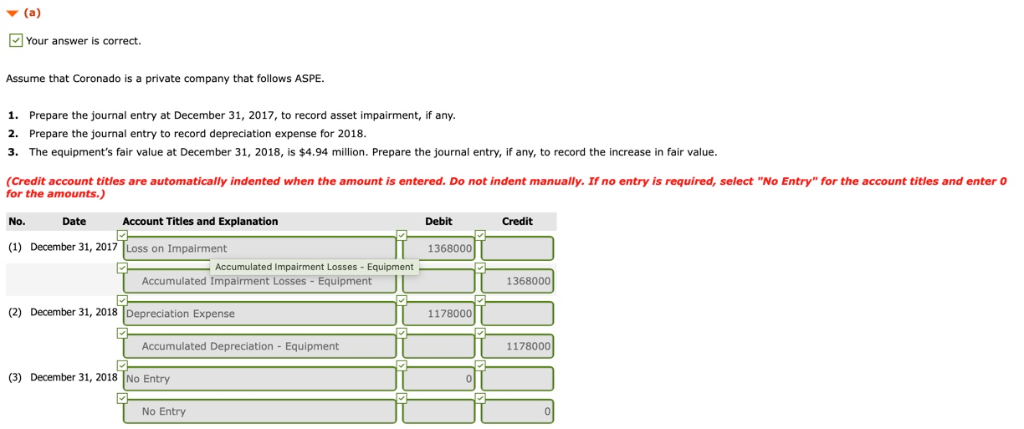

Impairment loss entry. The amount of impairment loss will be the difference between an assets carrying value and recoverable amount. The impairment loss should be recognised in the profit or loss immediately unless the revaluation decrease treatment is prescribed in another accounting standard. Dr Asset Account 900 Cr.

To arise or spring as a growth or result. Dr Revaluation surplus BS account. I would add that you have to look at the net carrying value of the asset.

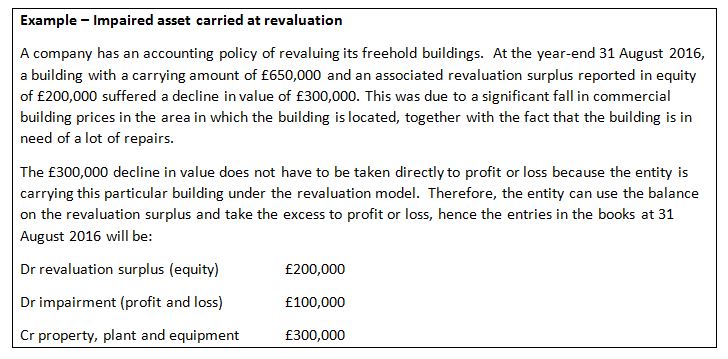

Here you need to take the same approach as in identifying the impairment loss. IAS 3659 The impairment loss is recognised as an expense unless it relates to a revalued asset where the impairment loss is treated as a revaluation decrease. An impairment loss is a recognized reduction in the carrying amount of an asset that is triggered by a decline in its fair value.

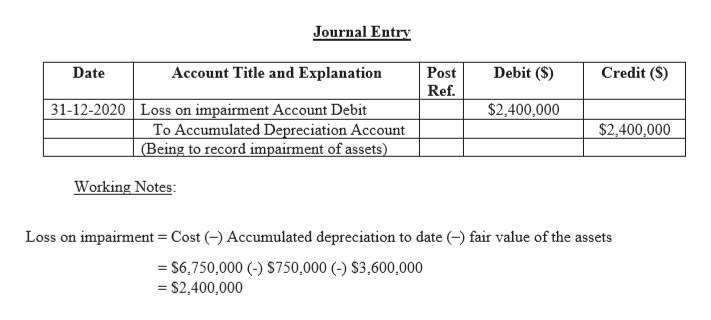

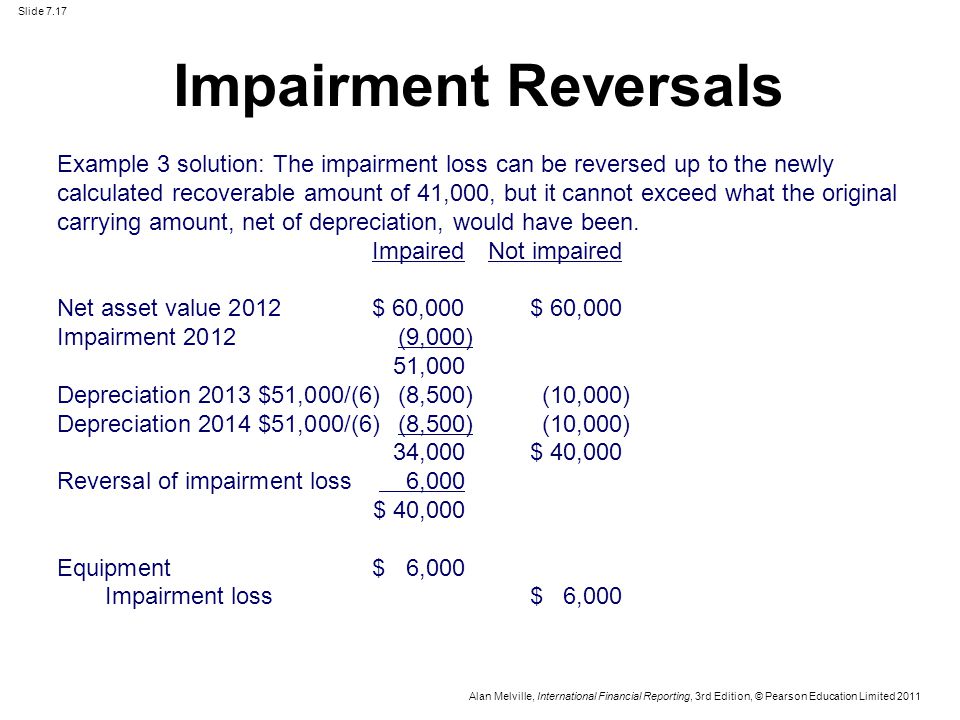

The double entry to record an impairment loss is as follows. The technical definition of impairment loss is a decrease in net carrying value of an asset greater than the future undisclosed cash flow of the same asset. Now your post asks about the reversal of a previous impairment lets say the reversal is for 900.

Impairment losses on receivables are charged to other operating expenses or financial expenses debit entry - depending on the type of claims covered by the allowance. Then other assets are reduced pro rata. Impairment loss Carrying amount - Recoverable amount.

Key Terms accrue. Asset carried at cost. Dr Impairment losses ac PL account Cr Asset account ac Balance sheet account If the asset is carried at revalued amount impairment loss is treated as a reduction in revaluation gain.