Looking Good Royalty Expense In P&l

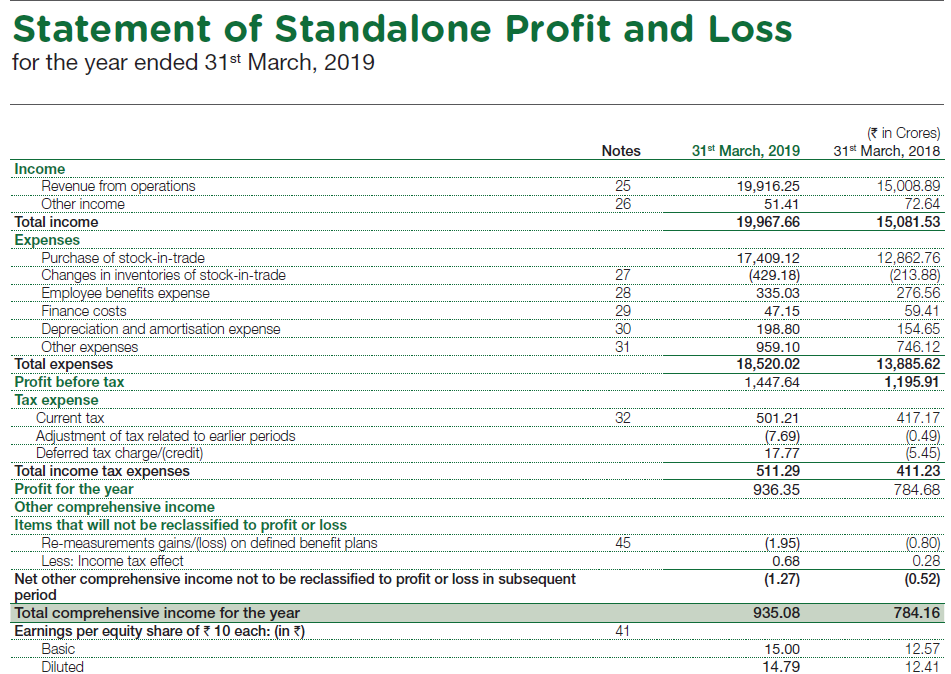

These types of companies receive income from fees commissions and royalties and do not have inventories of goods.

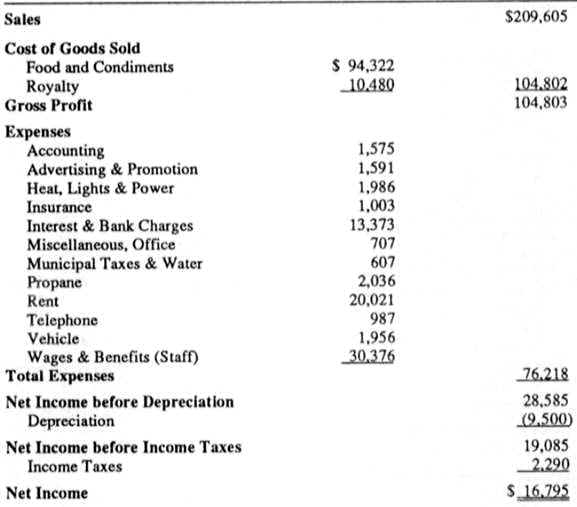

Royalty expense in p&l. It is the cost that the buyer bears to use the goodsservices provided by the owner. If producing or manufacturing products where royalty expense is directly involved in production such as the companys sole right to market sell or distribute a product the royalty would be excluded from capitalizing under section 1263A. Royalty is payable by a user to the owner of the property or something on which an owner has some special rights.

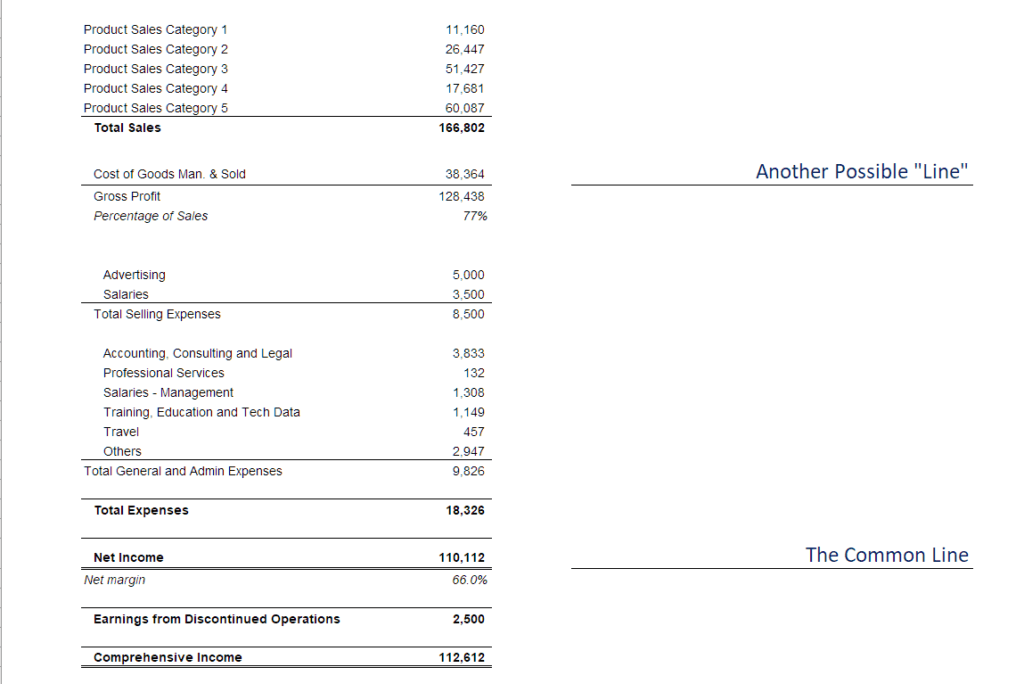

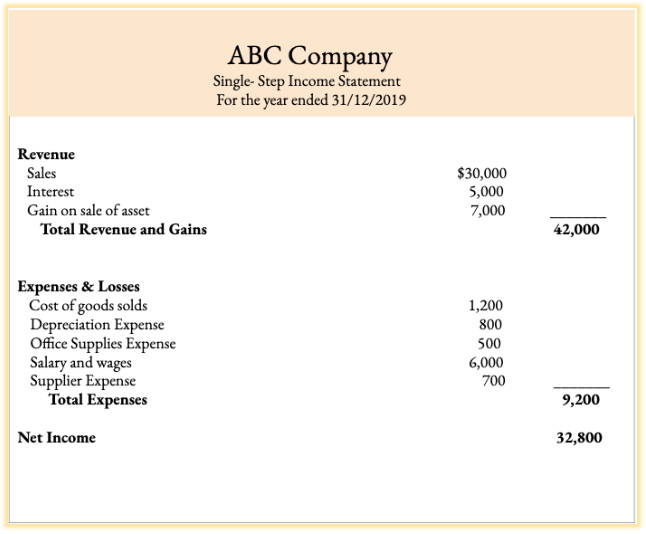

Royalties earned from use of copyrights trademarks and patents and royalties from the extraction of oil gas or minerals. The royalties paid were based on the rights described in an agreement between the taxpayer and the subsidiary. One other PL term which I would be remiss in not discussing is the famous EBITDA.

However the amount of royalty was calculated based on the number of products sold to the taxpayer each month. Arts including literature and music. In other words expenses must be incurred.

Royalty Expenses Treatment of royalty expense depends on the type of royalty paid and the terms as well as the allocation method. Royalties can arise in things such as. In case lessee fails to recover Short Working in the specific period it becomes irrevocable and is charged to PL in the year in which the Short Working recoup lapses.

Royalty payment rates are outlined in a contract between the company and the individual being paid and are therefore determined based on sales figures for the applicable product. This helps in getting the tax benefit over the asset. The prepaid royalty account now only totals 3000 10000 original minus 7000 from last period.

Occupancy expenses include insurance rent CAM charges utilities. First the royalty expense account would be debited for the full royalty amount 7000. A royalty agreement is prepared between the owner and the user of such property or rights.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

.jpg)