Unbelievable Loss On Disposal Cash Flow

The cash flow statement shows the impact of your companys sales and profit generating or operating activities on its cash.

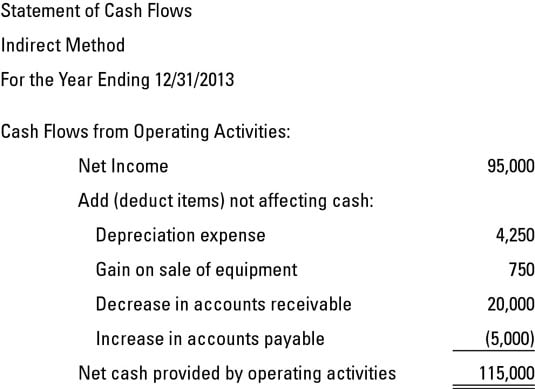

Loss on disposal cash flow. Cash Flow Statement. Disposal of a Fixed Asset with Zero Gain or Loss. This video shows how to account for the disposal of a fixed asset on the Statement of Cash Flows.

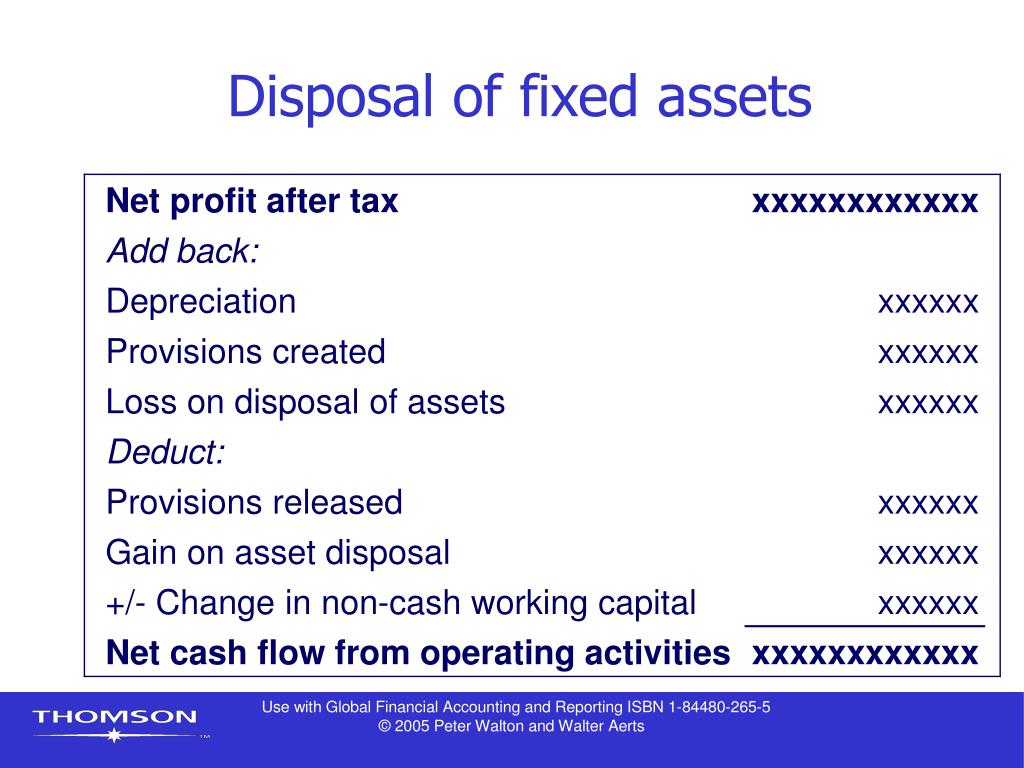

Because profit is not a cash flow. Disposal of a subsidiary net of cash disposed of 13 179 FRS 73942. Financing activity cash flows relate to cash flows arising from the.

A gain or loss on disposal can result. But profit is not a cash flow so we need. The debited account is Accumulated Depreciation and the credited account is the relevant Asset.

Chapter 22 - Statement of Cash Flow Statement of Cash Flow Cash flow from. Similar to Depreciation Expense it is a non-cash transaction which over-states or under-states Net Income Before Taxes NBIT. One other effect is the Gain Loss on Disposition is also a NON-CASH transaction that appears on the Income Statement and increases or decreases taxable income.

Involuntary conversion of assets can involve an asset exchange for monetary or non-monetary assets. What we want to see for the statement of cash flows is the actual cash received from the sale. A gain or loss on the disposal of an asset will affect the profit of an entity in the period of disposal.

Also this is an item which will be listed under cash flows from investing activities. It also shows how your companys use or acquisition of assets liabilities and equity impact cash. These account for the cash flows from the transaction.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)