Favorite Liquidation Basis Financial Statements

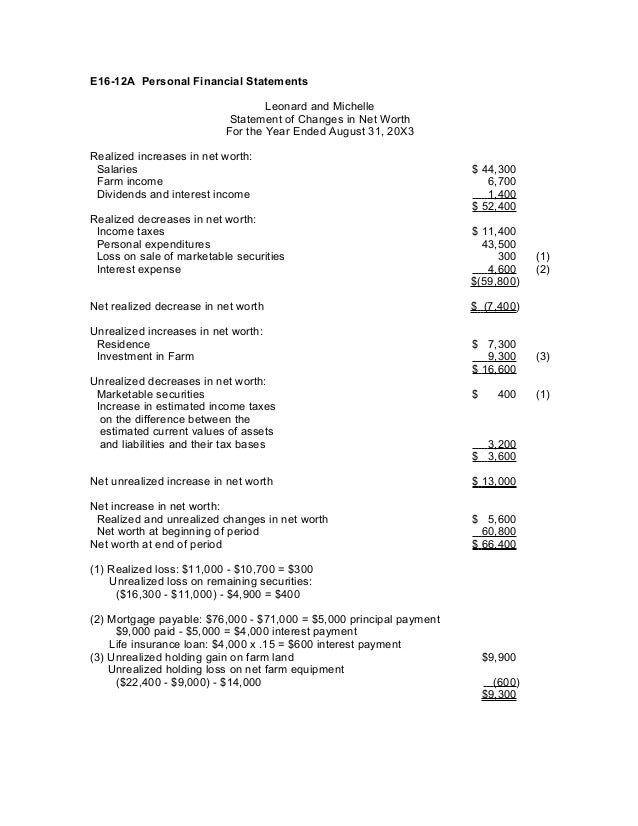

Liquidation Basis Statement of Changes in Net Assets Net assets in liquidation January 1 2020 444219 Cash distribution to common shareholders on January 31 2020 415000.

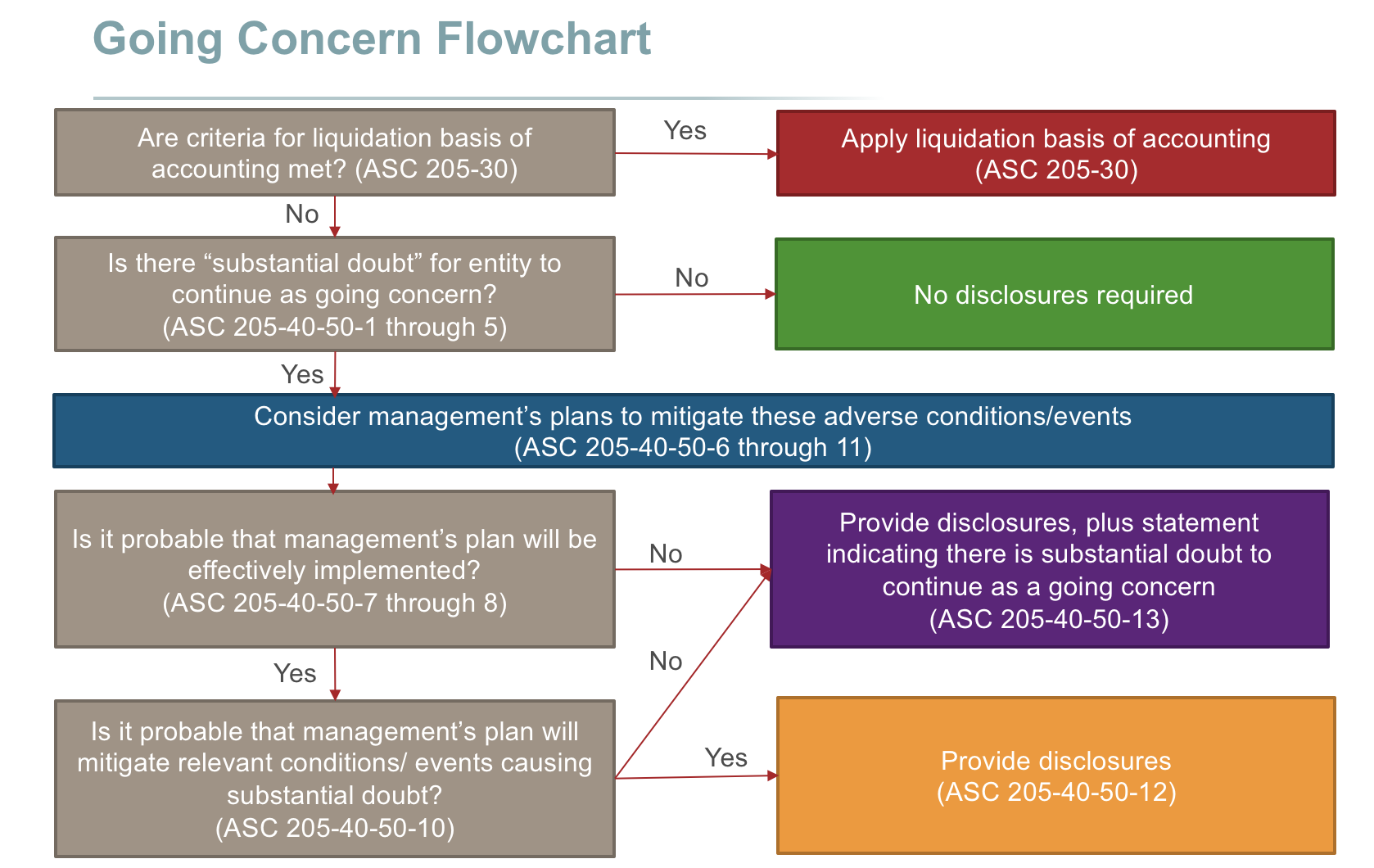

Liquidation basis financial statements. It says that all entities have to prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. The problem is that IAS 1 does not tell us how to prepare the financial statements when going concern does not apply. Financial statements might be prepared under what is sometimes referred to as a break-up basis or liquidation basis.

Accordingly a Consolidated Statement of Net Assets in Liquidation as at December 31 2011 has been presented rather than a Consolidated Statement of Financial Position on a going concern basis. As a result these financial statements have been prepared using the liquidation basis of accounting. Some people argue that under such a break up basis the objective of the financial statements changes from reporting financial performance to consideration of matters such as.

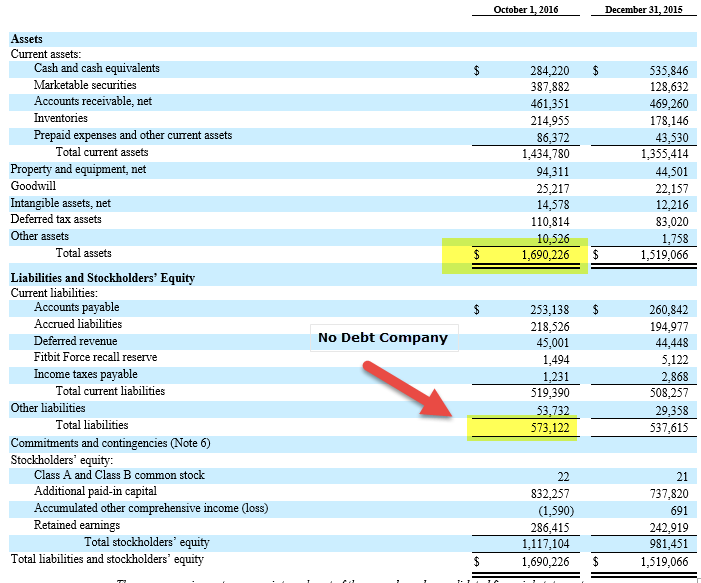

Get detailed data on venture capital-backed private equity-backed and public companies. The goal behind LBOA is to report the amount that an investor may expect to receive after the completion of the liquidation process. Its basis of accounting from a going concern basis to a liquidation basis.

The statement of changes in net assets in liquidation. The extent of assessment will depend on the circumstances. Ad See detailed company financials including revenue and EBITDA estimates and statements.

In accordance with IAS 1 Presentation of financial statementsIAS 1 the Company changed the basis of preparing its financial statements from going concern to liquidation effective September 10 2013. An entity shall not prepare its financial statements on a going concern basis if management determines after the balance sheet date that it either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. Under the liquidation basis of accounting a business must issue two new statements which are as follows.

Liquidation is imminent when the likelihood is remote that the entity will return from liquidation and either a a plan for liquidation is. Going concern the financial statements will need to be prepared on a liquidation basis. For an enterprise that has adopted the liquidation basis of accounting the financial statements consist of a statement of net assets in liquidation and.

:max_bytes(150000):strip_icc()/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)