Looking Good Normal Costing Income Statement

The most commonly used are statement of income statement of earnings statement of operations and statement of operating results Many.

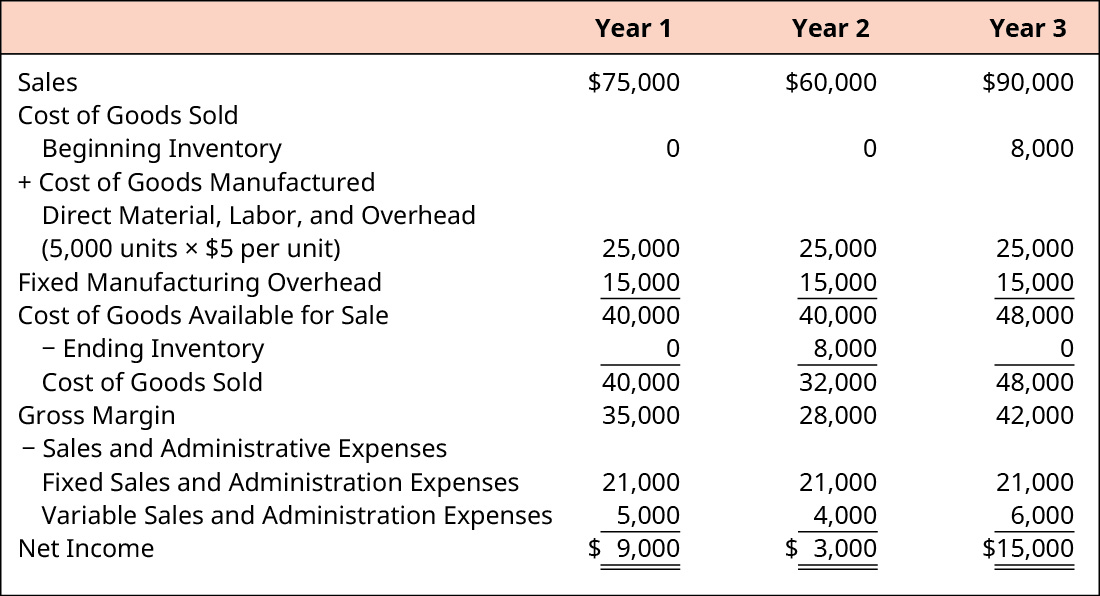

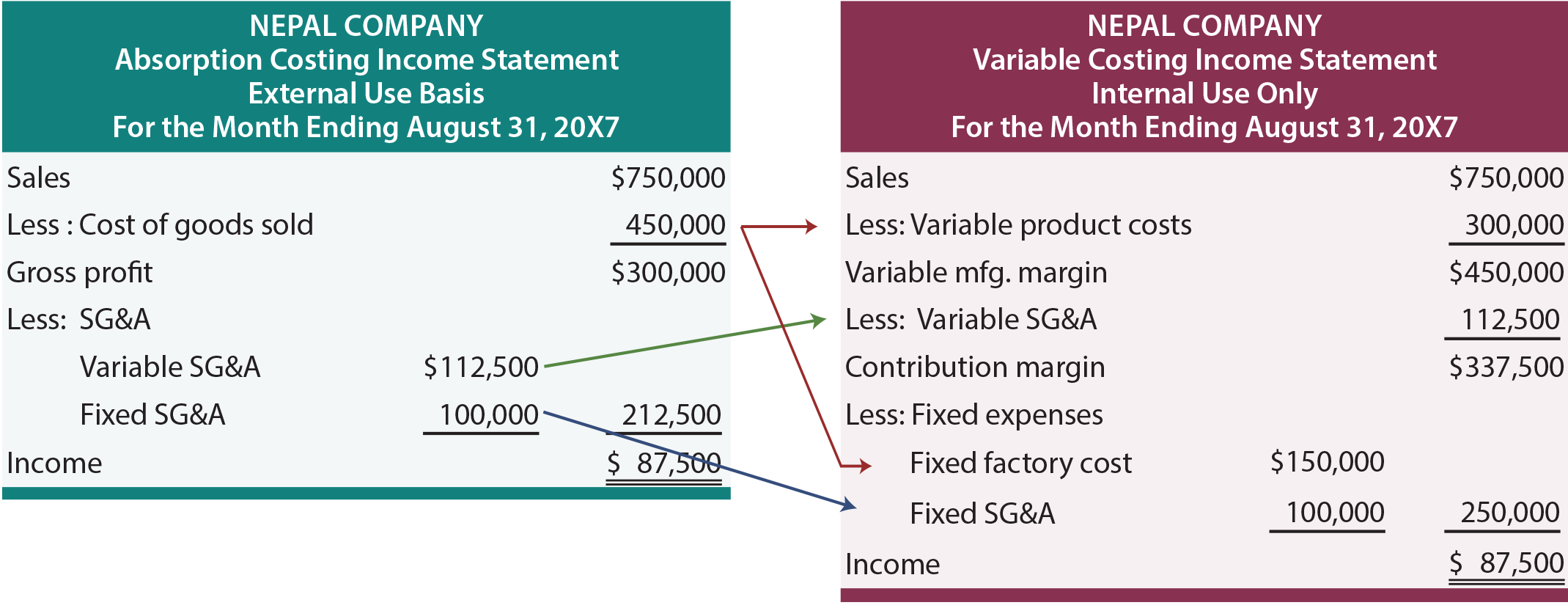

Normal costing income statement. Direct costing shows the business operating at a loss of 1000 and that the ending inventory has a zero cost. Profit and Loss Statement PL A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost.

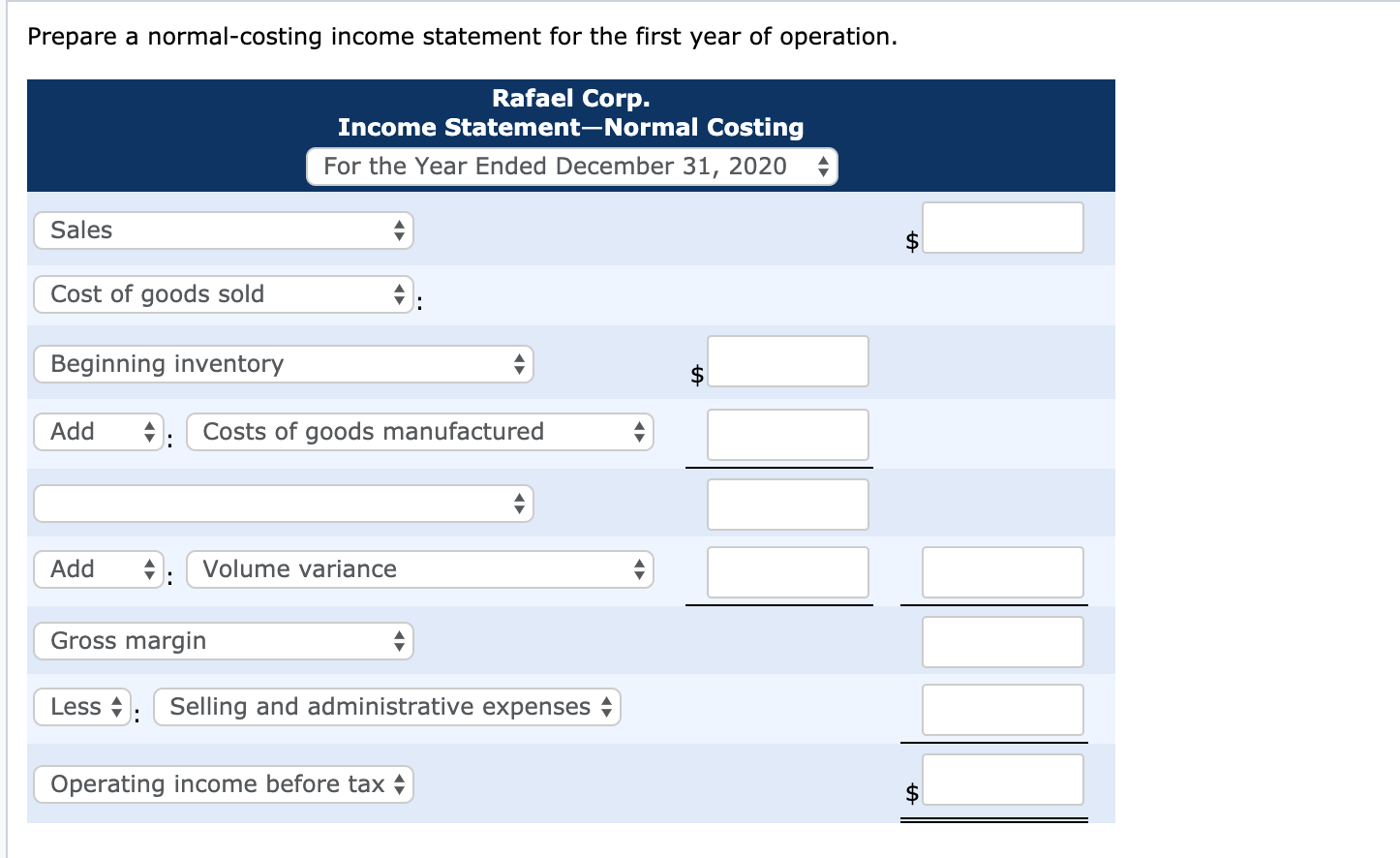

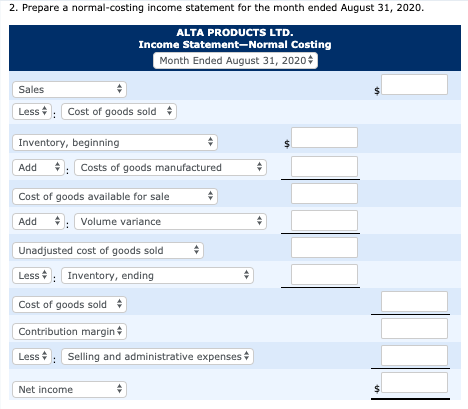

Chapter 4 Income Statement and Related Information 41 CHAPTER4 INCOME STATEMENT AND RELATED INFORMATION. Types of Income Statement Ratios. In other words the overhead rate under normal costing is based on the expected overhead costs for the entire accounting year and the expected production volume for the entire year.

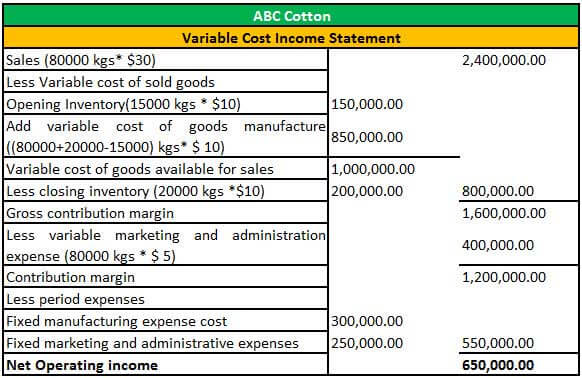

What is a Variable Costing Income Statement. Absorption costing shows income to be zero and ending inventory to be 1000. What is the difference between normal costing and standard costing.

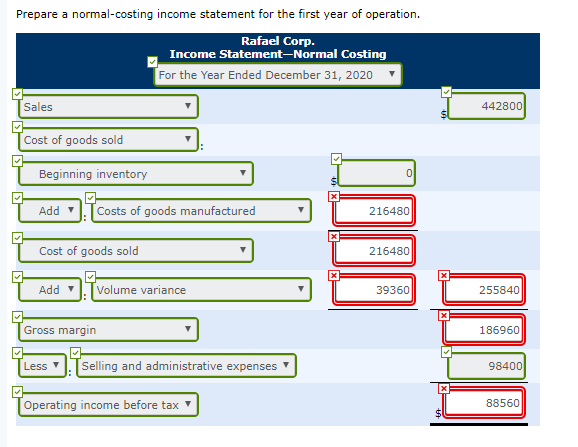

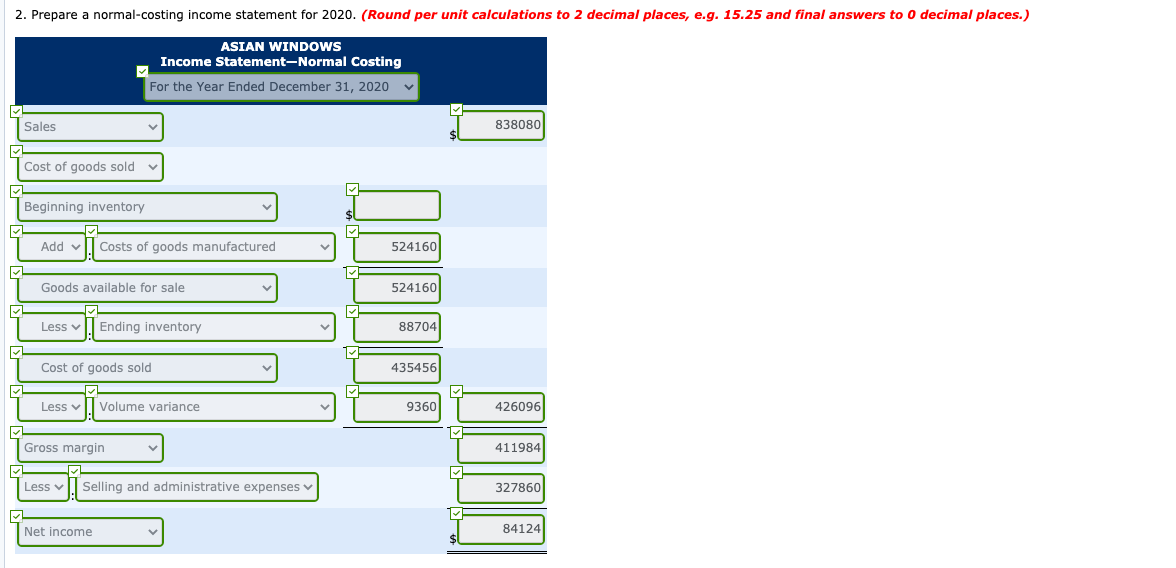

A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin. Normal costing uses a predetermined annual overhead rate to assign manufacturing overhead to products. Income Statement-Normal Costing Sales 442800 Cost of goods sold Beginning inventory Add Costs of goods manufactured 216480 Cost of goods sold 216480 Add Volume variance 39360 255840 Gross margin Less Selling and administrative expenses Operating income.

The three product costs are used for calculating the cost of goods sold and the cost of the. The cost of these purchases from suppliers is often called net purchases in the income statement in contrast to cost of goods manufactured in a manufacturers income statement. No Ratio Formula Description.

The net purchases line consists of purchases purchases returns and allowances purchases discounts and freight in. During the coming year it expects to sell 201000 units for 8 per unit. Financing CostsA separate item that identifies the financing cost of the company hereafter referred to as interest expense.

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)