Top Notch Non Operating Items On Income Statement

Non-operating income also known as peripheral or incidental income include items such as.

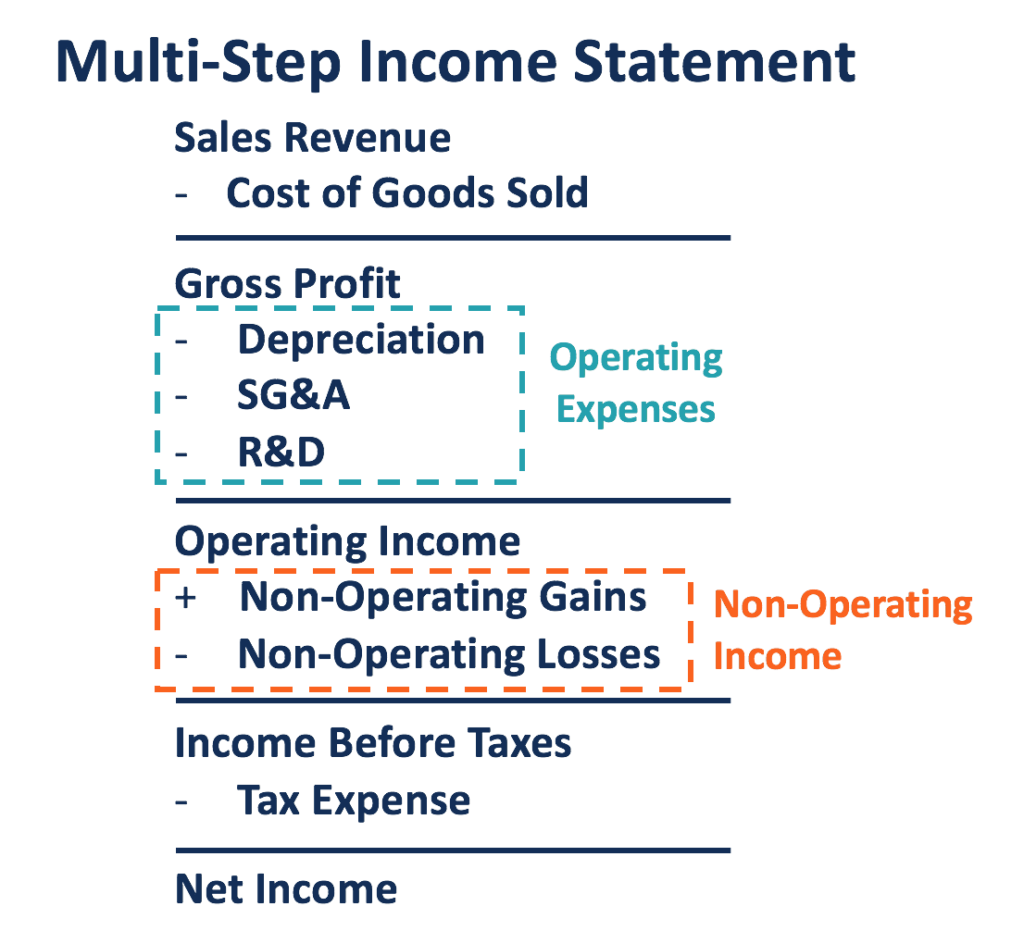

Non operating items on income statement. When analyzing the results of a business one can subtract these expenses from income to estimate the maximum potential earnings of. Gains and losses from the sale of assets or investments. Adjusting out the non-operating items disclosed on the income statement gives a truer picture of a companys profitability and can reveal when a company is over or under valued.

Examples include all restructuring expenses obsolescence expenses write-downs of assets impairments as well as financial expenses and income currency exchange gains and losses. Due to the material nature of non-operating items they are typically reported separately from operating items in a companys financial statements. Gains and losses from investments.

The operating income also referred to as operating profit is the basic or primary income that a business derives solely from its core operations. A non-operating expense is an expense incurred by an organization that does not relate to its main activity. By contrast extraordinary items are most commonly listed after the bottom line net income.

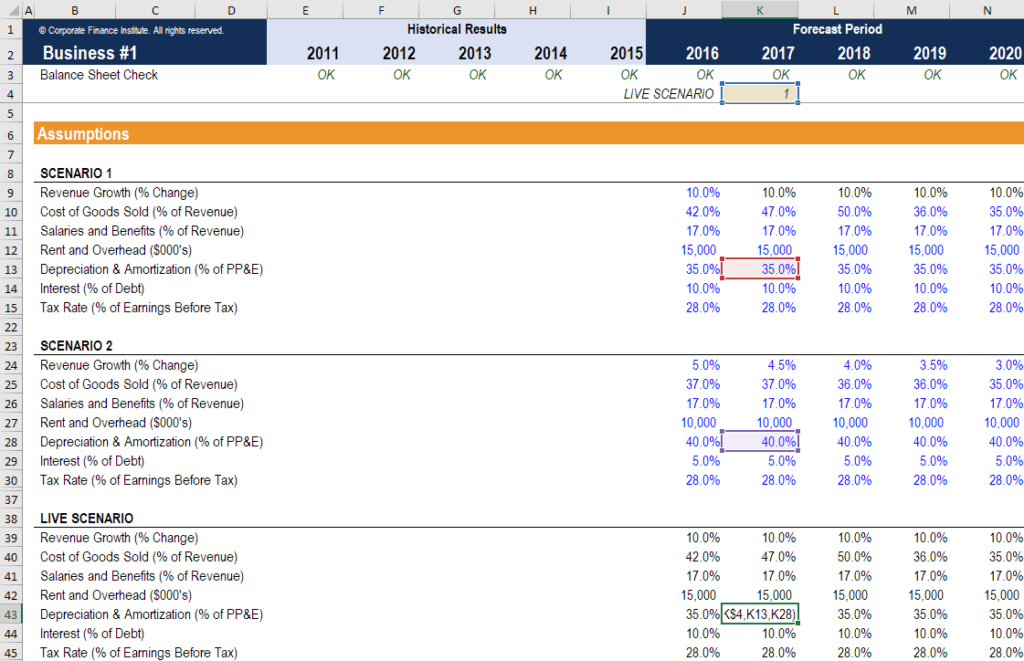

The following are all examples of non-operating income. These are adjustments that eliminate one-time gains or losses other unusual items non-recurring business elements expenses of non-operating assets and the like. Every appraiser employs such income statement adjustments in the process of adjusting normalizing historical income statements.

Non-operating items on the other hand are such that you dont need to keep your business running and wouldnt be expected to need in an ordinary course of business. Losses from asset impairment write-offs write-downs and restructuring. Presentation of non-operating income in the income statement of the company.

For the year ended December 31 2020. Interest and Investment Items. The concept is used by outside analysts who strip away the effects of these items in order to determine the profitability if any of a companys core operations.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)