Beautiful Loans And Exchanges On Balance Sheet

The defining characteristic of a balance sheet loan is that its kept on the original lenders books.

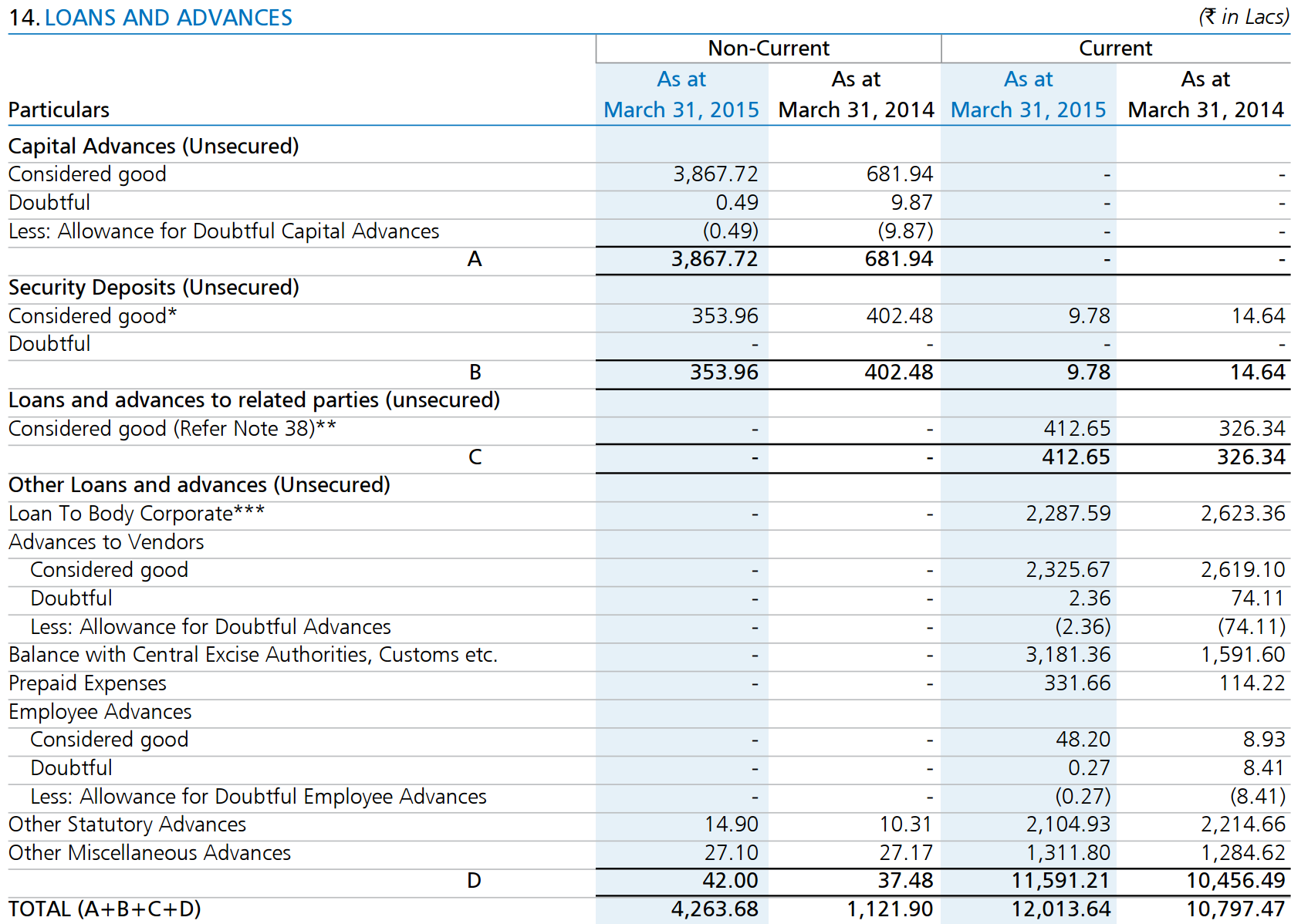

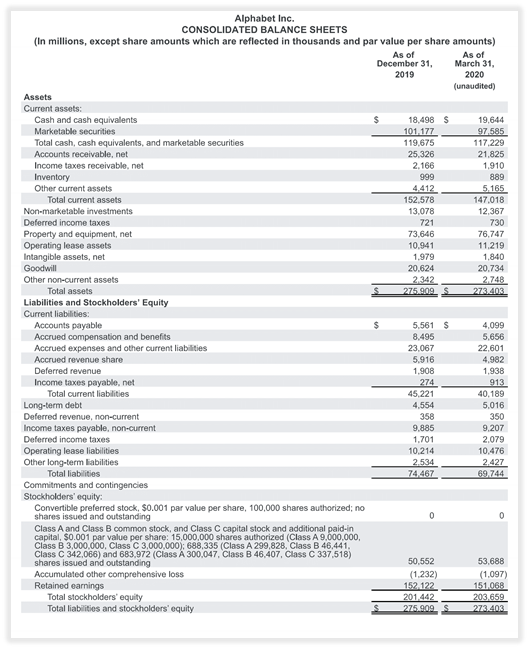

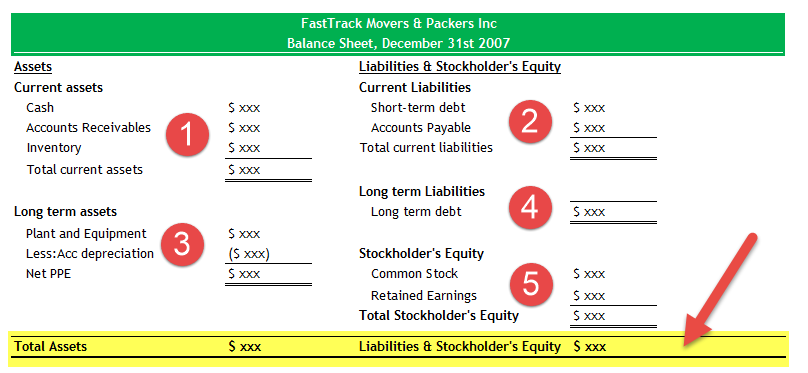

Loans and exchanges on balance sheet. An amortization schedule is used to determine how much of each payment is applied to interest and principal each period. Assets are something that is valuable that the company owns. Creditors including trade creditors.

Also referred to as portfolio lending balance sheet lending is when the original lender of a loan keeps the debt on their financial statements throughout the loans life cycle. Ad Looking for rates on personal loans. Great for both short-term and long-term loans the.

What does a balance sheet include. If a lender loans 50000 to a business owner but is only paid back 30000 for example they may sell the outstanding 20000 of debt to a collection. Current assets can be turned into cash within a year of the date.

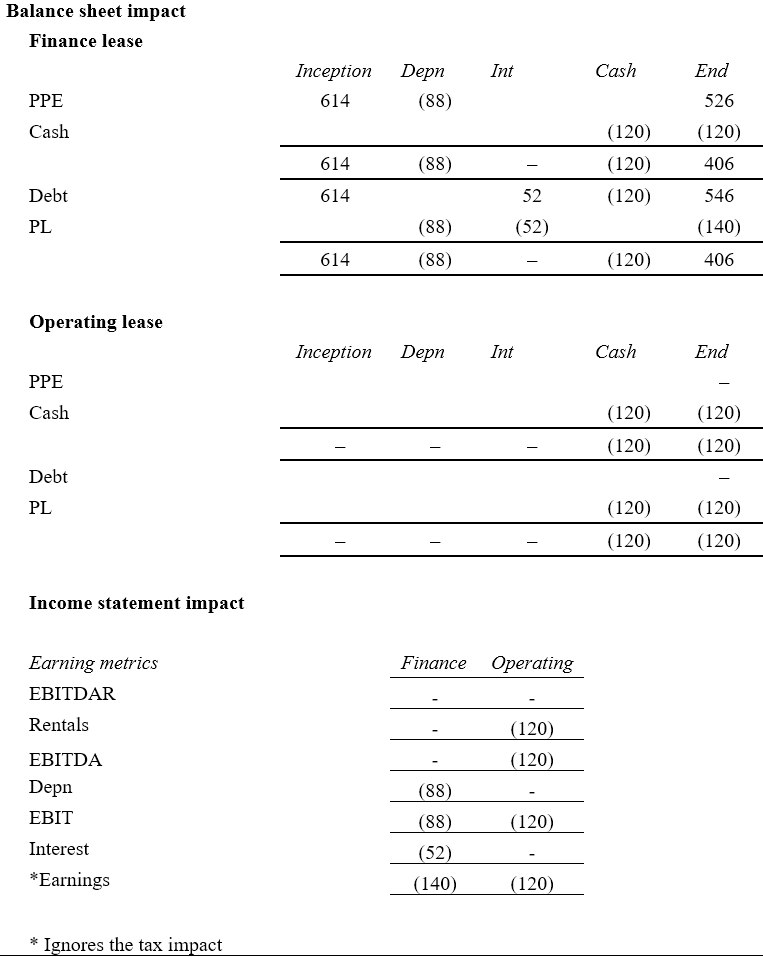

Your shareholder loan will appear on the balance sheet as either an asset or liability. Common examples of these types of financings are mortgages and lease liabilities. You must absolutely memorize this equation.

These loans can be short-term where the loan repayment is processed in less than a year or a long-term loan which can be paid back in over a years time. Basically things the company owns. On Thursday the Chinese banking regulator ordered banks to bring an estimated Rmb1660bn 252bn of such off-balance sheet loans back on to their books this year.

Funds in your checking or. The loan is initially measured on a present value basis. Here are four steps to record loan and loan repayment in your accounts.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)