Glory Preliminary Expenses In Balance Sheet

These are amortized written off to PL on a systematic base till the the balance goes to null.

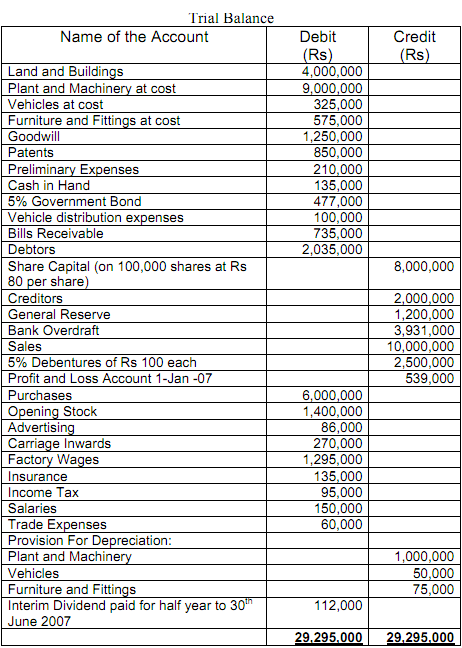

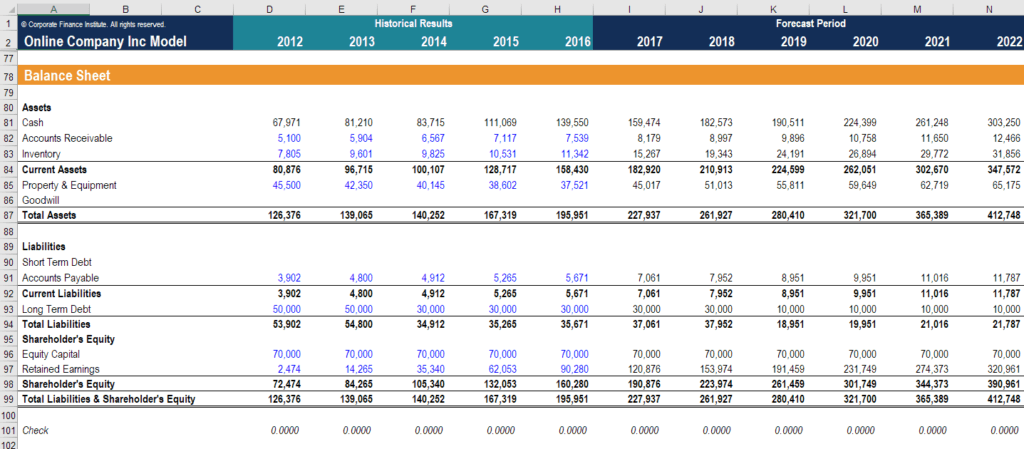

Preliminary expenses in balance sheet. As per the accounting standard this time is ten years. Interest paid out of capital during construction. Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of sales costs and expenses for the fiscal year beginning January 1 2017 the following tentative trial balance as of Decembers 31 2016 is prepared by the Accounting Department of.

Preliminary expenses are basically are part of deferred assets in Balance Sheet. How to treat preliminary expenses in the vertical balance sheet. They are therefore classified as capital expenditure and shown on the balance sheet under Current Assets subcategory.

Validate or refuse with just one click. Major repair expenses on plant and machinery. The auditor should verify these expenses with reference to supporting documents such as invoices and contracts relating to these expenses.

Research development expenses. The expenditure on preliminary expenses shall not be carried forward in the balance sheet to be written off in subsequent accounting periods. Normally preliminary expense are treated as intangible asset and shown on the asset side of the balance sheet under the head Miscellaneous asset.

In most of the cases these preliminary expenses are treated as intangible asset and shown on the asset side of the balance sheet under head miscellaneous asset. Ad With Odoo Expenses youll always have a clear overview of your teams expenses. Ad With Odoo Expenses youll always have a clear overview of your teams expenses.

These expenses are incurred before the start of the company. Alternatively fully woff preliminary expenses in the year of occurrence as per AS-26. As explained above the preliminary expenses can be written off within five years however as per Section 35 of The Income Tax Act 1961 the total preliminary expenses cannot be more than 5 of the capital employed which can be amortised in five equal installments this also means that a company cannot write off preliminary expense more than 1 of the capital employed in one year.