Casual Trial Balance Short Note

Preparation of Trial Balance.

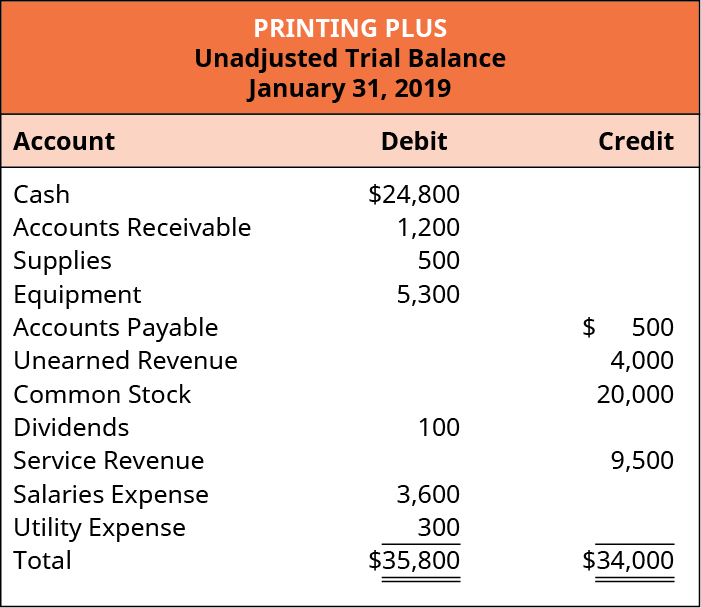

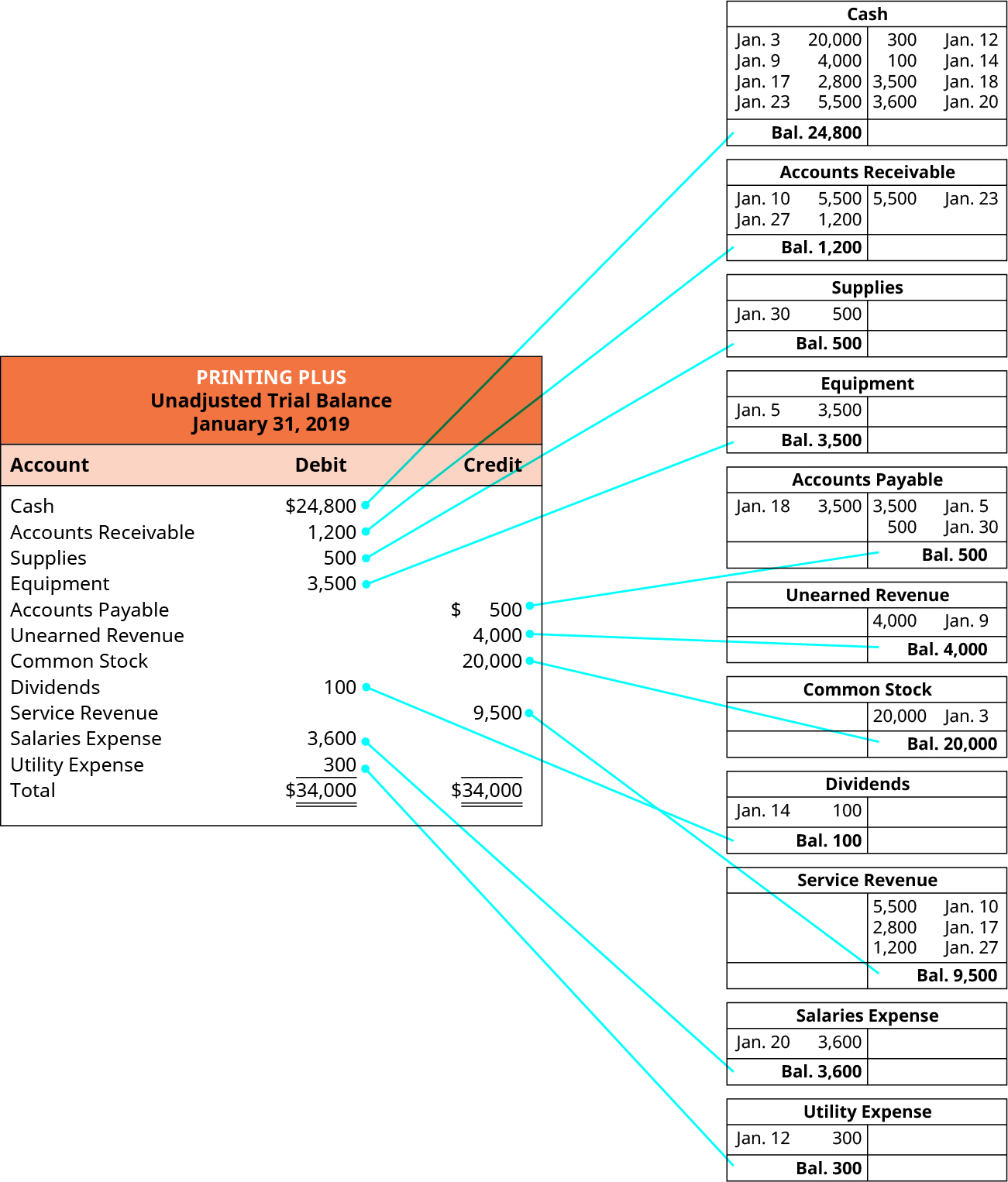

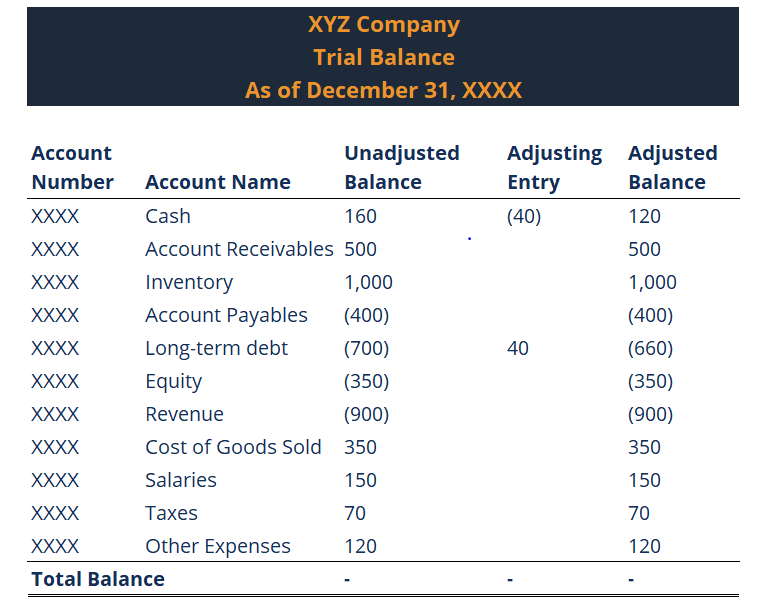

Trial balance short note. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Bookkeepers and accountants use this report to consolidate all of the T-accounts into one document and double check that all transactions were recorded in proper journal entry format. Cash reduces by 2000 here and a note payable liability is recorded for 3000.

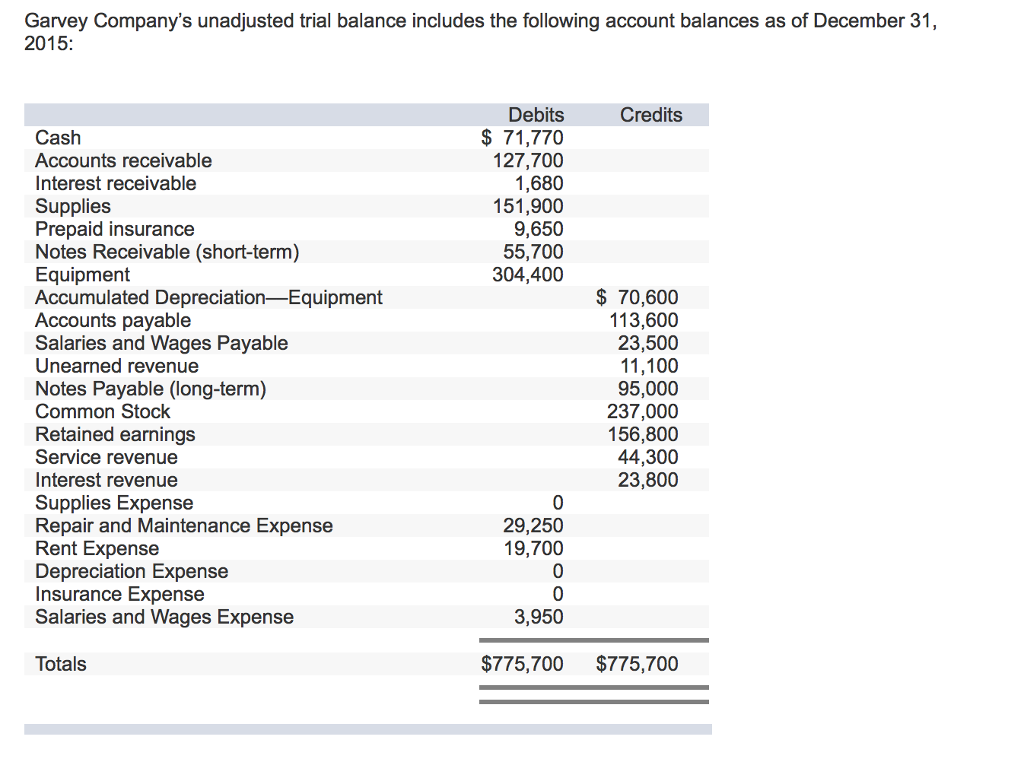

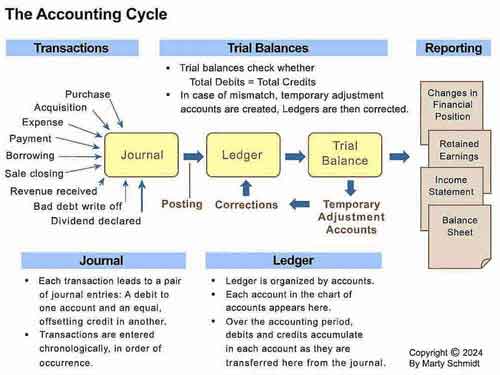

The 5 th step of the accounting cycle is the preparation of the trial balance. Creditors Account has been balanced short by Rs. The trial balance is the only way to detect errors of accounts if any.

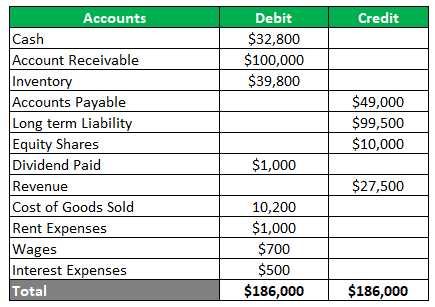

Trial Balance is a statement of debit and credit balances taken out from all ledger accounts including cash book. Short answer questions are the best collection of short answer type questions of trial balance. Trial balance may be defined as an informal accounting schedule or statement that lists the ledger account balances at a point in time compares the total of debit balance with the total of credit balance.

A Trial Balance is a statement that shows the total debit and total credit balances of accounts. The golden rules that Accounting equation remains balanced all the time and For every business transaction there is an equal debit and credit shall always prevail in the whole accounting theory. What is a Trial Balance.

Iv Error of Posting. Today were going to learn about the 25 Short Questions and Answers Trial Balance. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc.

The act of testing somethingTrying something to find out about it. The trial balance is an accounting report or worksheet mostly for internal use listing each of the accounts from the general ledger together with their closing balances debit or credit. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities capital and income accounts appear on the credit side.