Outrageous Prepare Profit And Loss Appropriation Account

PL account is used to determine Net Profit or Net Loss of an organization for a given accounting period.

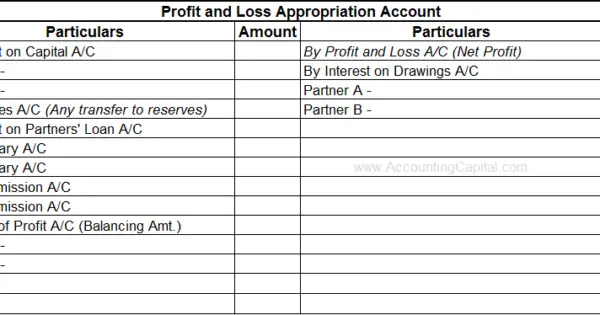

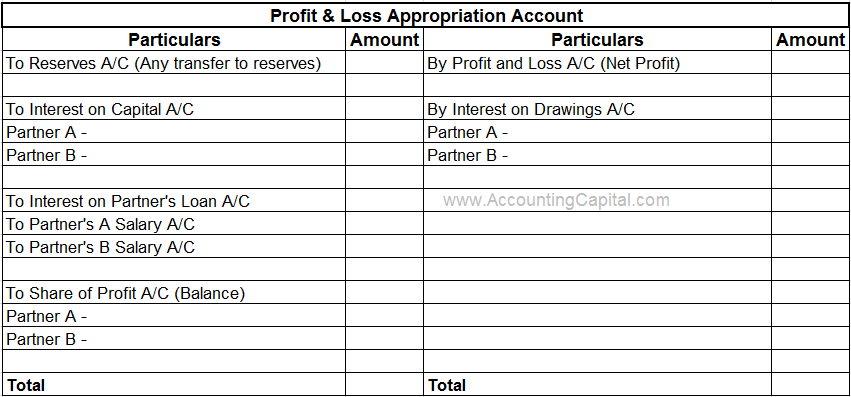

Prepare profit and loss appropriation account. Profit and loss Appropriation account is Prepared after preparing Profit and Loss Account. It is a special account that a firm prepares to show the distribution of profitslosses among the partners or partners capital. 1 Fatima is given a guarantee that her share of profit in any year will not be less than 5000.

It is debited with interest on capital and remuneration to partners and credited with the net profits bd from the profit and loss account and interest on drawings. In the case of partnership firms it is prepared to show how profits are distributed among the partners involved in the partnership. Ad Find Loss Profit Statement.

It is prepared to distribute the profitsLosses among the partners. 6000 and Anum Rs. PL appropriation account is used for allocation and distribution of Net Profit among partners reserves and dividends.

Ad Find Loss Profit Statement. Ad Find Loss profit statement. Meaning of Profit and Loss Appropriation Account.

A Interest on Capital is to be allowed Rs. In other words Net Profit or Net Loss from Profit and Loss Account will be transferred to opposite side Below the line method. It Is usually prepared after preparing Profit and loss account.

Profit and Loss Appropriation Account is used for allocation of net profit among different partners. Profit and Loss Appropriation Ac. It is an extension of profit and loss account.