Impressive Patent Balance Sheet Classification

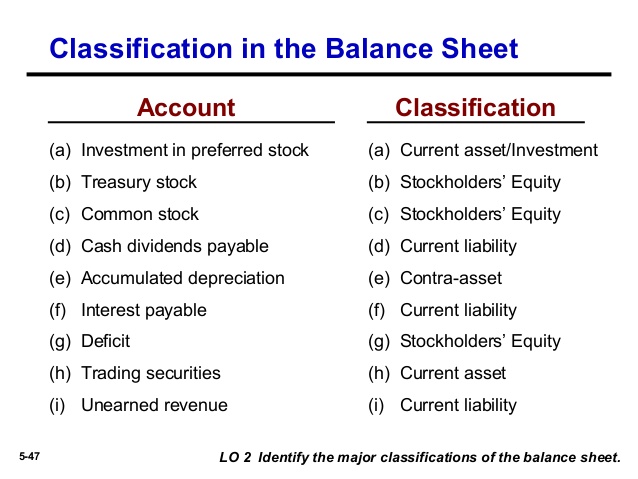

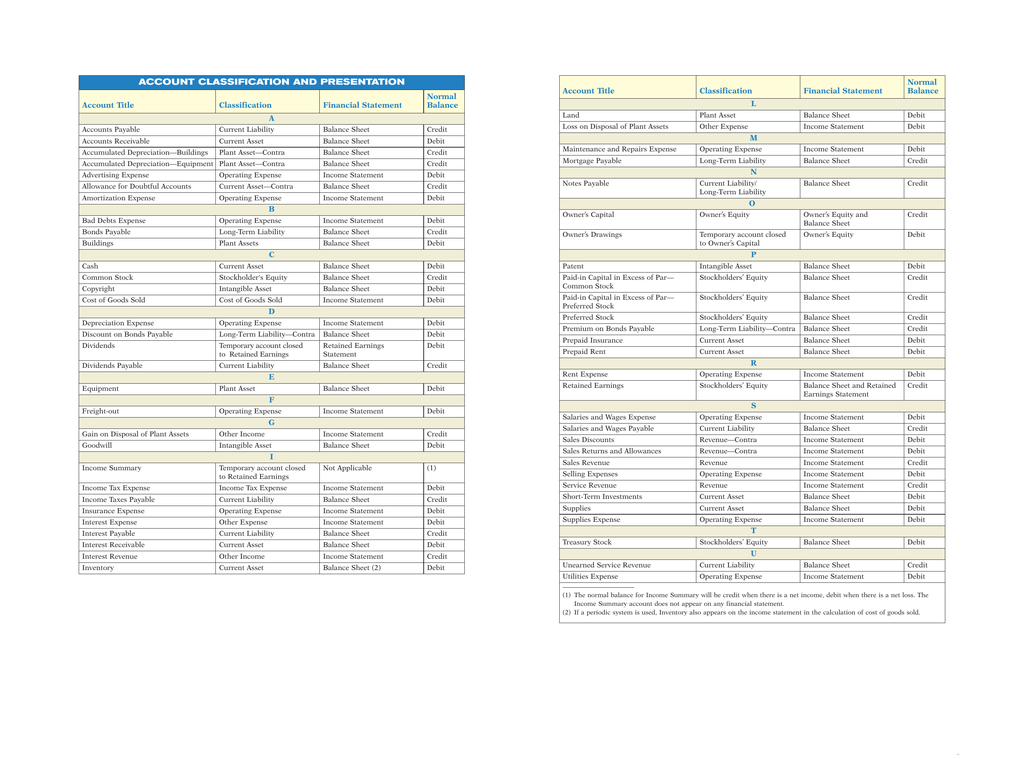

Start studying Classify each of the following financial statement items based upon the major balance sheet classifications.

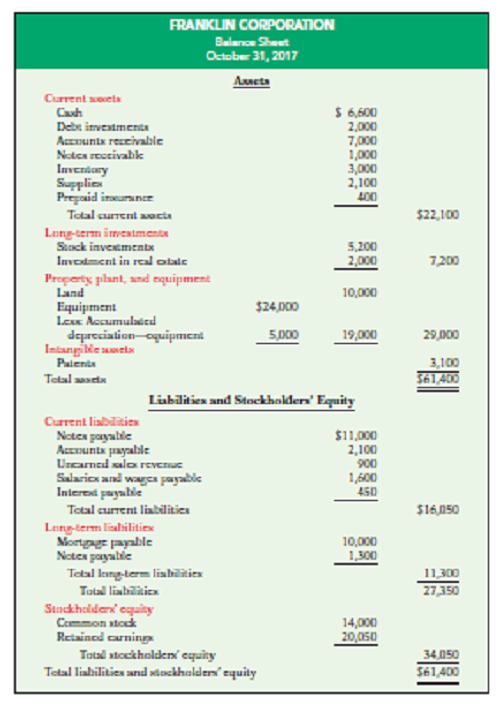

Patent balance sheet classification. Debit 52000 to the patent account. When a company sells bonds it usually classifies the bonds value as a long-term liability. Unrecovered costs of a successful legal suit to protect the patent.

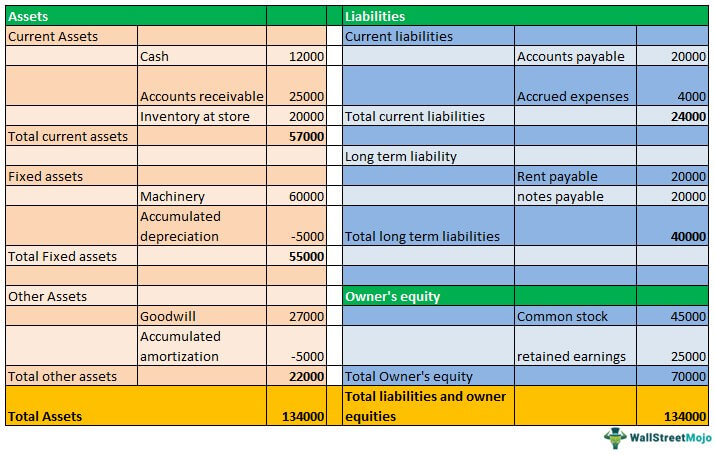

Indication of flexibility in meeting financial demands of THE OPERATING CYCLE. A trademark that was developed internally rather than purchased might have a cost of 0 and therefore it will not be listed on the. Since an intangible asset is classified as an asset it should appear in the balance sheet.

Cost of purchasing a patent from an inventor 2. Thats because the bond is not due for repayment for a specified number of years usually between five and 20. This is because a patent does not have physical substance and provides long-term value to the owning entity.

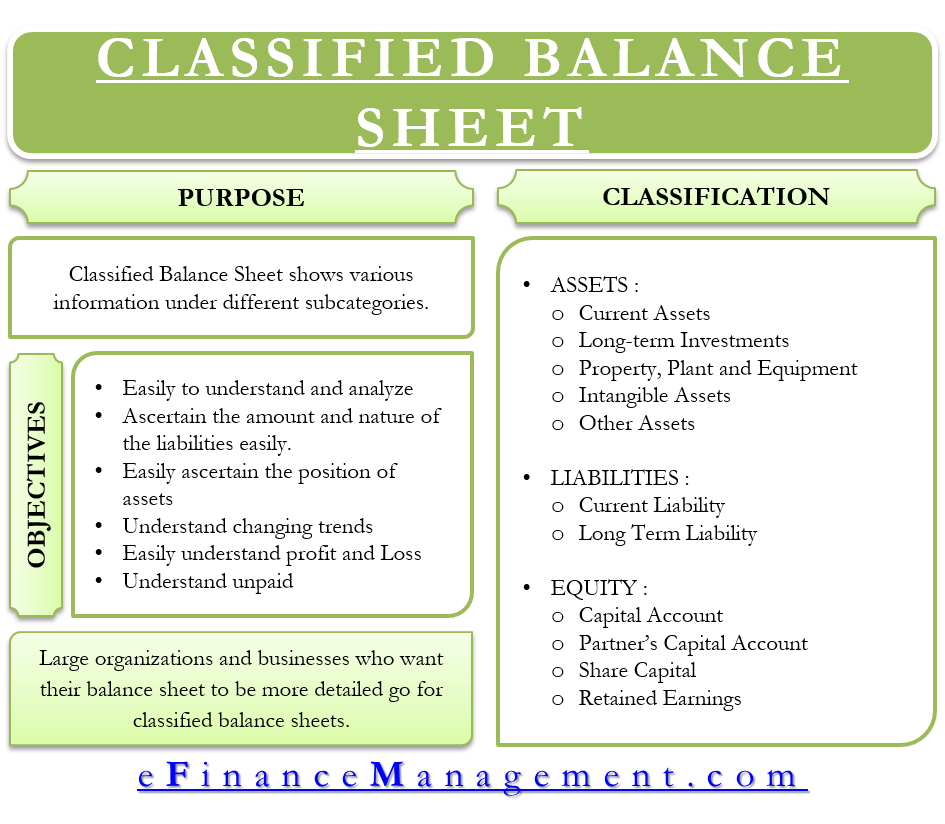

2 Indication of. Such balance sheets are called classified balance sheets Assets The asset side of the balance sheet may be divided into as many as five separate sections when applicable. Supplies Current Assets 13 Match each of the financial statement items to its proper balance sheet classification.

E121 LO 1 2 Classification Issues-Intangibles Presented below is a list of items that could be included in the intangible assets section of the balance sheet. Match each of the following accounts to its proper balance sheet classification. Patent Intangible Assets 12 Match each of the following accounts to its proper balance sheet classification.

Retained Earnings Treasury Stock. WORKING CAPITAL Current assets Current liabilities. A patent is considered an intangible asset.