Casual Provision For Doubtful Debts Example

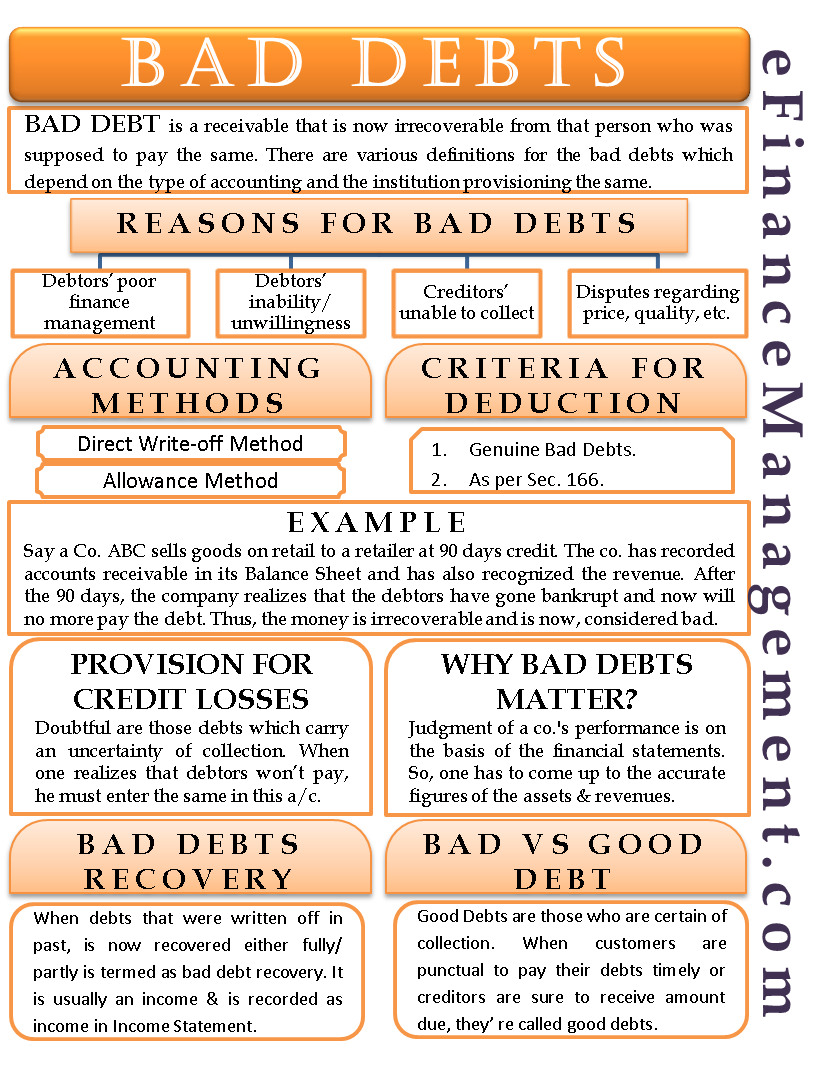

The doubtful debt are those debts which carry some risk of non payment.

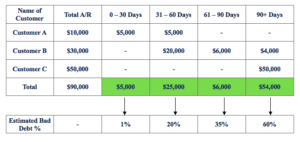

Provision for doubtful debts example. Take a bank for example. On March 31 2017 Corporate Finance Institute reported net credit sales of 1000000. It is identical to the allowance for doubtful accounts.

The allowance for doubtful debts is created by forming a credit balance which is deducted from the total receivables balance in the statement of financial position. A business which started trading on 1 January 20X7 adjusted its doubtful debt provision at the end of each year on a percentage basis but each year the percentage rate is adjusted in accordance with the current economic climate. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

Company A decides to create a provision for doubtful debts that will be 2 of the total receivables balance. New doubtful debts regime The provisions of section 11j of the Income Tax Act the Act allow for taxpayers to claim tax relief in respect of doubtful debts. Irrecoverable debt 800 Specific Provision 200 Net Trade receivables 5 200.

Allowance for Doubtful Debts Expense 500. Banks usually provide lots of loans and under IFRS 9 they have to apply general models to calculate impairment loss for loans. According to ATO legislation this doesnt happen just because time has passed and its overdue but because you have tried your best to recover the debt and been unable to do so.

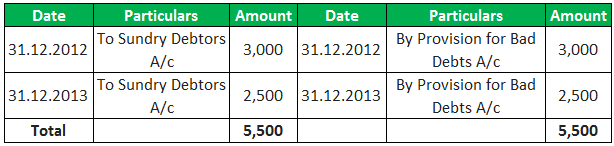

General provision is 3000 whereas specific provision is 1200 and total provision for doubtful debts would be made at 4200. But occasionally banks can have other financial assets too. As on 122013 Bad Debts written off is 2500.

Assuming in year 1 we need to. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet. As on 01012012 Provision for Bad Debts is 5000.