Fabulous Sba Form 413 2021

If you have applications in process using the old form dont worry SBA will accept them.

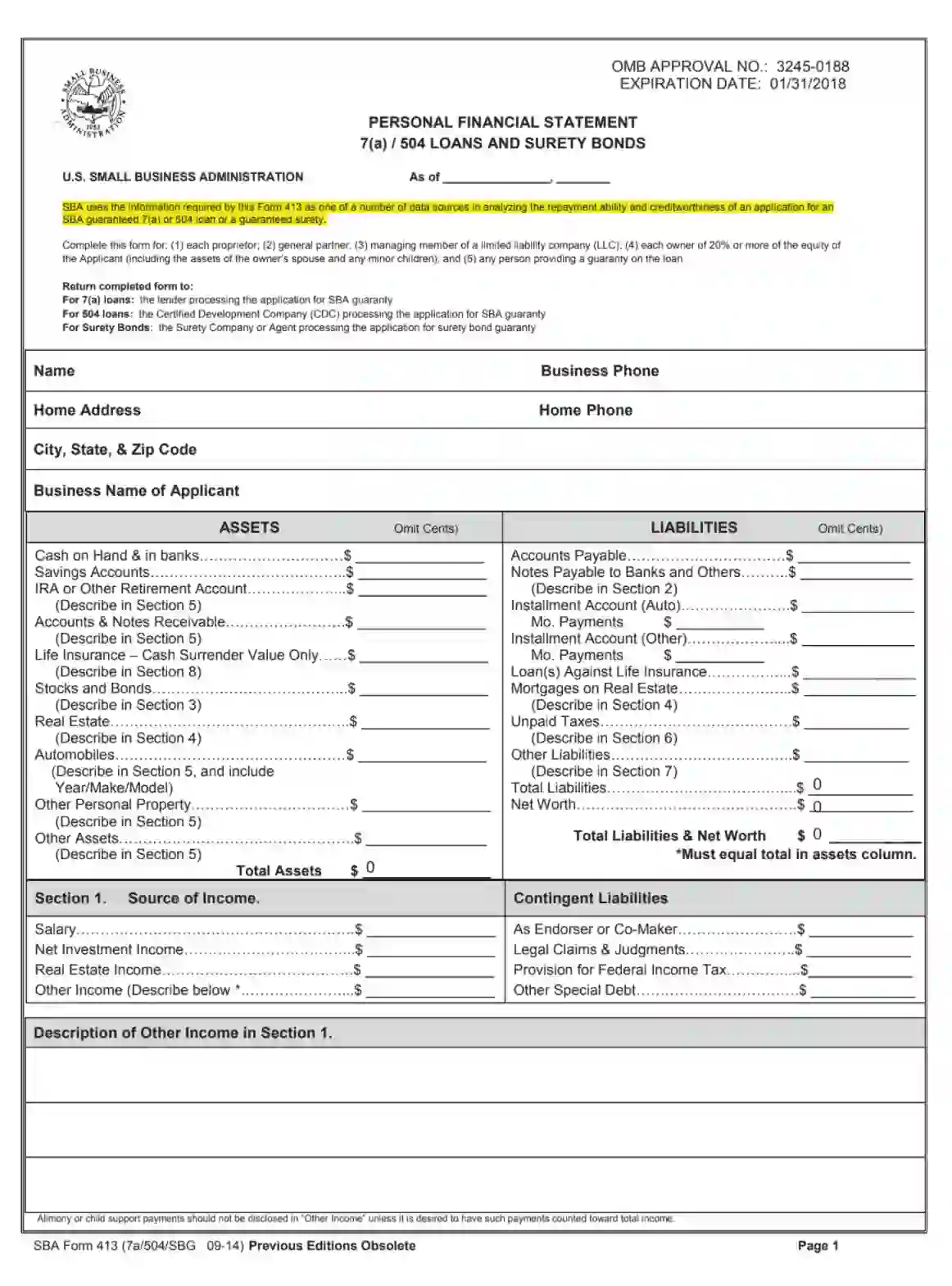

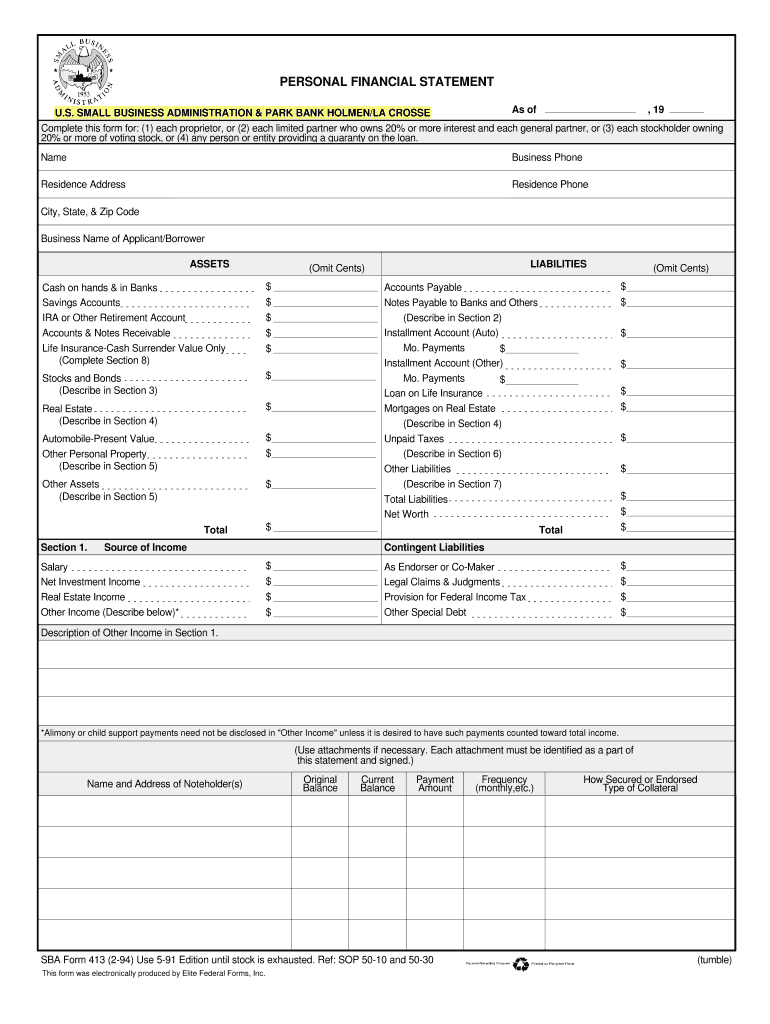

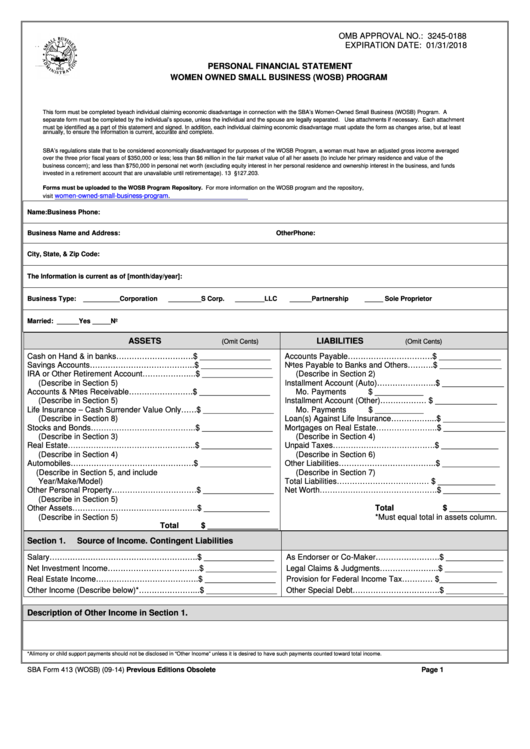

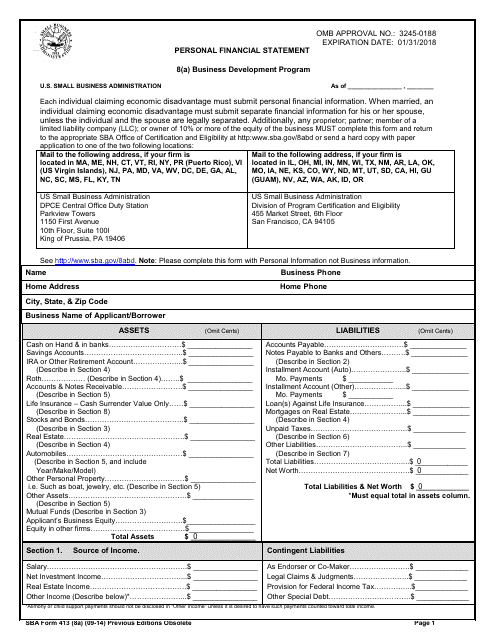

Sba form 413 2021. Whats the SBA Form 413. SBA Form 413 If you need an SBA-guaranteed loan most commonly the 7 a or 504 loan program the SBA Form 413 will need to be completed. Government Guaranteed Loans Past Emails SBA Loans.

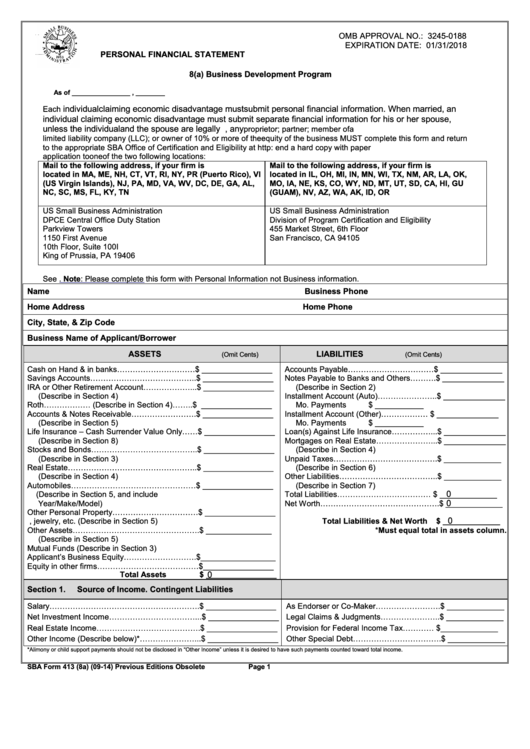

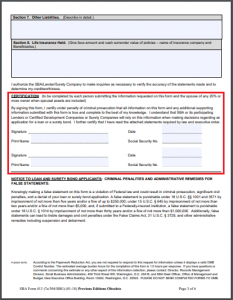

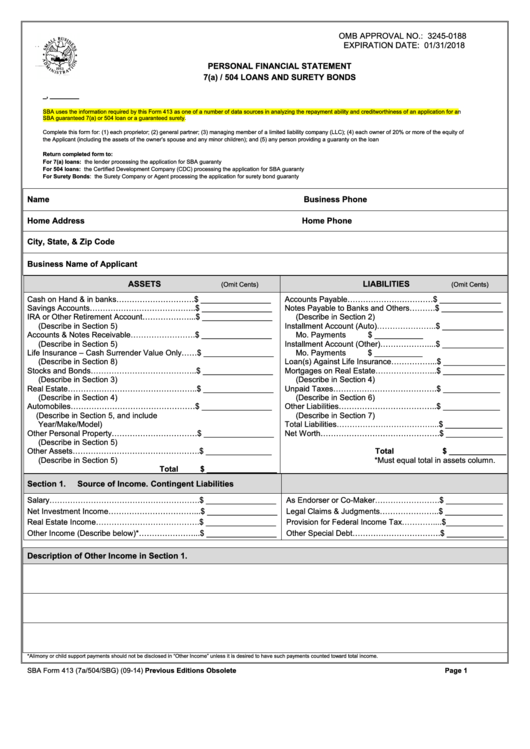

SBA uses the information required by this Form 413 as one of a number of data sources in analyzing the repayment ability and c reditworthiness of an application for an SBA guaranteed 7a or 504 loan or with respect to a surety bond to assist in recovery in the event that the contractor. While the general requirement is that SBA expects lenders to continue to use an expired form until its replacement is issued NAGGL recently checked in with SBA to learn the status of the 413 form and what lenders should be doing now. If you arent sure which type of loan you may be applying for the SBA Form 413 will be still be accepted by most banks for non-SBA loans.

7a 8a CDC504 Surety Bonds. We hope you can find what you need here. Information put and ask for legally-binding electronic signatures.

Sba Form 413 2014-2021. If your business is applying for a guaranteed surety bond youll need to also submit a completed Form 413. It was coming from reputable online resource which we like it.

Save or instantly send your ready documents. August 2 2021. 6 Pages Updated 05-2021 NEW.

Data put and request legally-binding digital signatures. Work from any device and share docs by email or fax. New SBA Guidance IFR FAQs Information Notice and more Update for July 30 2021 July 30 2021.