Looking Good Treatment Of General Reserve In Balance Sheet

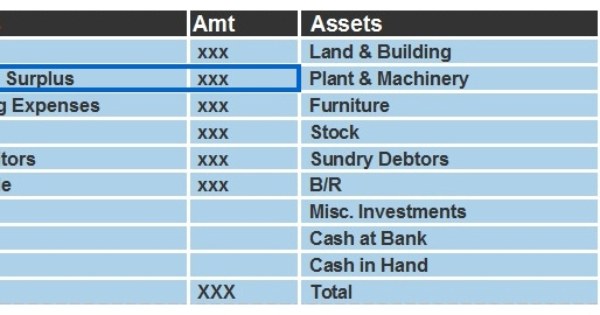

Impairment of assets 19.

Treatment of general reserve in balance sheet. If there is no other information. Transferring all the liabilities except Partners Loan Account and Partners Capital Accounts to the credit side of the account. The accounts often occupy a place just underneath the operating cash account.

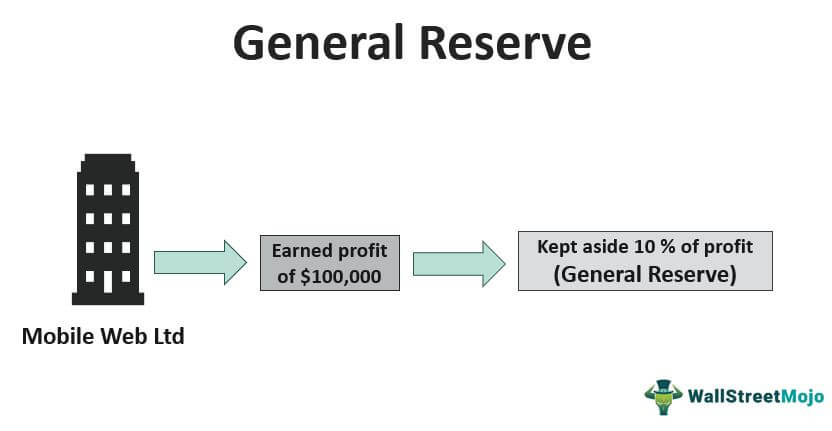

Iv where the dividend proposed exceeds 20 per cent of the paid-up capital the amount to be transferred to reserves shall not to be less than 10 per cent of the current profits. Post balance sheet events and financial statements 23. A general reserve is a capital or a equity account.

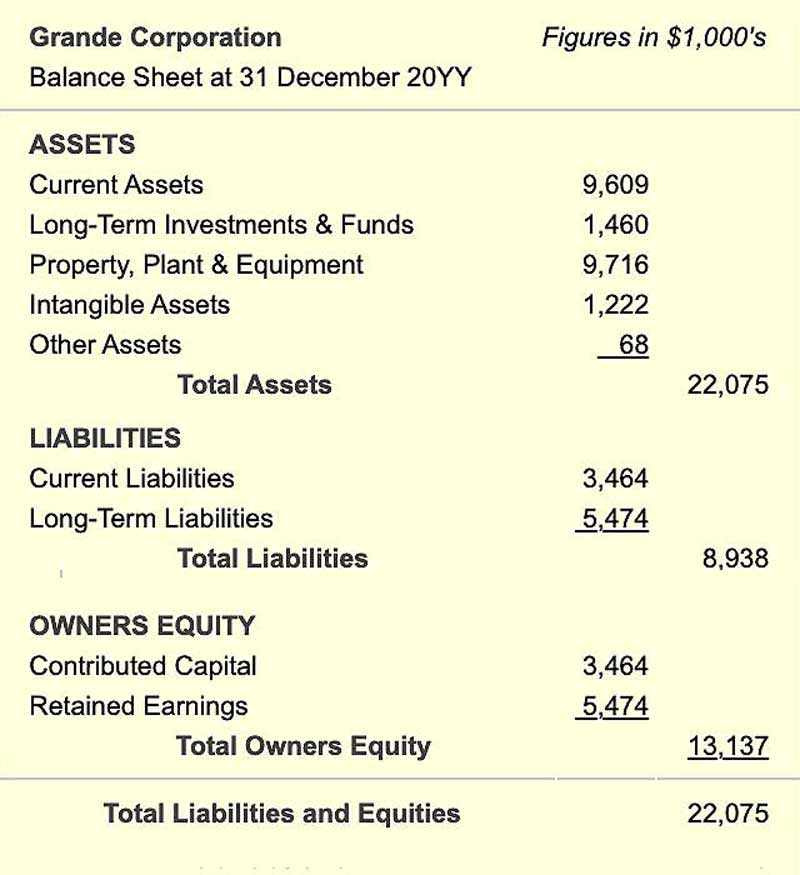

After these adjustments the general reserve or. Intangible fixed assets 16. Your retained earnings account is now 57 million.

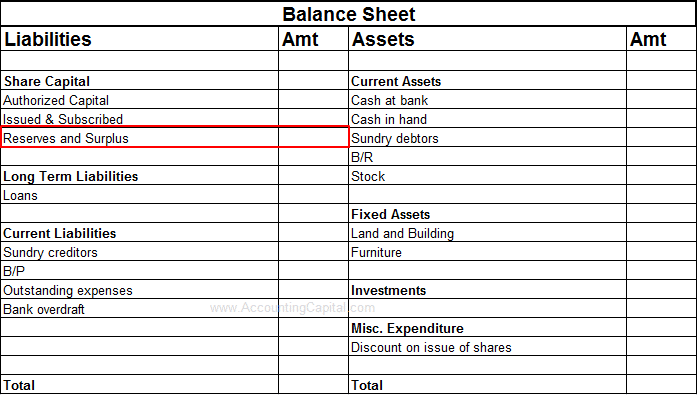

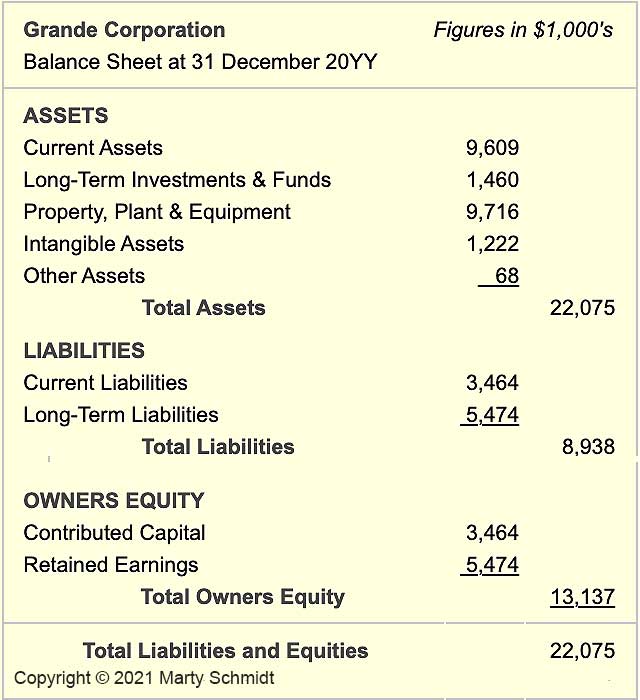

The assets are on the left side and liabilities and capital are on the right side. Total profit before acquisition of subsidiary company XXXX. These undistributed losses are also transferred to Partners CapitalCurrent Account in the old profit sharing ratio.

General reserves are shown in liabilities side of balance sheet. To pay dividends to shareholders more than specified limits. Treatment of Pre Acquisition of reserve and profit Pre acquisition profit and reserve of subsidiary company will be shown as capital reserve in consolidated balance sheet but the value of minority interests profit or reserves deducts from it and add in minority interest value.

If a claim on account Workmen Compensation is estimated at 45000. Debiting the dissolution expenses of the firm. Retained earnings RE go in the shareholder equity section of the balance sheet.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)