Divine Southwest Airlines Financial Ratios

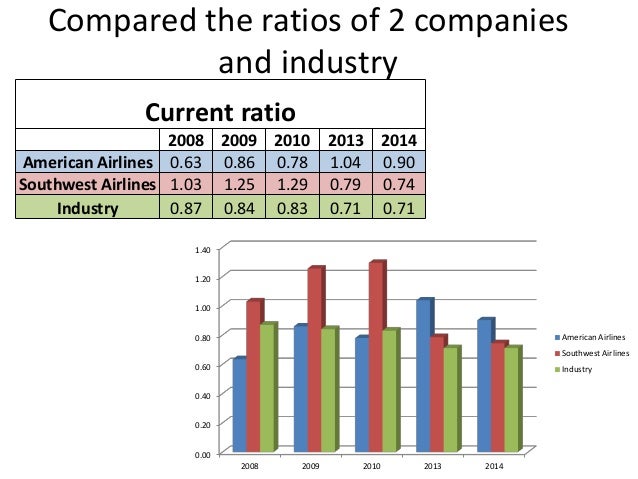

67 rows Southwest Airlines current ratio for the three months ending June 30 2021 was 154.

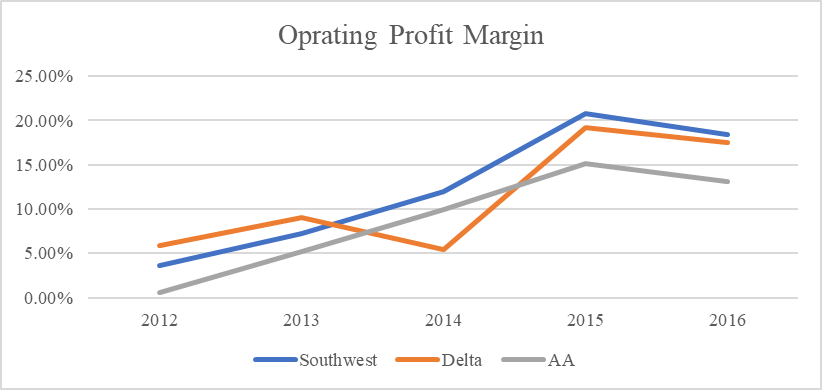

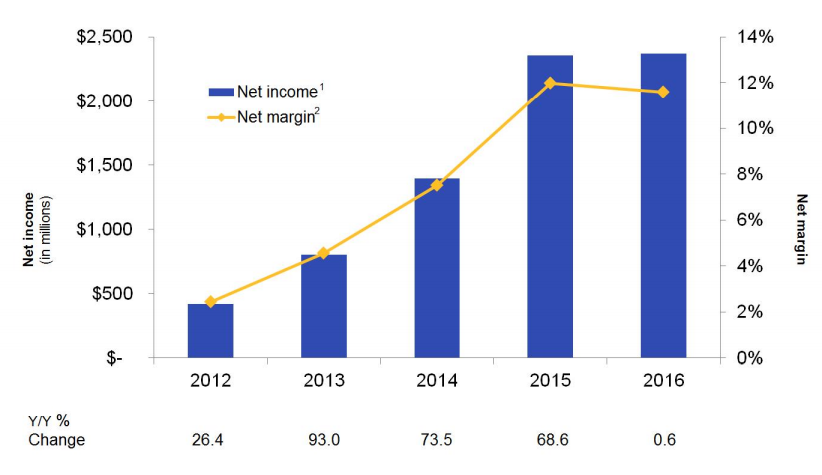

Southwest airlines financial ratios. The EVEBITDA NTM ratio of Southwest Airlines Co. To see Industry Sector or SP 500 Performance click on each Category respectivly on the top of the Table. According to Statista in 2017 total operating revenue for domestic airlines was over 220 billion.

Southwest Airlines current ratio ended 2015 at54. Objective To measure the solvency or the ability of Southwest Airlines Co. Obtén el Más Barato ahora.

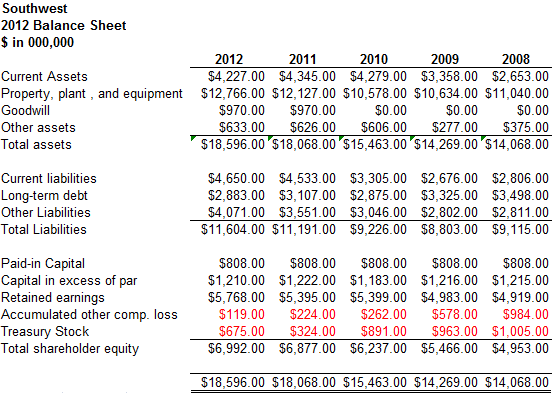

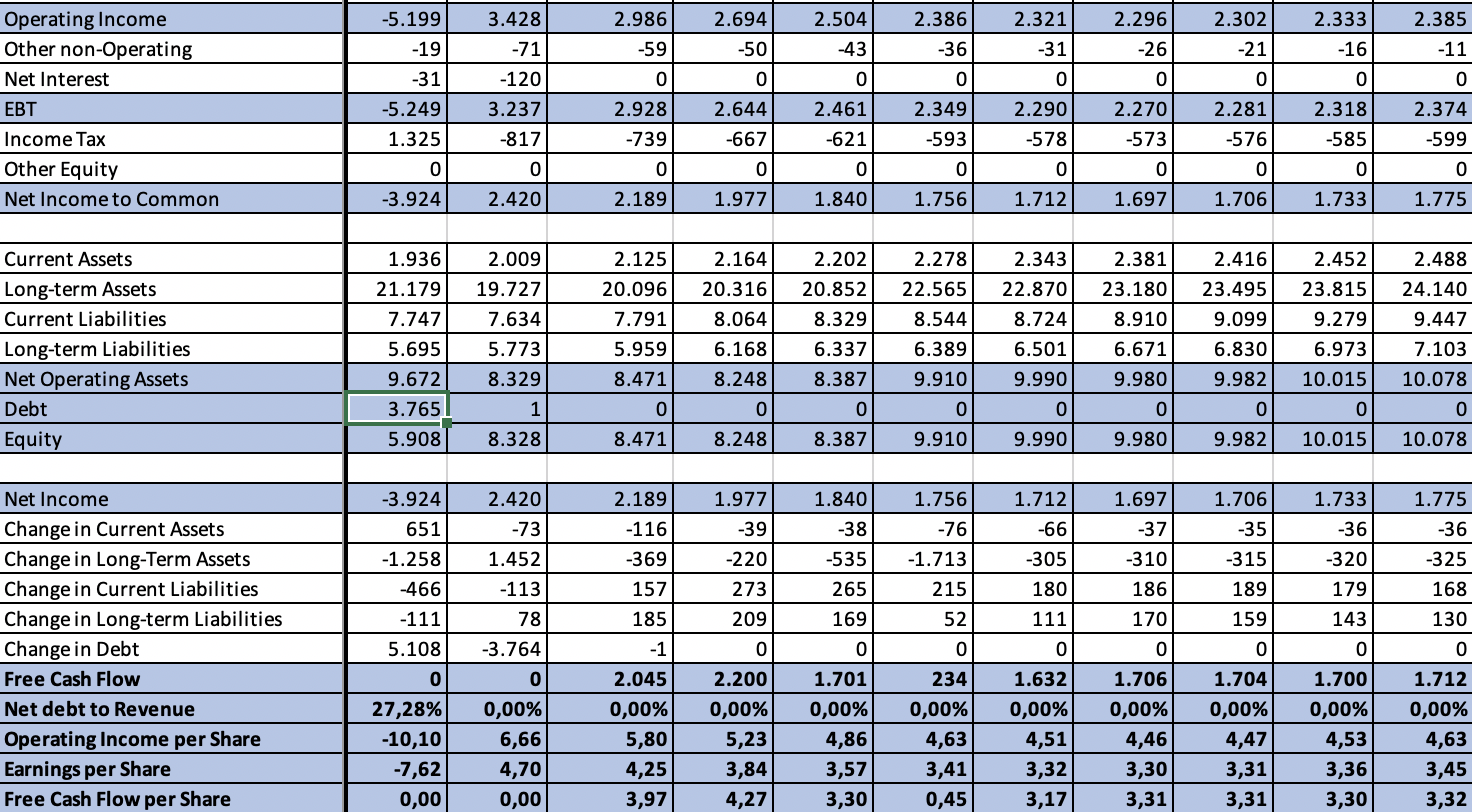

In the next two years the company would increase its current ratio of 27 in 2017. Year with the strongest balance sheet in Southwests history with adjusted debt3 to total invested capital of only 24 percent. The financial condition of Southwest Airlines Company in 2020 is better than the financial condition of half of all companies engaged in the activity Air Transportation Scheduled Due to the fact that the average industry ratios are much lower than those for all industries there is a negative result when compared with all companies.

To convert current assets to cash to reduce current liabilities. Y Y Revenue Change MRQ or. The EVEBITDA NTM ratio of Southwest Airlines Co.

Current ratio can be defined as a liquidity ratio that measures a companys ability to pay short-term obligations. LT Debt to Equity MRQ. 5 days ago According to these financial ratios Southwest Airlines Cos valuation is way above the market valuation of its peer group.

To view Detail Information Trends click on Individual Category. Southwest Airlines Company key financial stats and ratios LUV price-to-sales ratio is 459. Data is currently not available.