Matchless Goodwill Impairment Loss Journal Entry

In the group statement of financial position the accumulated profits will be reduced 30.

Goodwill impairment loss journal entry. Record the journal entry to recognize any goodwill impairment. This accounts for a reduction in Goodwill by using Loss on Impairment. Acquired asset Dr XXX.

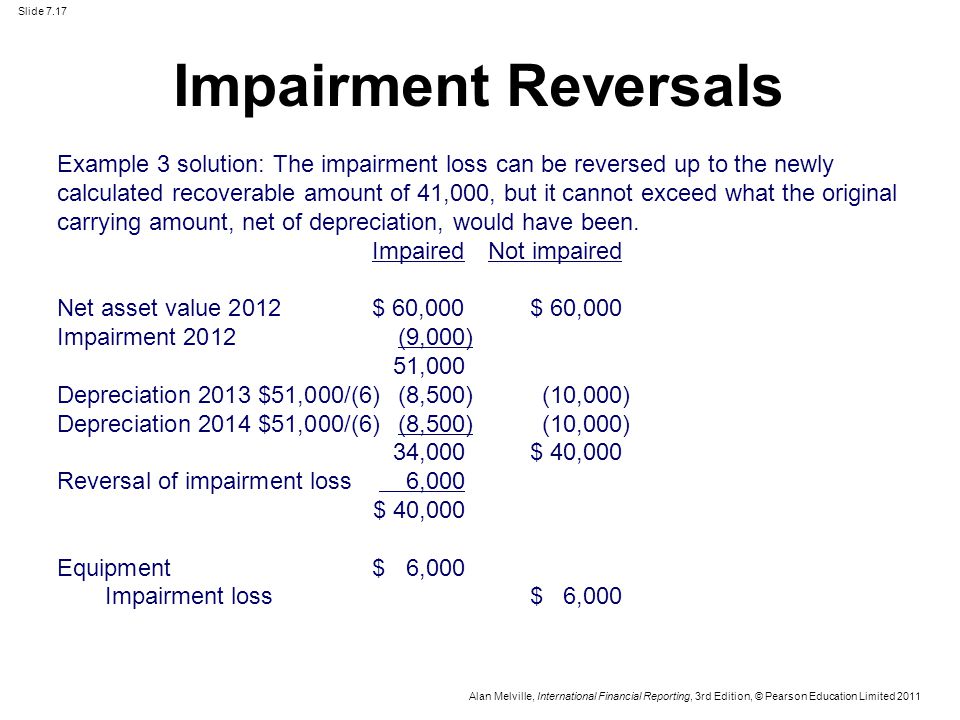

Following are the main journal entries of Goodwill. In this scenario the carrying amount of 12000 equals the fair value of the unit for 12000. Impairment Loss 7 million.

This value is ultimately shown as an impairment loss in the books of accounts. Sometime vendor of company will demand excess value business than market value difference will be goodwill. If the goodwill account needs to be impaired an entry is needed in the general journal.

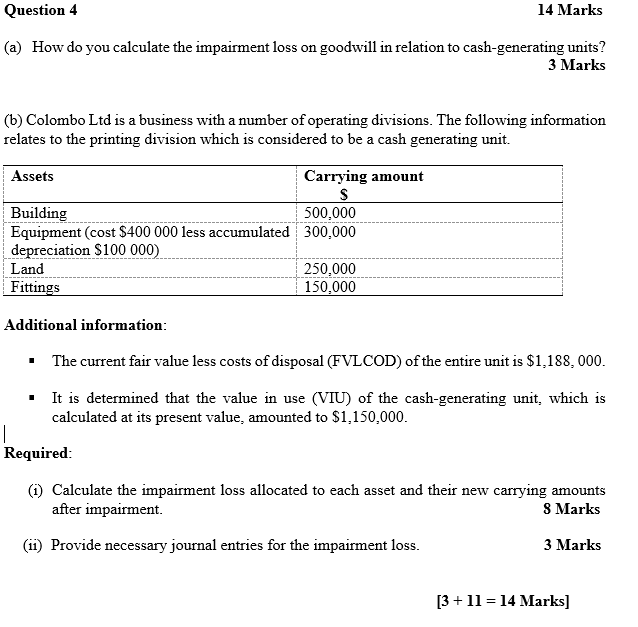

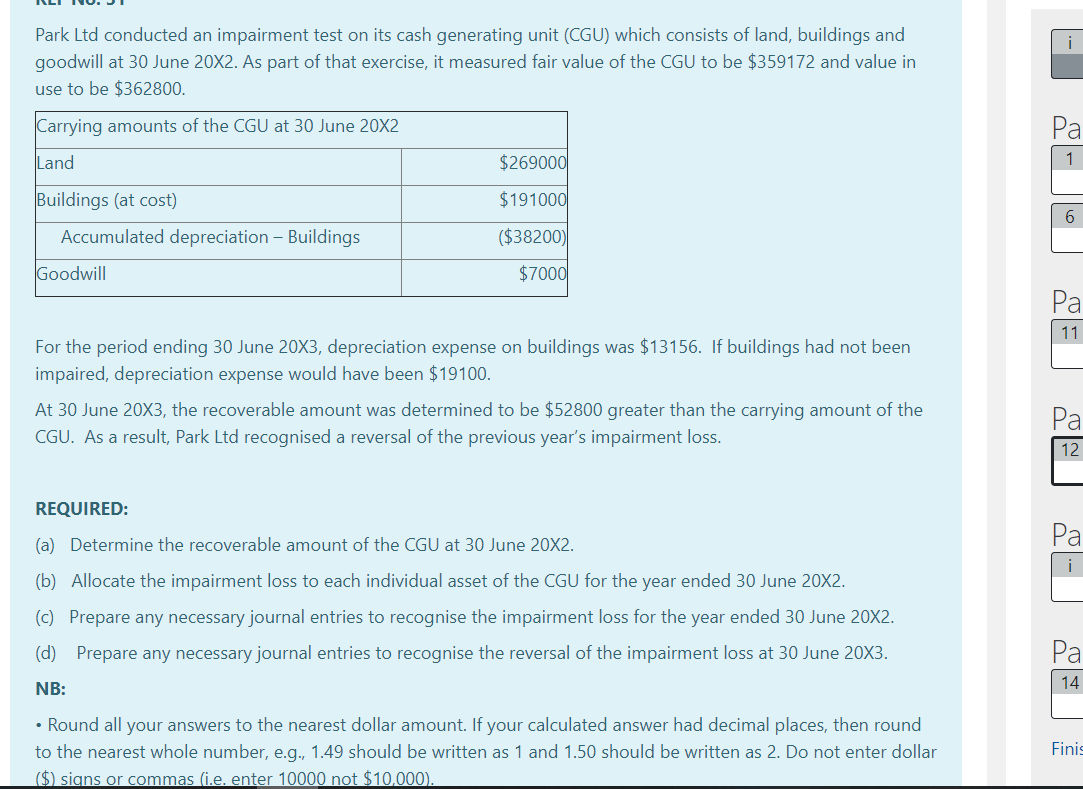

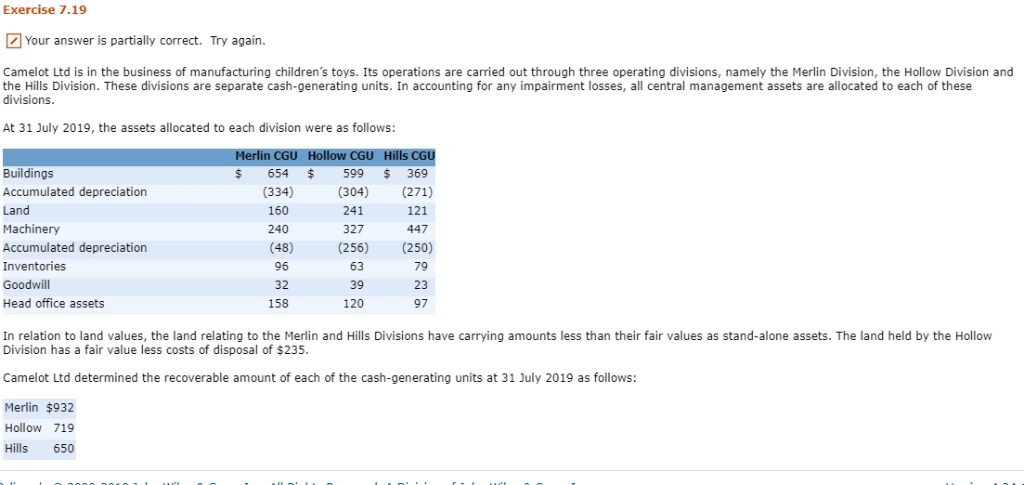

Find out impairment loss if. Impairment loss Carrying amount - Recoverable amount. If implied goodwill calculated above is lower than the goodwill allocated the difference should be expensed out.

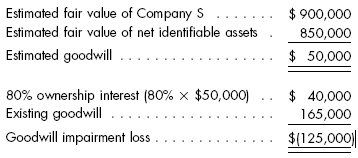

For CGUs the impairment loss is allocated to goodwill first and then to the rest of the assets pro rata on the basis of the carrying amount of each asset IAS 36104. Goodwill Entity A acquired Entity S with the following information. O Goodwill emerges during consolidation elimination entry so impairment loss is done on consolidation adjustment entry Journal entry o Dr Impairment loss o Cr Goodwill Journal entry impairment losses that are in prior periods o Dr Retained earnings opening balance o Cr Goodwill.

Has the following assets and liability. The impairment loss will be applied to write down the goodwill so that the intangible asset of goodwill that will appear on the group statement of financial position will be 270 300 30. Goodwill Accounting Journal Entries.