Cool Trial Balance Is Prepared To Check Accuracy Of

Accounts having debit balances 1.

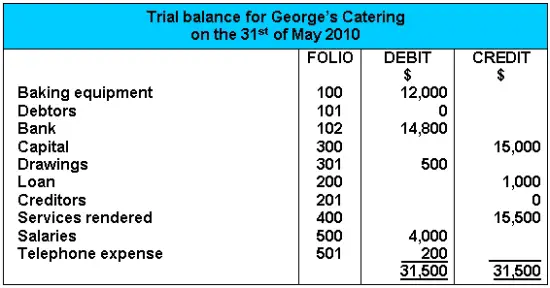

Trial balance is prepared to check accuracy of. How A Trial Balance Works. Generally it is prepared at the end of every month. Cash Flow statement balances.

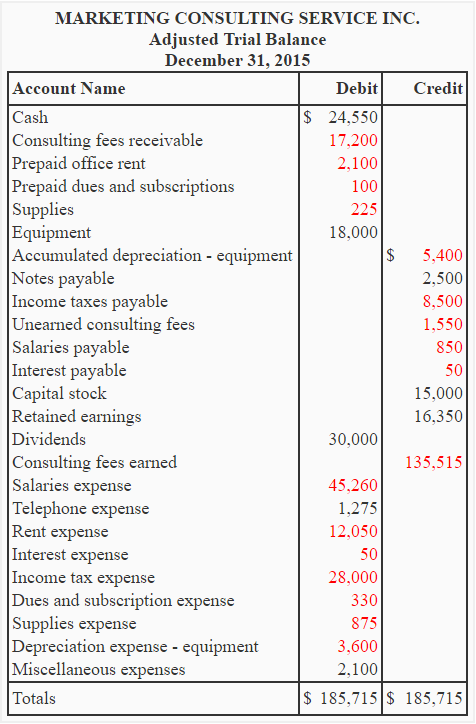

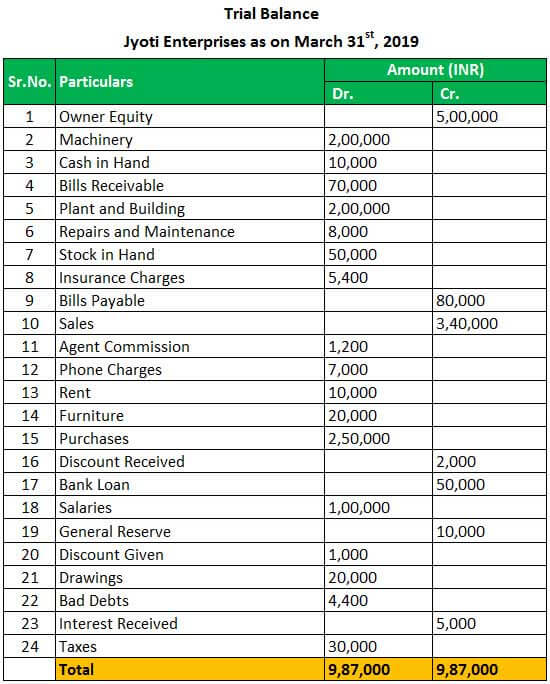

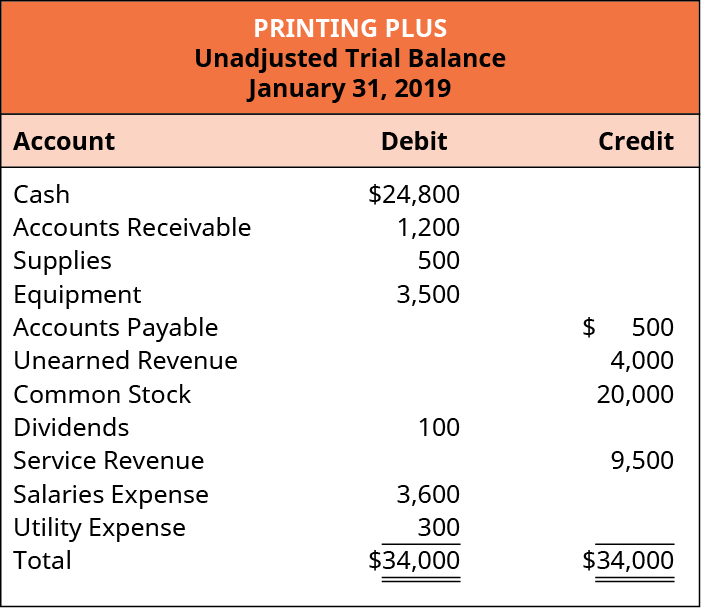

A trial balance is prepared to check the arithmetical accuracy of double-entry bookkeeping so it helps in locating arithmetical errors. D All of the above. In order to test the arithmetical accuracy of our ledger we should prepare a statement called trial balance.

Which of the following is a method of preparation of trial balance. Preparation of trial balance. It means that the trial balance is used to check the parity between debit totals and credit totals.

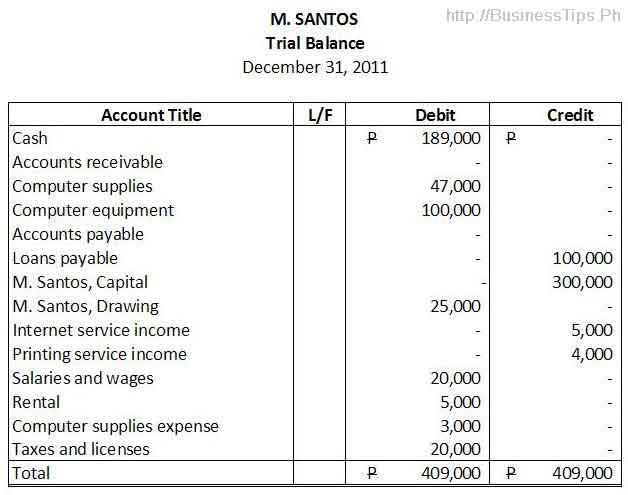

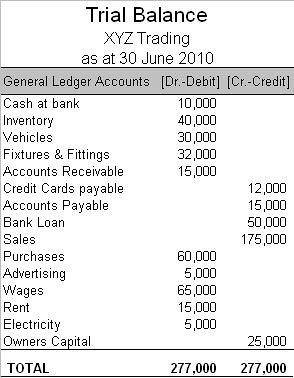

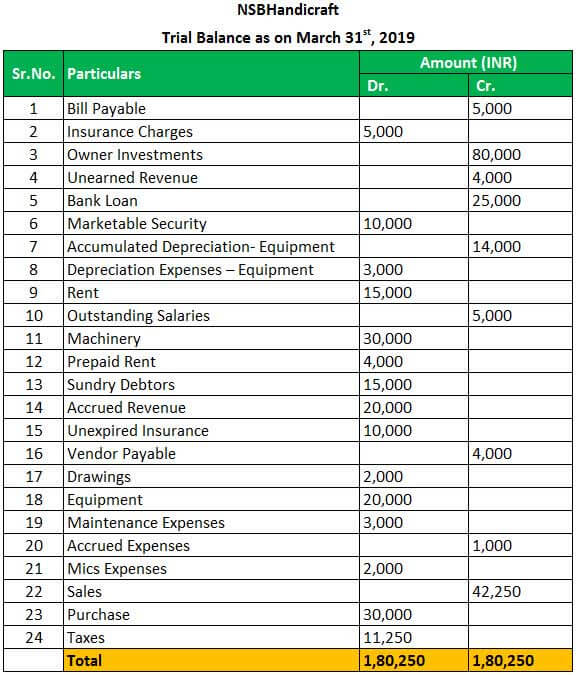

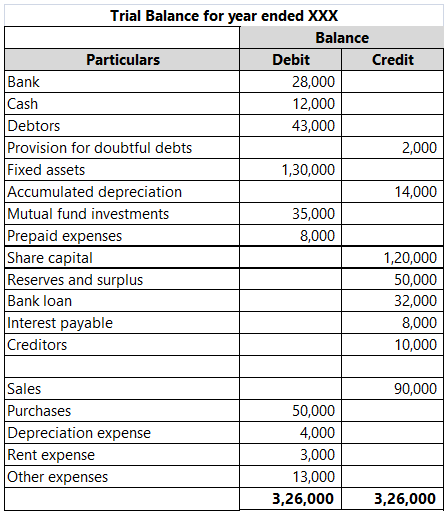

The total of debit amounts shall be equal to the credit amounts for the trial balance to tally. Hence it verifies the arithmetical accuracy of the postings in the ledger accounts. A trial balance is a statement showing the balances or total of debits and credits of all the accounts in the ledger with a view to verify the arithmetical accuracy of posting into the ledger accounts.

If a transaction is completely omitted from the books of accounts will it affect the. Cash flow statement balances. A trial balance is prepared to check the mathematicalarithmetic accuracy of accounting.

Which of the following errors affects trial balance. Trial balance plays an essential tool in checking the arithmetical accuracy of posting ledger accounts assisting the accountant in preparing the financial statements proceeding with audit adjustments etc. But it can be prepared quarterly or half yearly.