Awesome Types Of Accounting Ratios Pdf

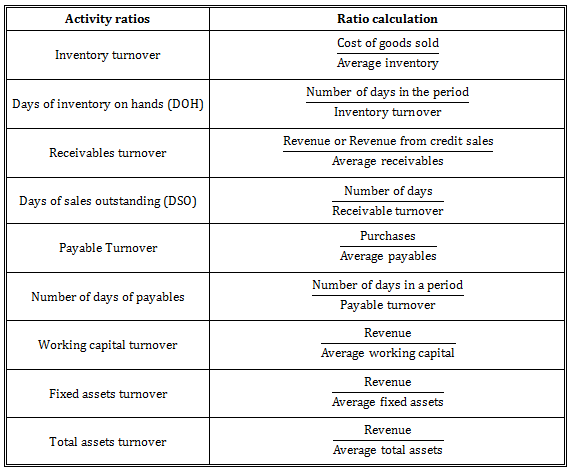

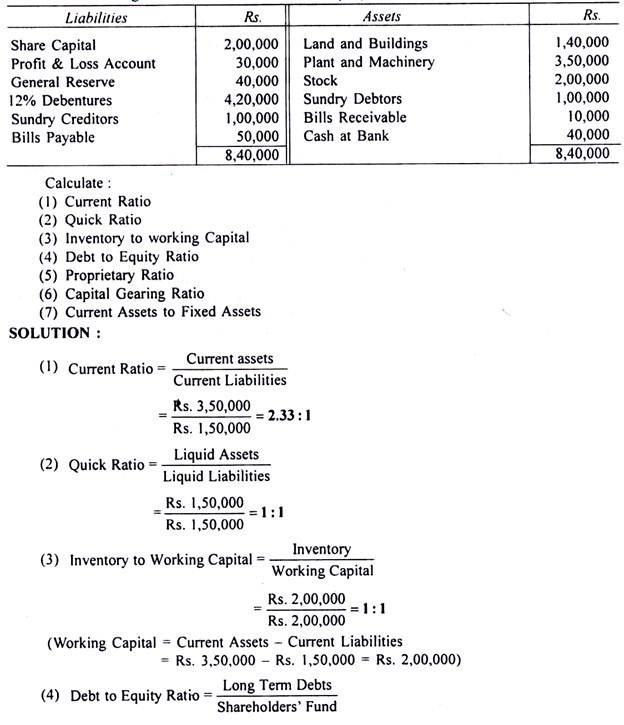

Current Liabilities Efficiency ratios Rate of stock turnturnover Collection period debtors OR Payment period creditors OR.

Types of accounting ratios pdf. Customize your course in 30 seconds. There are mainly 4 different types of accounting ratios to perform a financial statement analysis. Pertaining to companys financial statements.

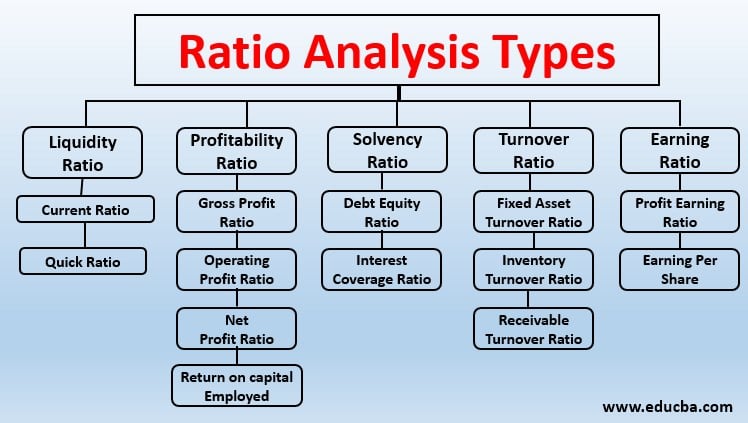

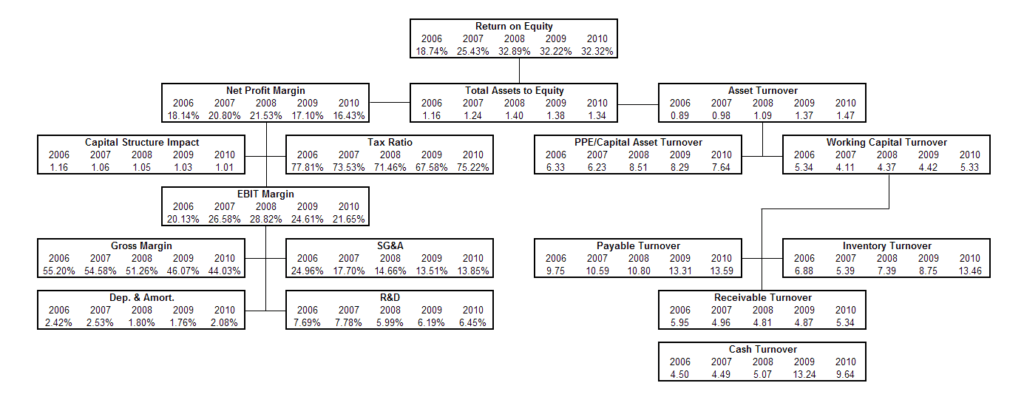

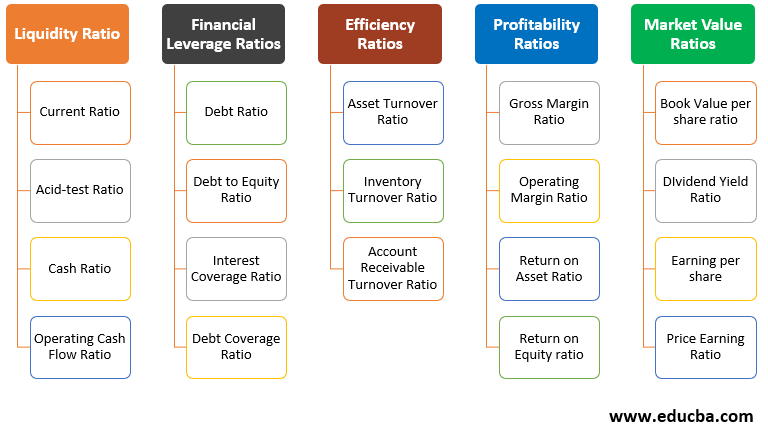

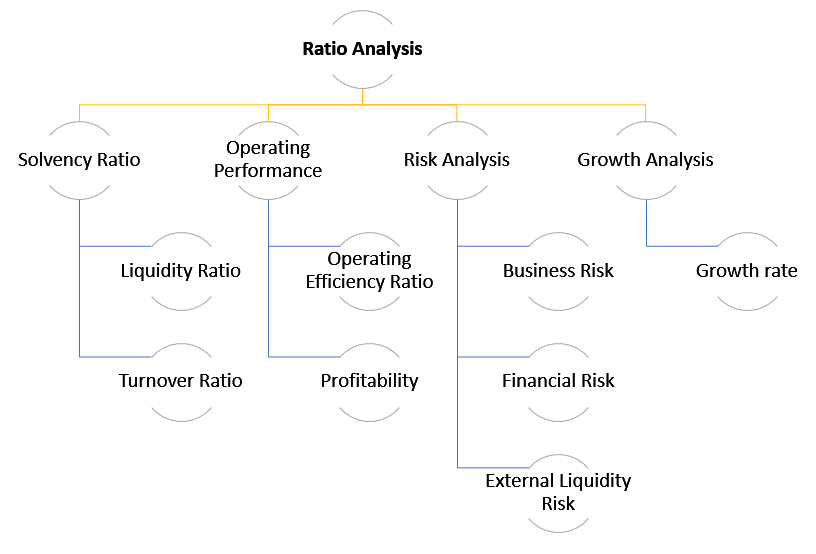

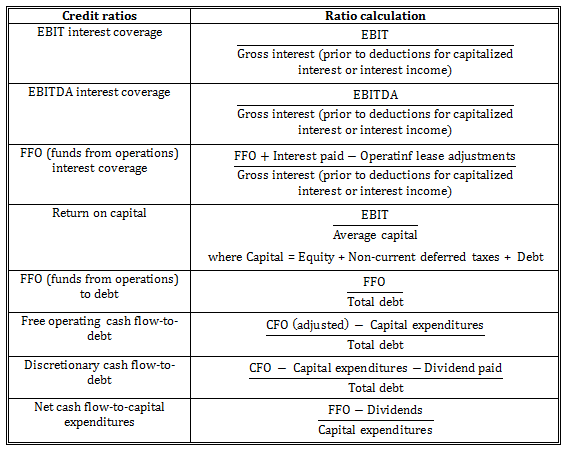

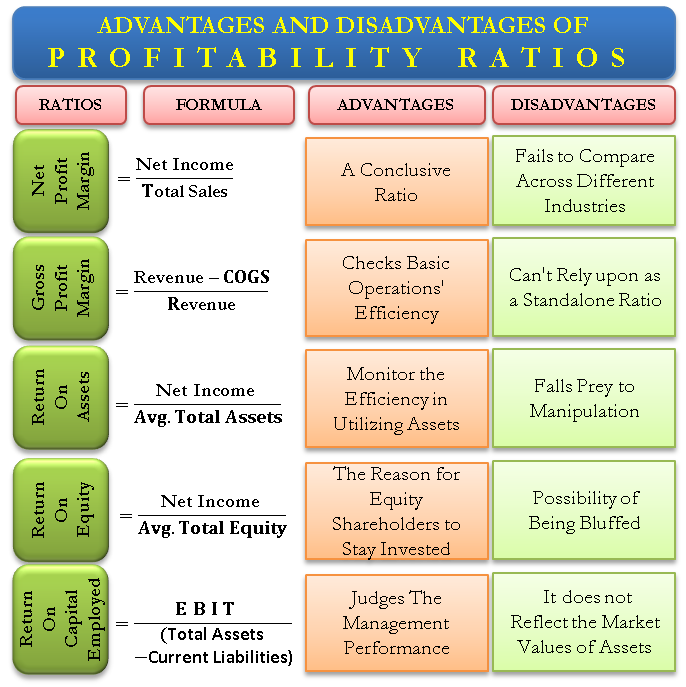

10000 and the Revenue from Operations are Rs. The following section provides a summary of the five categories of financial ratios along with descriptions of how each ratio is calculated and its relevance to financial analysis. Corporate finance ratios can be broken down into four categories that measure different types of financial metrics for a business.

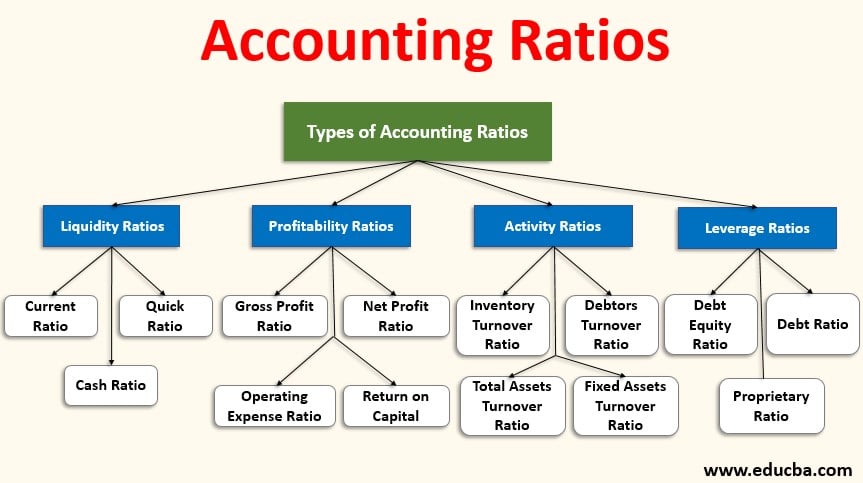

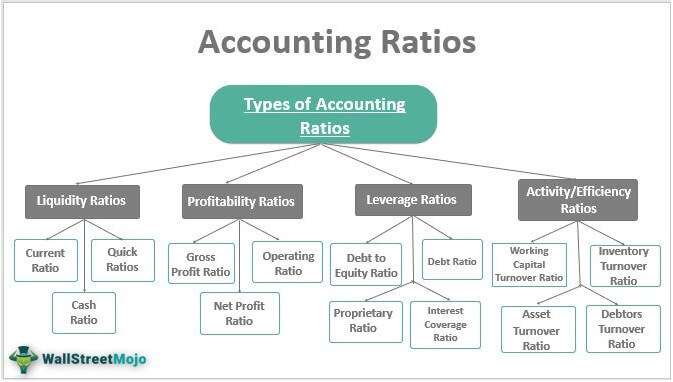

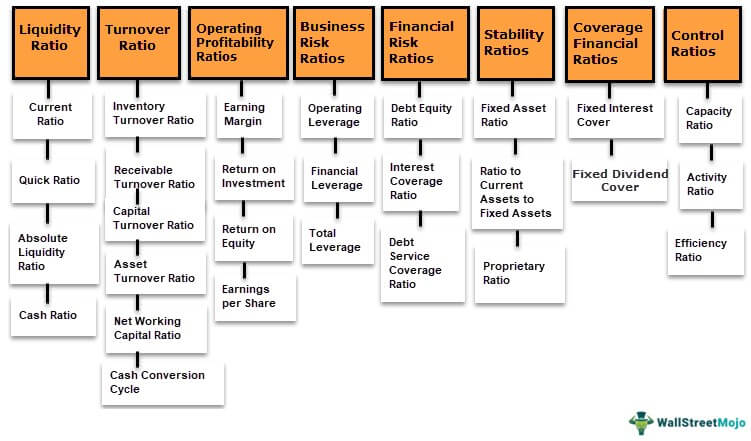

The accounting ratios are divided into the following groups. Ratios can be divided into four major categories. Let us learn more about them.

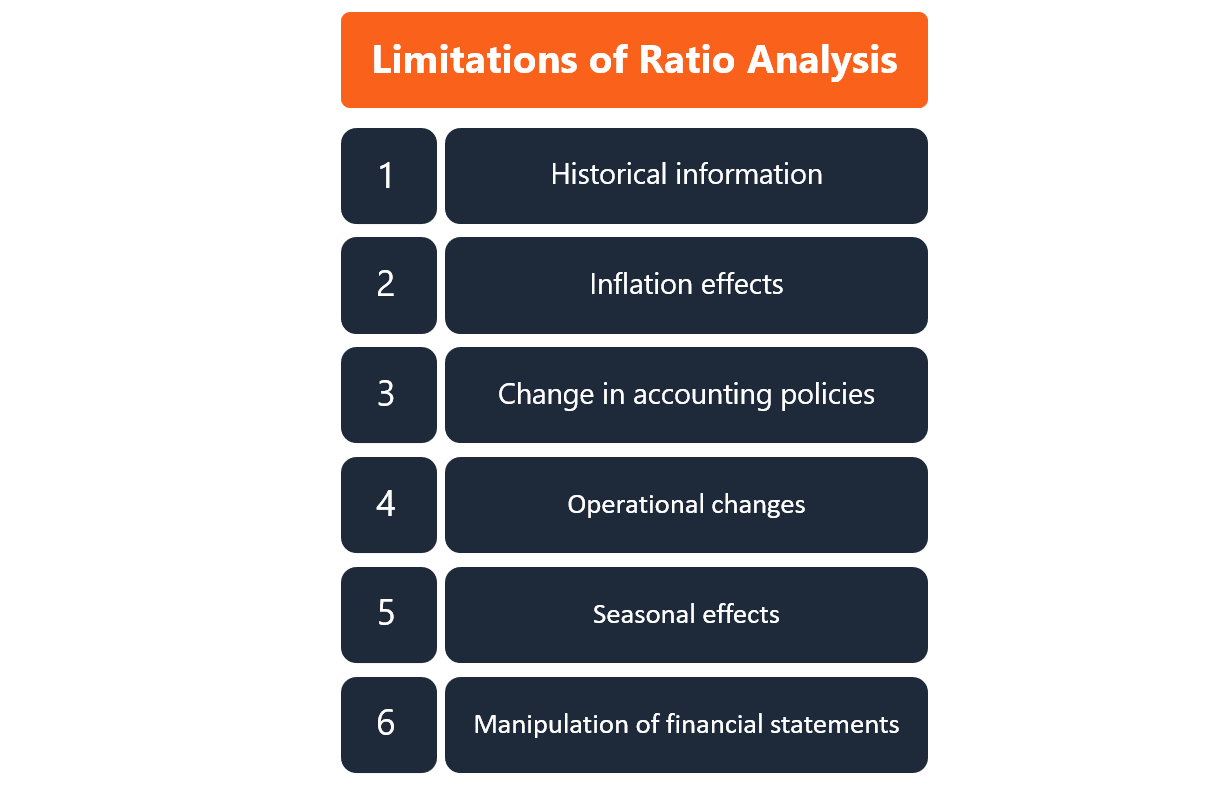

Judgments accounting ratios computed based on such information is also not free from such limitation. Activity Inventory Cost of goods sold Inventory turnover Accounts receivable Sales on credit Accounts receivable turnover Total assets Sales Total asset turnover Fixed assets Sales Fixed. Quick ratio Days inventory held Debt to equity CFO to interest Inventory turnover Operating profit margin Cash ROA ROCE Cash ratio Days payables outstanding Long term debt to total capital CFO to debt Fixed asset turnover Net profit margin ROA Dividend yield CFO ratio Net trade cycle Cash flow adequacy Asset turnover ROE Dividend payout.

O Profitability Sustainability o Operational Efficiency o Liquidity o Leverage Funding Debt Equity Grants The ratios presented below represent some of the standard ratios used in business practice and are provided as guidelines. Liquid capital ratio Current assets Inventories Current liabilities also known as the acid test or quick ratio Gearing ratio Debt loan capital preference shares if any Equity ordinary shares reserves also known as capital gearing ratio or debtequity ratio. Quick assets are current assets that can be con-verted to cash within 90 days or in the short-term.

These are the ratios which show the ability of the enterprise to. Now we propose to discuss the nature of each ratio their interpretation. Liquidity Ratios Solvency Ratios Activity Ratios and Profitability Ratios.