Brilliant Understanding Balance Sheet India

Better utilization of finances ultimately leads to more profitability and cash flows.

Understanding balance sheet india. Vikram Sarabhai Marg Ahmedabad 380 015 Many business people managing family owned business or even some corporate executives not. Typically you can group a standard balance sheet into three account categories. CFA Level I - QA Review Sessions.

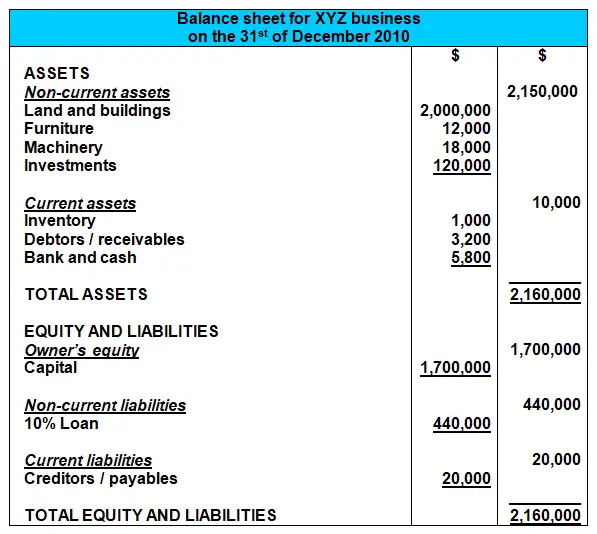

The balance sheet is a measure of the solvency of the business. SLR is prescribed by the Reserve Bank of India. Talking about the balance sheet in more colloquial terms we can say that it tells how a company has handled its finances.

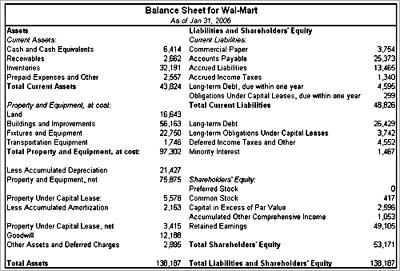

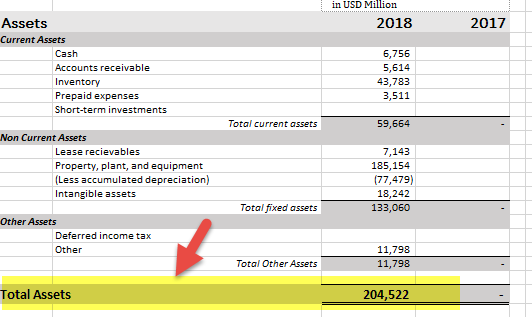

A bank is expected to hold a certain ratio presently 23 of their Net Demand and Time Liabilities NDTL in approved securities like government securities cash or gold. Balance Sheet is the most important financial statement as it helps us see the financial position of the company at a given point in time. The balance sheet is one of the three main financial statements along with the income statement and cash flow statement.

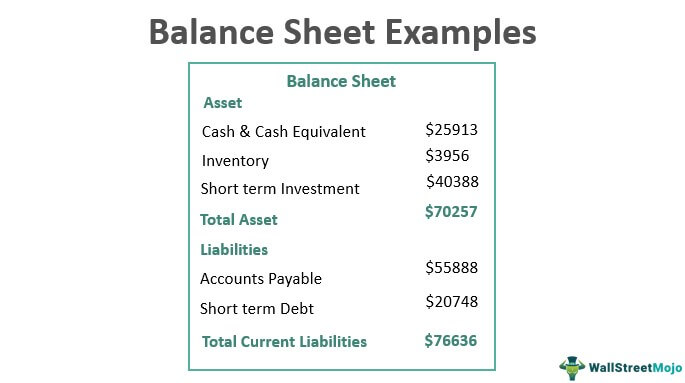

At its simplest a balance sheet shows what assets your company controls and who owns them. Safal Niveshak explains how investors can analyse the Equity and Liability side of a companys Balance Sheet. A balance sheet gives a snapshot of your financials at a particular moment incorporating every journal entry since your company launched.

Cash is self explanatory. Updated Feb 20 2021 A companys balance sheet also known as a statement of financial position reveals the firms assets liabilities and owners equity net worth. The balance sheet together.

Assets liabilities and ownership equity are listed as of a specific date such as the end of its financial year. It is like a report card to measure a companys performance. Torrent-AMA Management Centre Core-AMA Management House AMA Complex Dr.