Fantastic Financing Cash Flow Items

However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters.

Financing cash flow items. Financing Cash Flow Items. Cash flow from investing activities is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific. The concept fact1label with a value of fact1value is an accrual-based item in the.

Increasedecrease in Federal Funds SoldREPOs. The cash flow statement does not tell us the profit earned or lost during a particular period. Note that interest paid on long-term debt is included in operating activities.

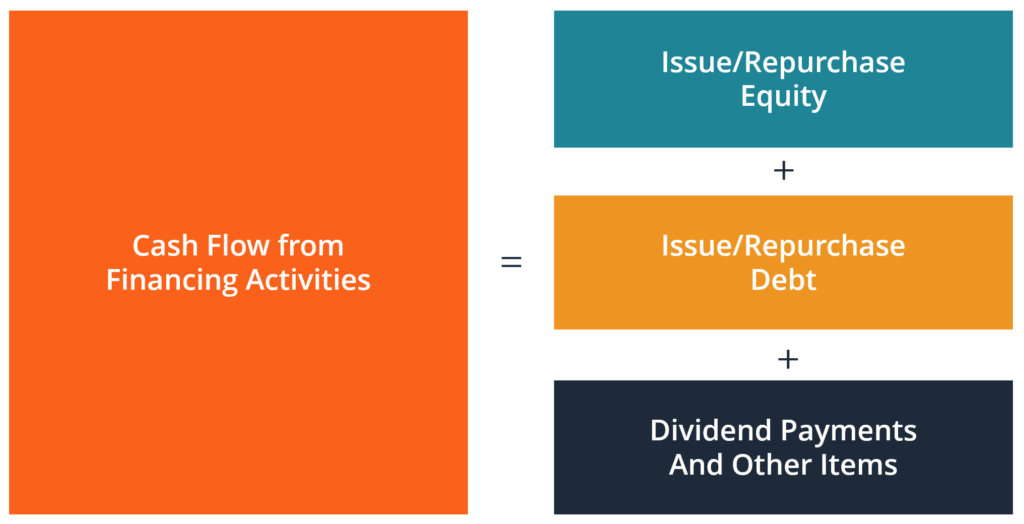

Financing cash flow is funding that comes from a companys owners investors and creditors. Investing activities include purchases of long-term. Other Financing Cash Flow.

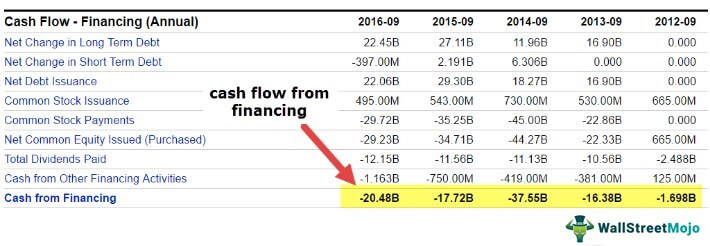

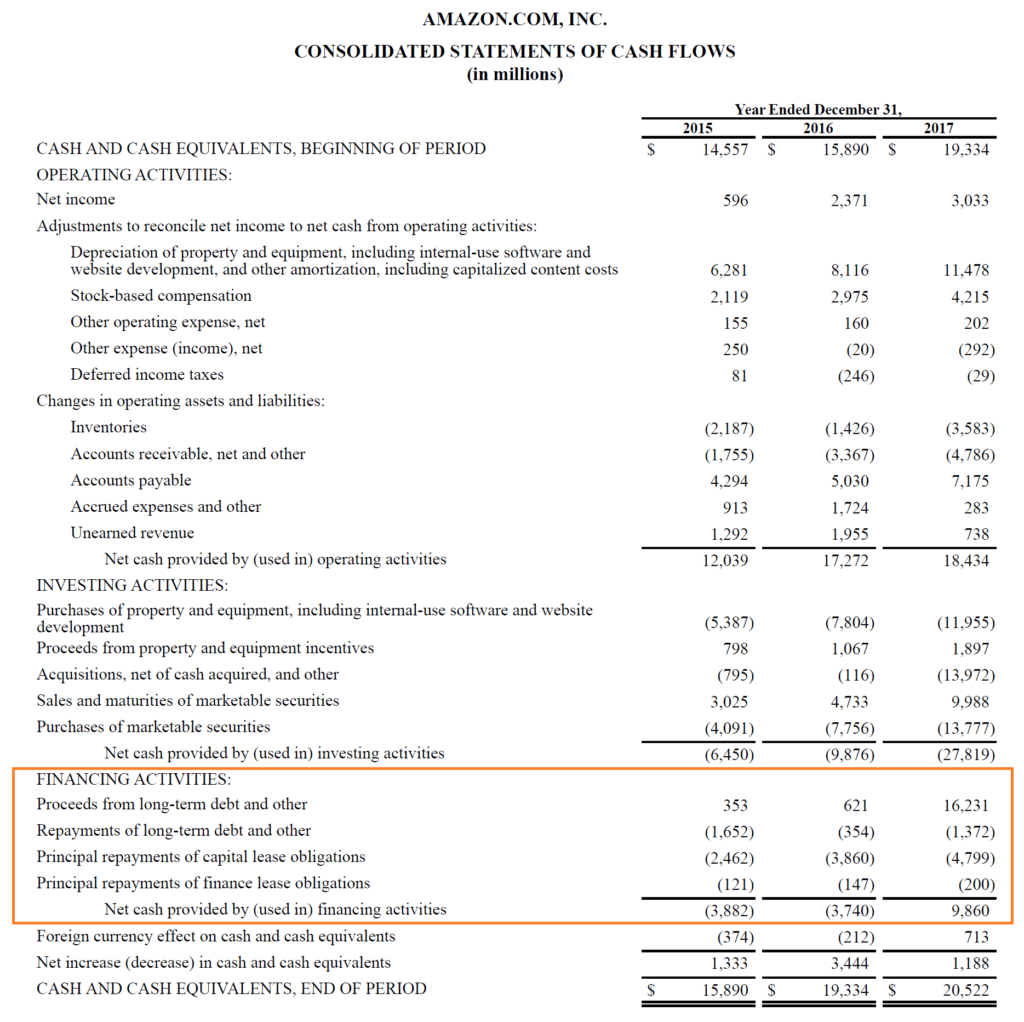

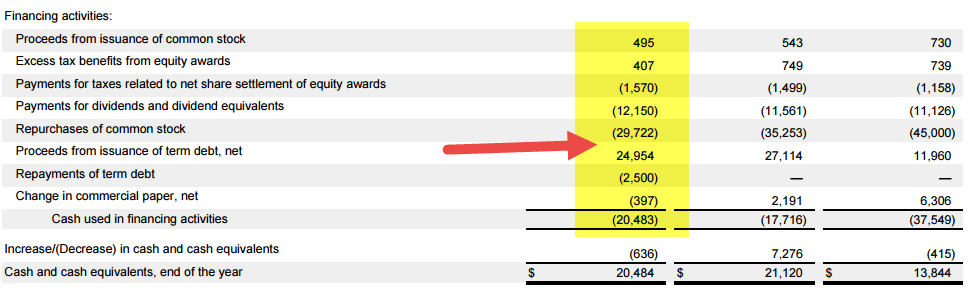

This is true even for items on. The largest line items in the cash flow from financing activities statement are dividends paid repurchase of common stock and proceeds from the issuance of debt. The general approach is to disclose a schedule of non-cash investing and financing activities at the bottom of the statement of cash flows.

They can however also be included as a separate schedule or in the notes to the financial statements. Payment of interest is not included because interest expense appears on the income statement and is therefore included in operating activities. These are long-term or capital investments and include property assets in a plant or the purchase of stock or securities of another company.

Financing cash flows typically include cash flows associated with borrowing and repaying bank loans and issuing and buying back shares. Cash flow financingor a cash flow loanuses the generated cash flow as a means to pay back the loan. In other words financing cash flow includes obtaining or repaying capital be it equity or long term debt.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)