Cool Balance Sheet Dr Cr

Income statement Dr and balance sheet Cr.

Balance sheet dr cr. Deferred revenue is reduced to zero. The VAT is the balance between these two entries being Dr 12. The credit side of this journal increases the accruals balance on the balance sheet.

Abbreviated as dr and cr every transaction consists of two entries that balance each other. The revenue associated with the contract flows through the income statement and assuming it was priced appropriately positive Net Income NI in the image below. Stockholders equity retained earnings specifically grows by this amount of net income.

On December 31 2017. Dr Expense Account PL Cr Accruals Balance Sheet The debit side of this journal increases the expense account balance ie. CR Bond Payable 860653.

Subsequently we will pay our supplier. Cash which is a balance sheet account will go down a bad thing so we expect a 72 Cr. It recognizes the expense in the income statement.

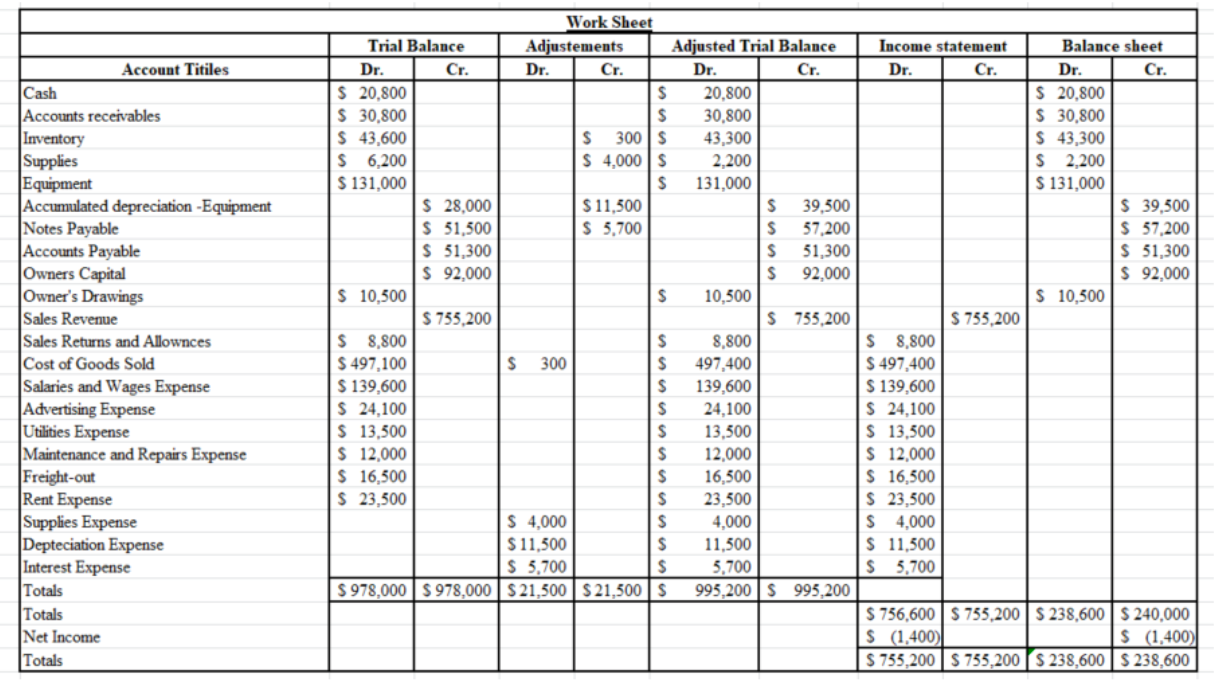

Unadjusted Trial Balance October 31 2018 DR CR 371195 158620 23000 14600 24000 385000 255000 64500 SET A 12 yearly Cash Accounts Receivable Notes Receivable Office Supplies Prepaid Insurance Land Office Furniture and Equipment. Dr Non-Current Assets Balance Sheet Cr Provision Balance Sheet The non-current asset is then depreciated per normal. 37000 Ending balance on 30th January 37000.

For a single obligation best estimate of. DR Interest Expense 83869. In the unadjusted trial balance of its worksheet for the year ended December 31 2012 Taitum Company reported Equipment of 120000.