Ace R&d Cash Flow Statement

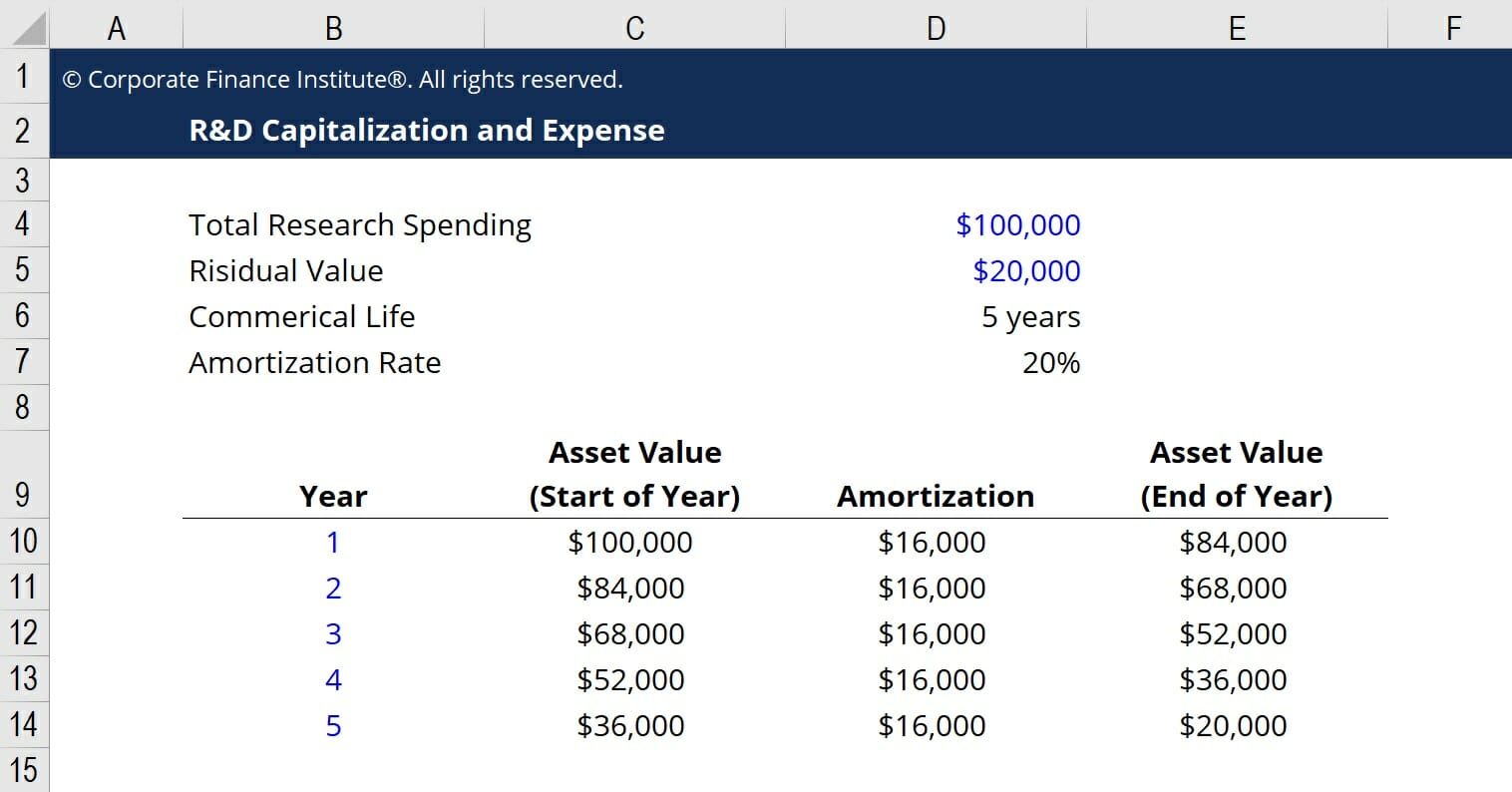

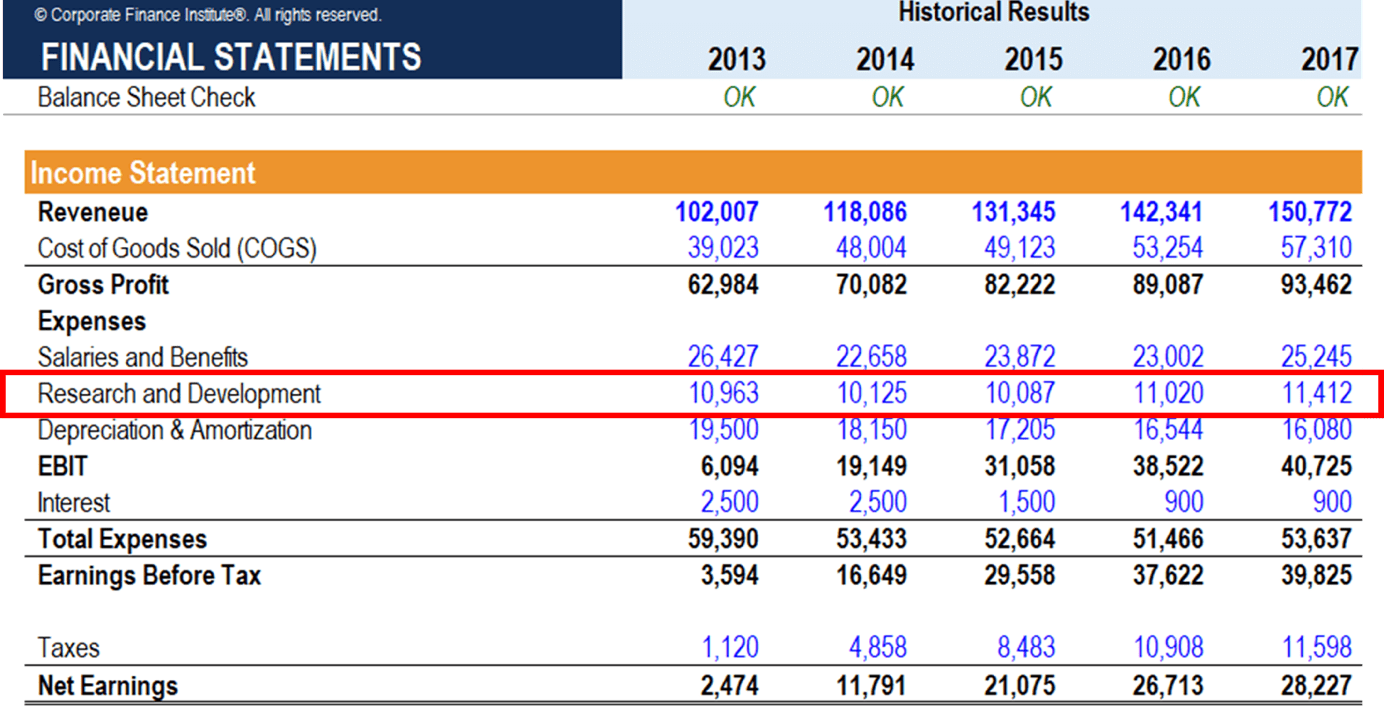

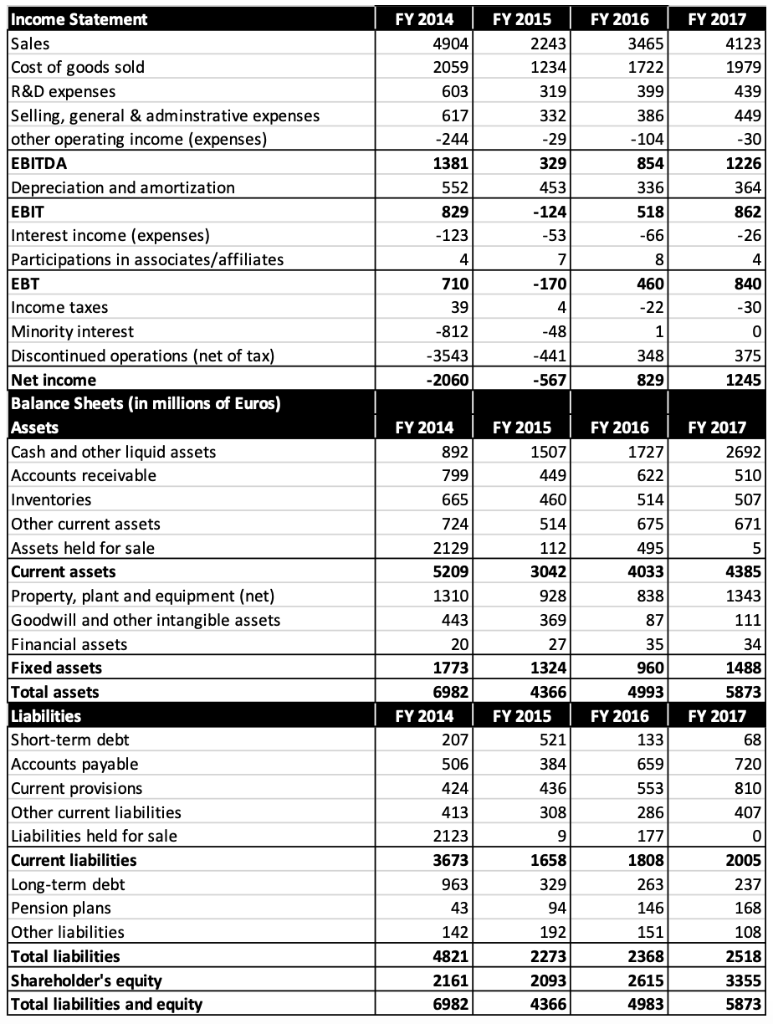

In financial projections is it reasonable to project capitalized RD expense especially if my own understanding in part 1 above is correct.

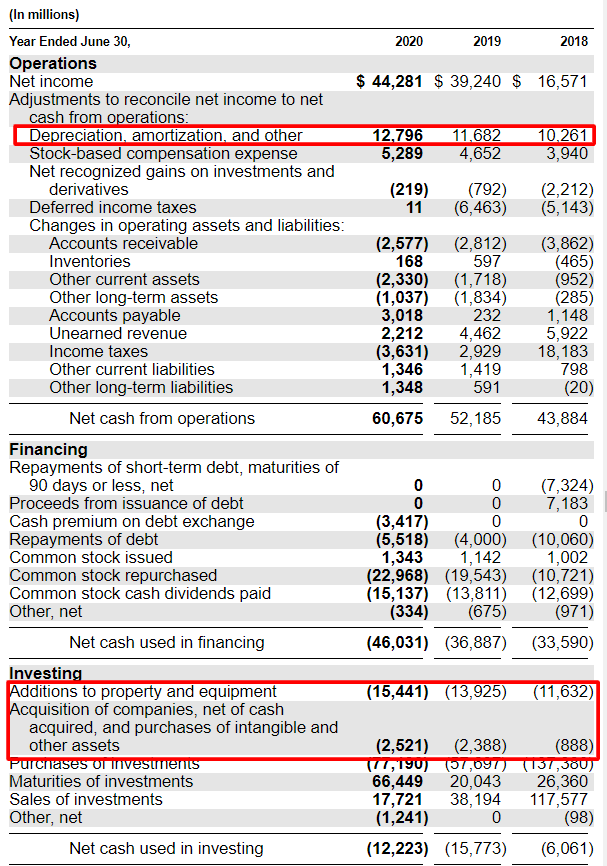

R&d cash flow statement. RD investment is an investment in the long-term cash flow generation of the company and as such should be capitalized not expensed. It leads to a truer number as RD is a capital expense for a company like Microsoft. In general it is up to.

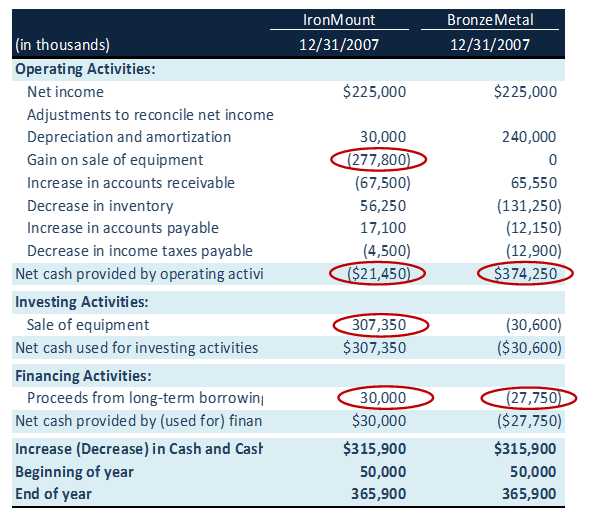

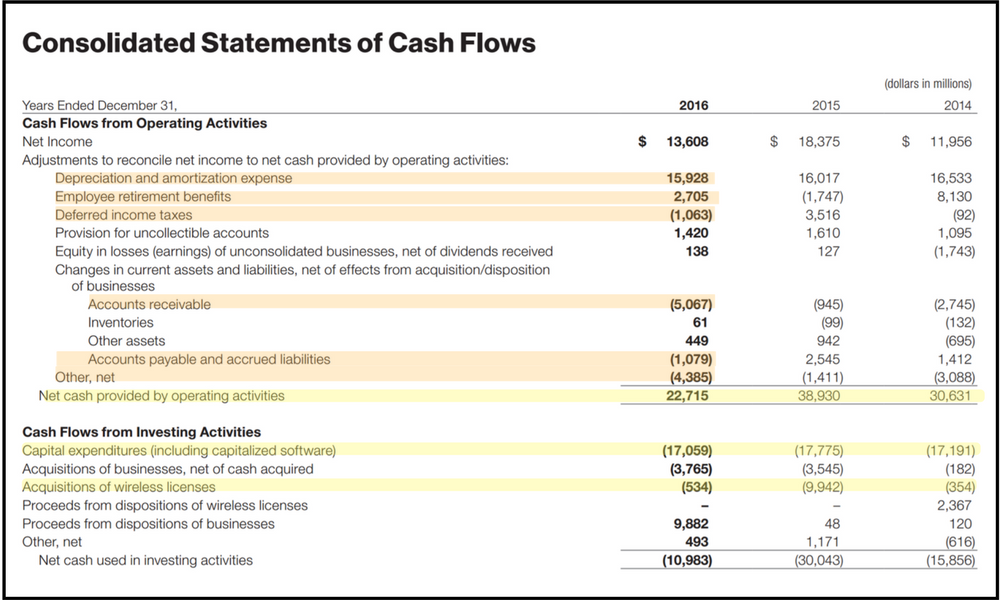

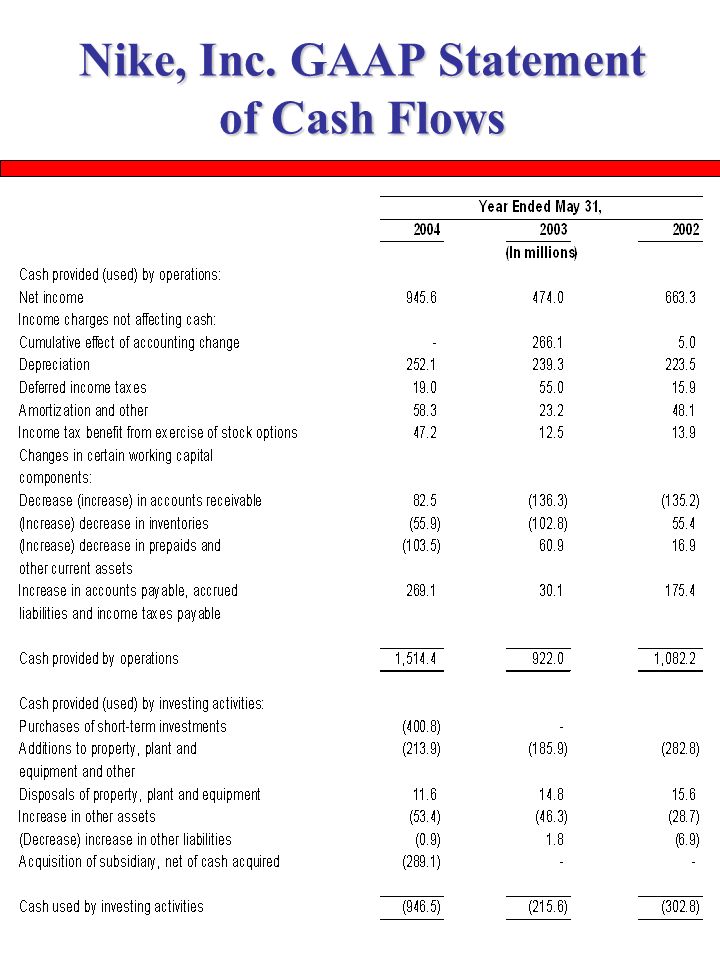

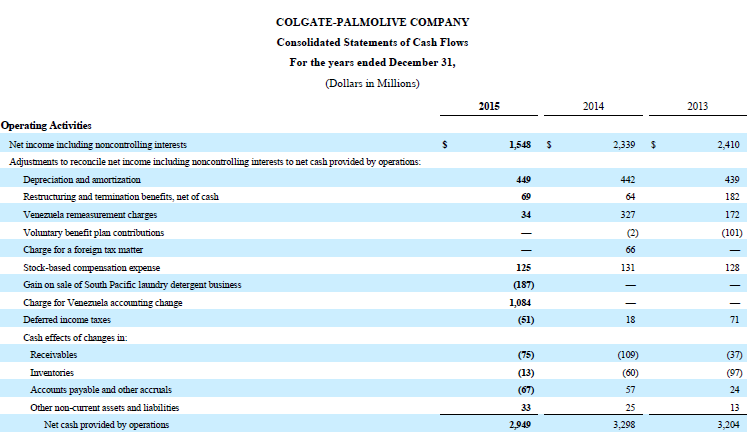

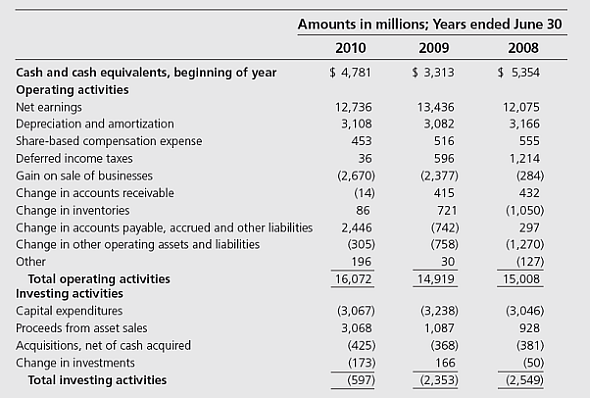

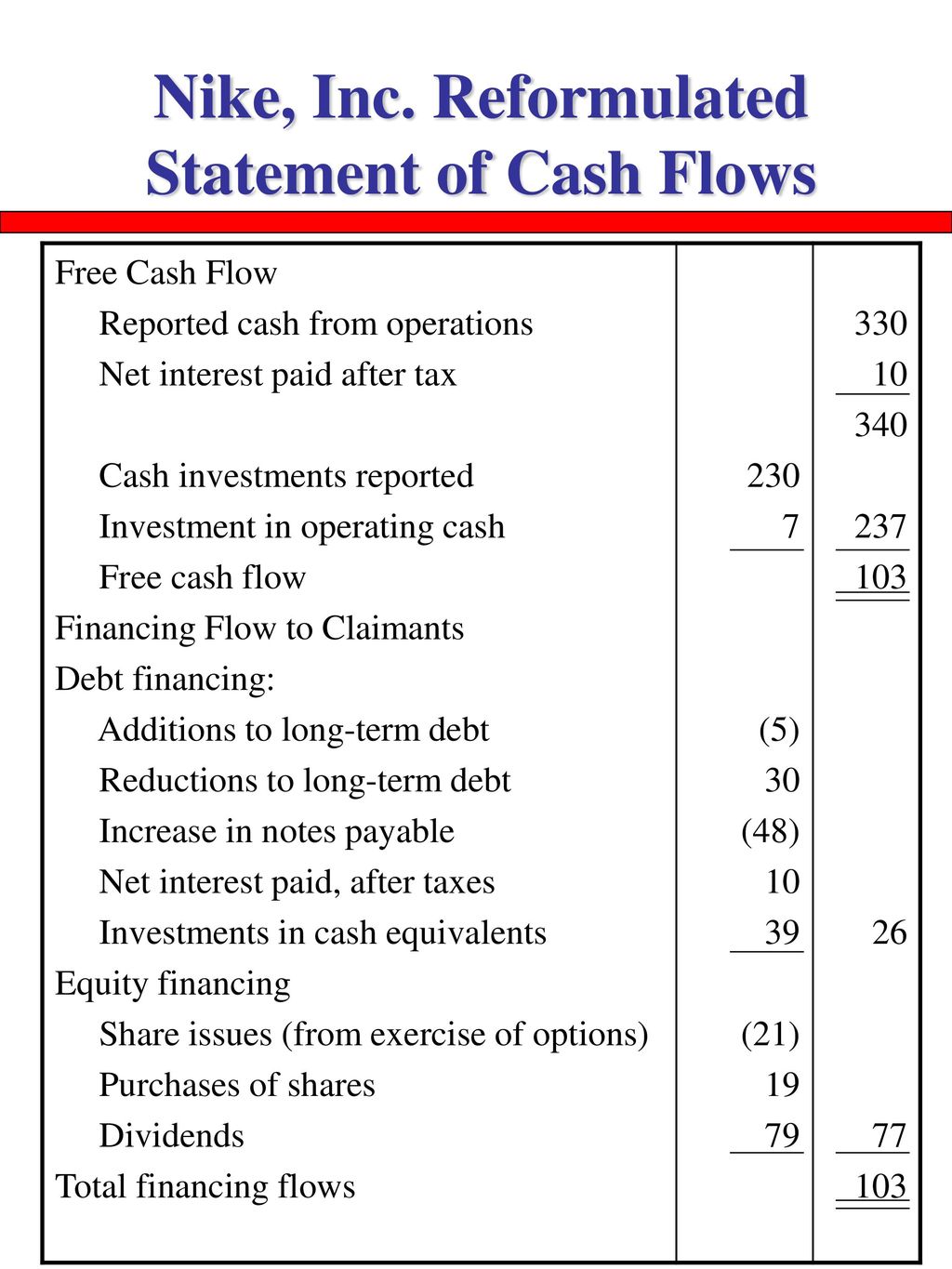

What impact does capitalizing RD expenses have on the cash flow statements. Essentially the cash flow statement is concerned with the flow of cash in and out of the business. It is important to understand the classifications especially because it is not uncommon for one entity to place an item as an operating activity whereas a peer-group entity might place the same item as a finance activity.

Most companies benefit from RD spending in the form of acquired know-how. When a statement of cash flows is prepared these three types of cash flows are reported under separate sections operating activities section investing. What Is a Cash Flow Statement.

Firstly cash flow can be defined as the movement of cash into or out of a business project or financial product. Previously a large number of empirical literature has quantified the role of financial resources in the funding of RD. Assuming a company have 10mm RD this past year if the company now capitalizes 1mm of the RD expense how does that flow through the three statements.

To answer this we look at empirical research to investigate the impact of cash flow on RD expenditure. The following 17 items are listed in. Capitalisation or write off is mere act of recording.

Of the cash-flow statement or in the footnotes of the statement of cash flows. As its name suggests cash flow statements also specify where incoming money came from and where you spent it. The cash flow statement should be prepared on a monthly basis during the first year on a quarterly basis for the second year and annually for the third year.