Fun Estimated Liability For Damages In Balance Sheet

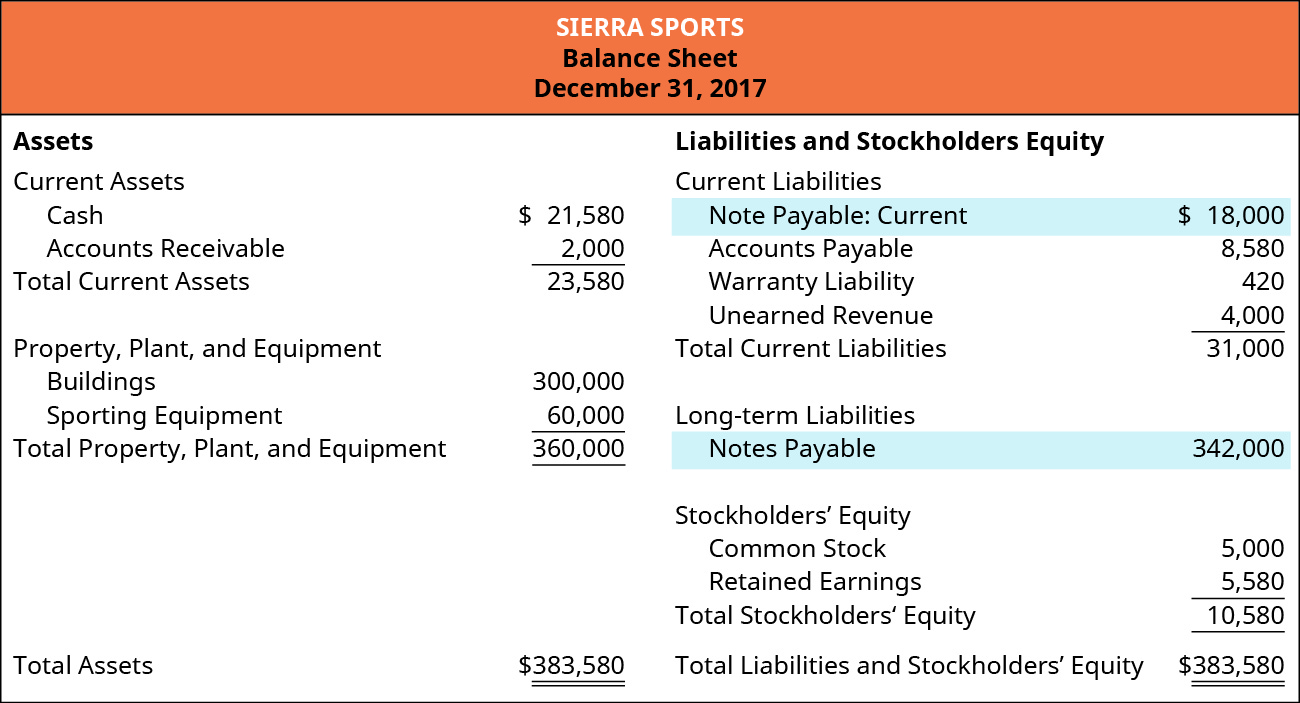

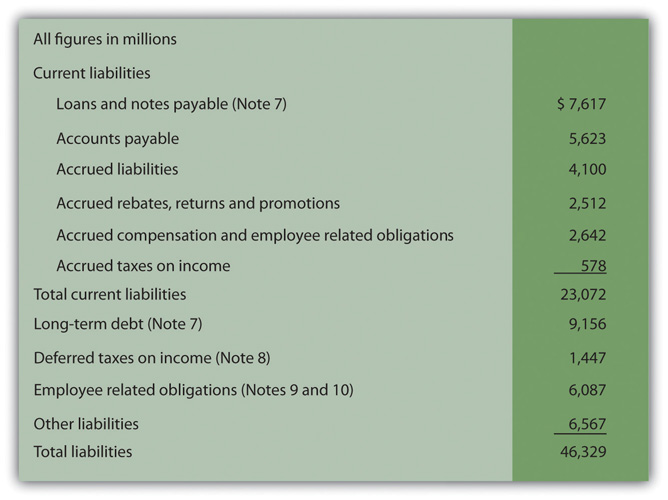

Using the ATT NYSET balance sheet as of Dec.

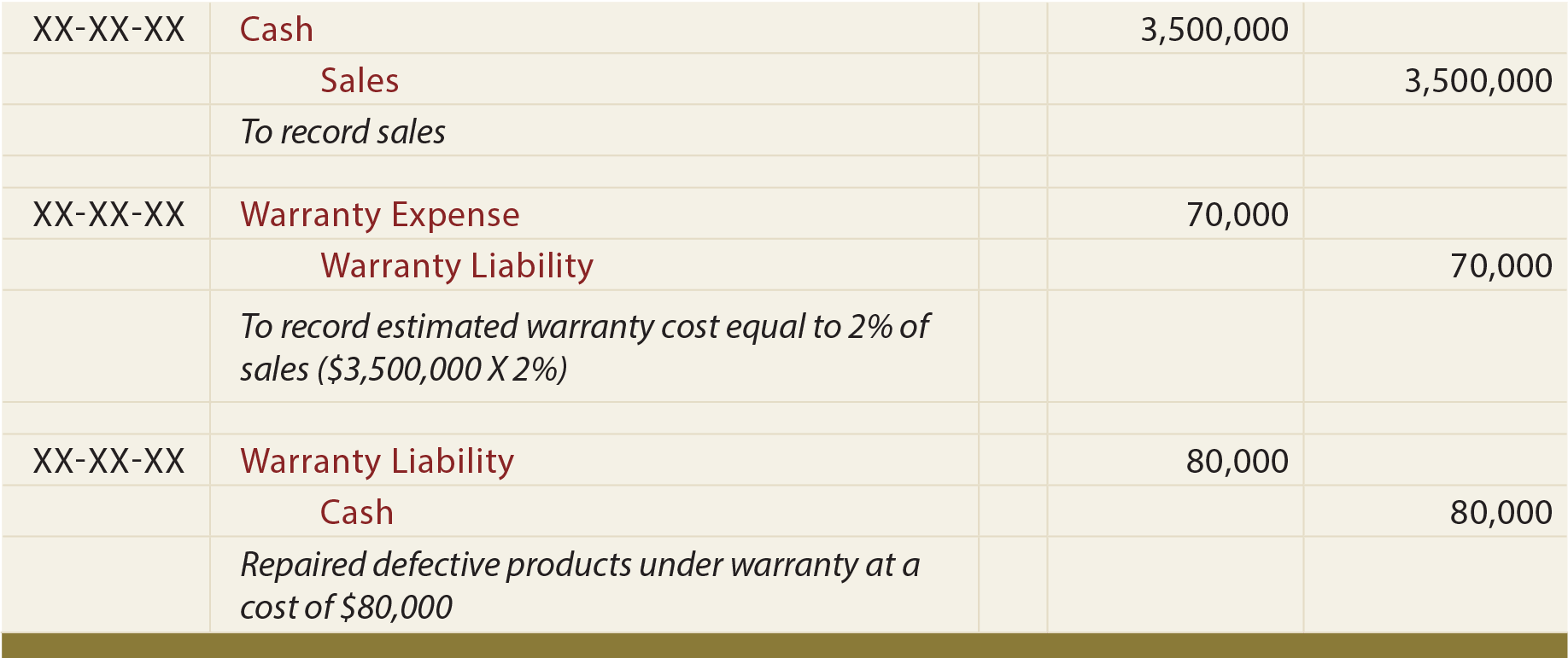

Estimated liability for damages in balance sheet. The company is required to estimate the amount since the estimated amount is far better than implying that no liability is owed and that no expense was incurred. Advances received with orders 200000 Less. Does the Balance Sheet Always Balance.

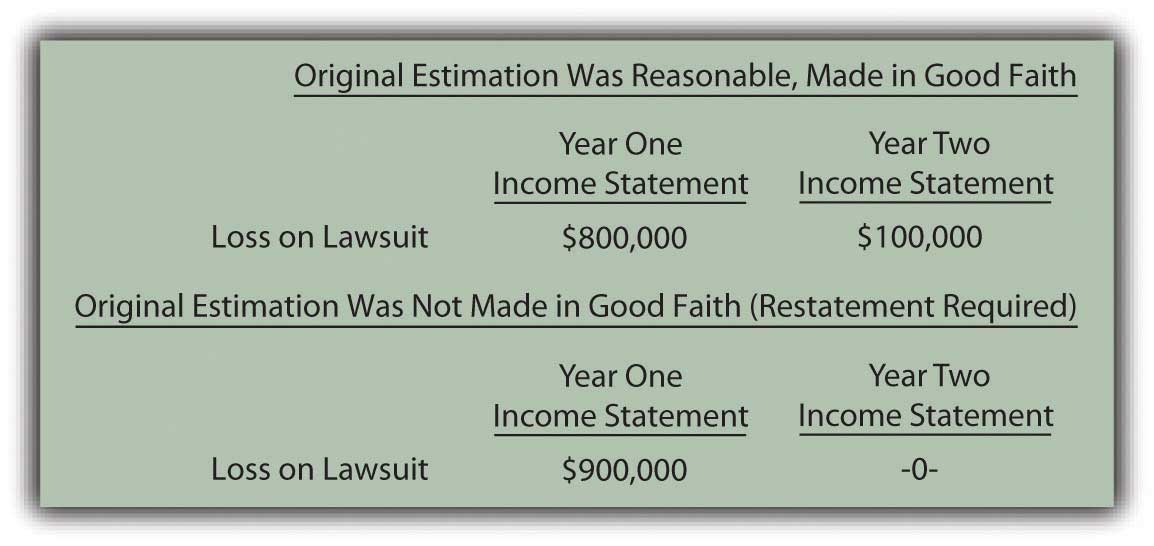

Are you a CPA candidate or accounting student. If the future cash flows can be estimated reasonably reliably damages can be calculated on the basis of the net present value model following which the value of a project is equal to the cash. Instead the accountant must make an estimate based on the available data.

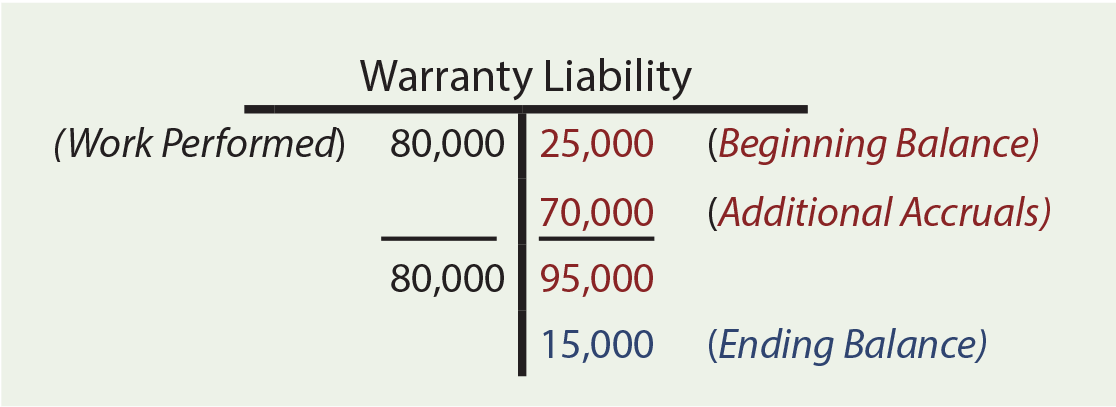

Bookkeeping and accounting use the term provision meaning an estimated amount set aside when it is probable that a liability has been incurred or an asset impaired. An estimated liability is a liability that is absolutely owed because the services or goods have been received. The amount to be presented as a current liability for customer advances at year-end 2X13 is computed as follows.

Estimated liability decreasing the amount of revenue recog nized at the time of the sale. If the value can be estimated the liability must have greater than a 50 chance of being realized. Advances for orders shipped 160000 Balance12312X13 260000 EXAMPLE.

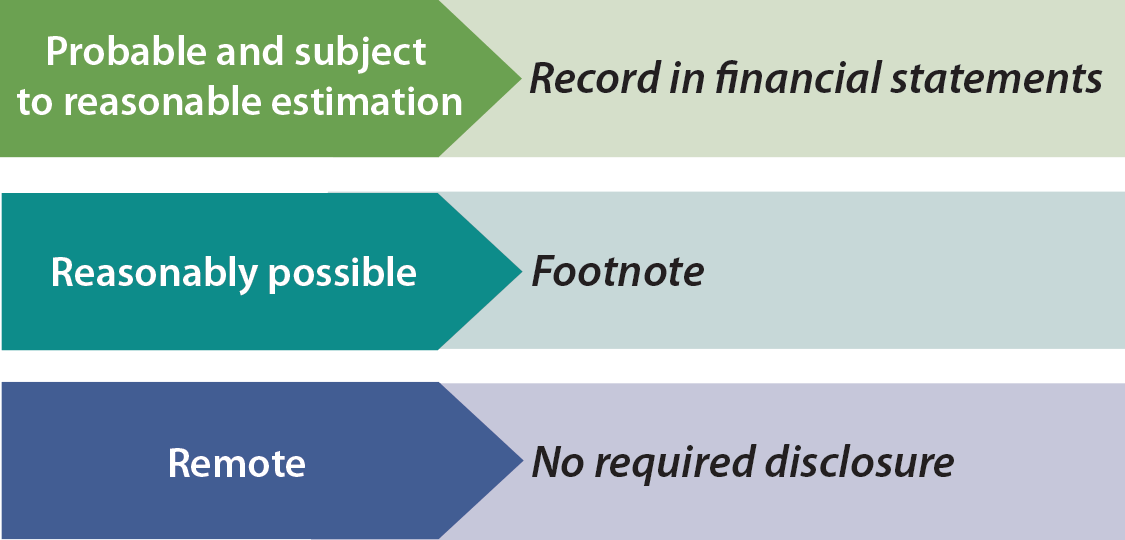

First it must be possible to estimate the value of the contingent liability. Two principal categories of current liabilities are definitely determinable liabilities and estimated liabilities. Although definitely determinable liabilities such as accounts payable notes payable dividends payable accrued liabilities and the current portion of long-term debt can be measured exactly the accountant must still be careful not to overlook existing liabilities in these.

What are contingent and estimated liabilities. The amount recognised as a provision should be the best estimate of the expenditure required to settle the present obligation at the balance sheet date that is the amount that an entity would rationally pay to settle the obligation at the balance sheet date or to transfer it to a third party. Example of an Estimated Liability A warranty reserve is based on an estimate of the number of warranty claims that will be received.

/liabilities_-_resized-5bfc371146e0fb0051c0a014.jpg)

/GettyImages-175599141-5dfc6b7cfd474f7a96ed1f5eb7379f61.jpg)