Stunning Preparation Of Trial Balance Is Gst Balance Sheet Format

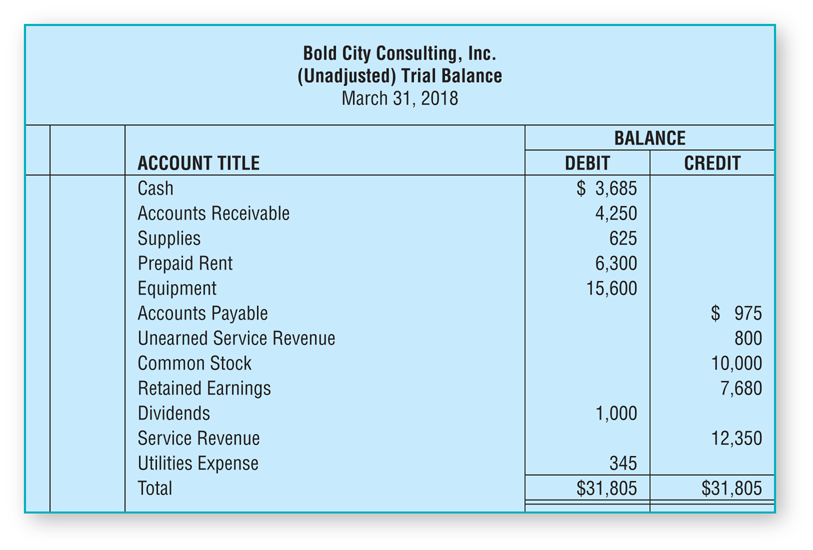

Preparation of Trial Balance Trial balance is prepared to check arithmetical accuracy of debit and credit balance.

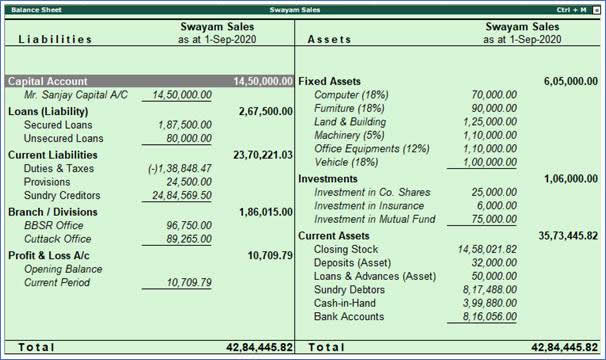

Preparation of trial balance is gst balance sheet format. Balance Sheet format With Trial Balance fill trial Balance Auto made Balance Sheet as per Company Schedule and Regular Format Simple Format both. One of the best features of our Balance Sheet Software is the capability to import data directly from Tally Busy MS Excel and other popular accounting and tax software. If there is any error it is rectified with journal entries.

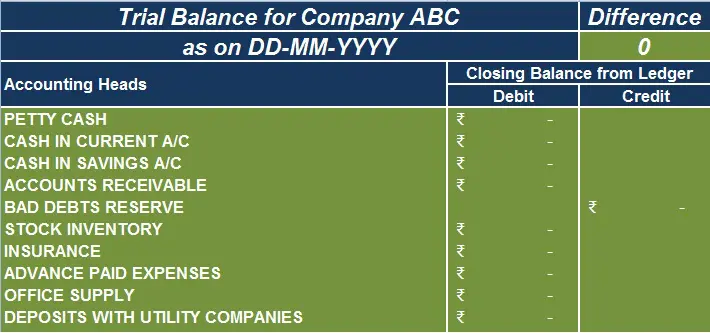

Account number name debit balance and credit balance. It can be produced as a documentary evidence. The trial balance preparation process is simple You just need to extract all balances from the ledgers on a particular date and place the name of the ledger and balances in.

If accounts receivable ending balance is 2250 this is the amount to be. Another significant distinction between trial balance and balance sheets is the format of the financial statements. Involves re-arranging of items or Accounts in the Trial Balance.

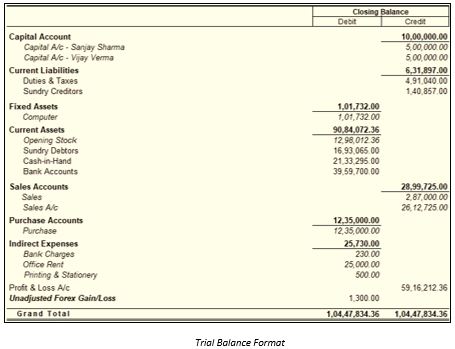

Trial Balance Format The trial balance format is easy to read because of its clean layout. Its always sorted by account number so anyone can easily scan down the. There are various methods of managing BAS payments but we are now of the view that these should be moved to.

Balances shown in the trial balance are not in order. Generally the trial balance format has three columns. A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book.

It cannot be produced as a documentary evidence in the court. Trial balance can be prepared at any time. Objectives of a Trial Balance.