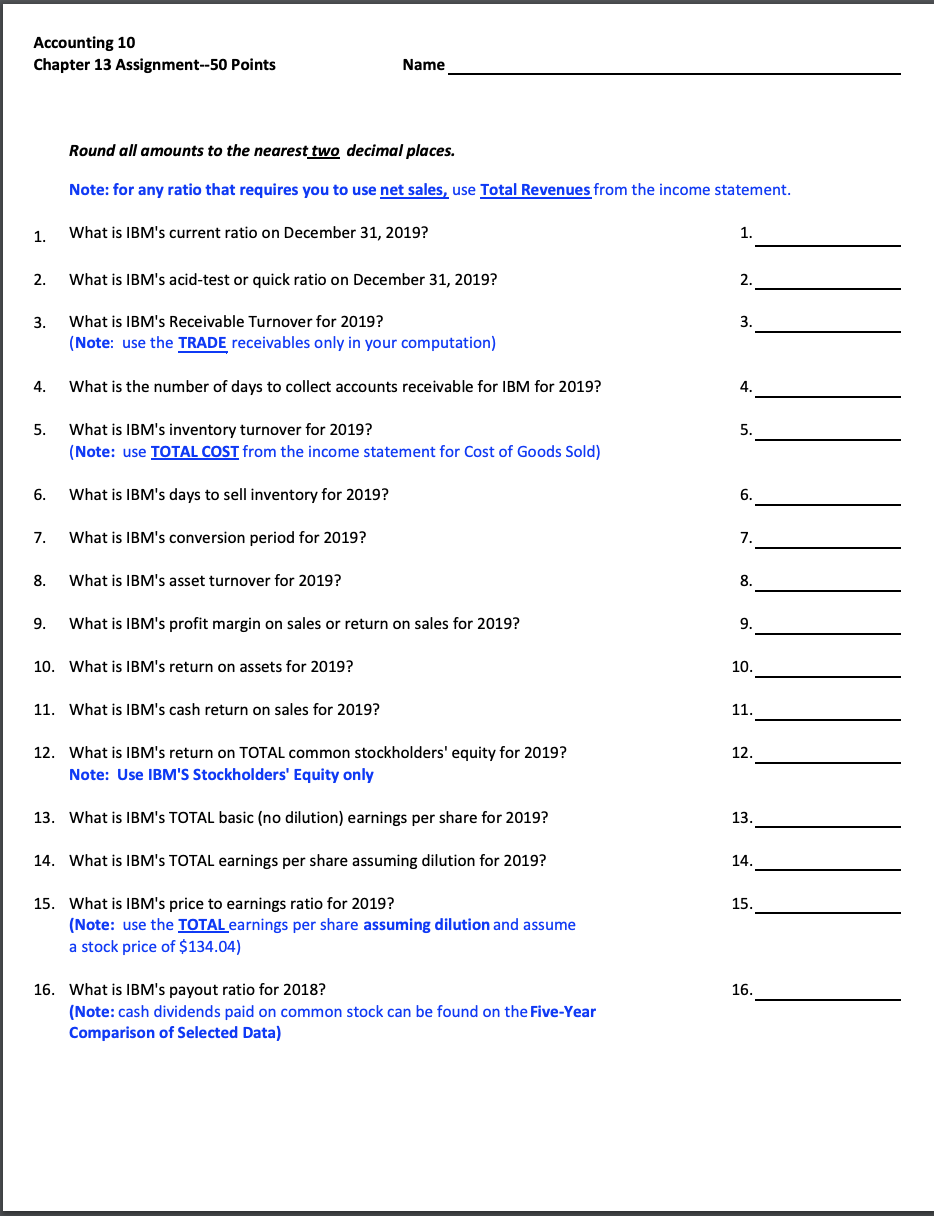

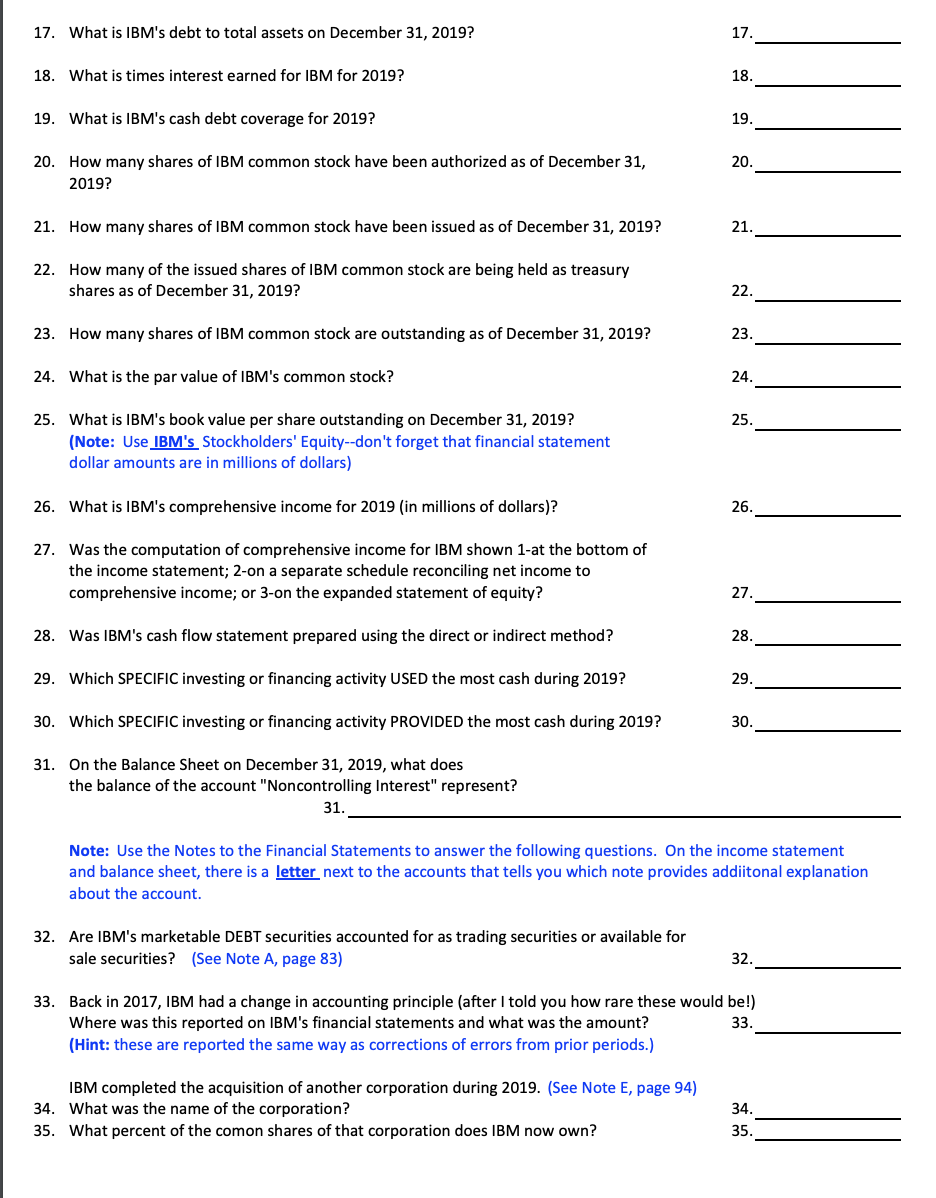

Simple Ibm Financial Ratios

Of Stocks that are in still loss if held for 10yrs.

Ibm financial ratios. This is a similar case when comparing. 2 above the third quartile. Read this Business Study Guide and over 89000 other research documents.

Ibm Financial Ratio Analysis. The PEG ratio is a refinement of the PE ratio and factors in a stocks estimated earnings growth into its current valuationThe general consensus is that if the PEG ratio indicates a value of 1 this means that the market is correctly valuing the current PE ratio a stock in accordance with the stocks current estimated earnings per share growth. Average gain of all 1-Star stocks.

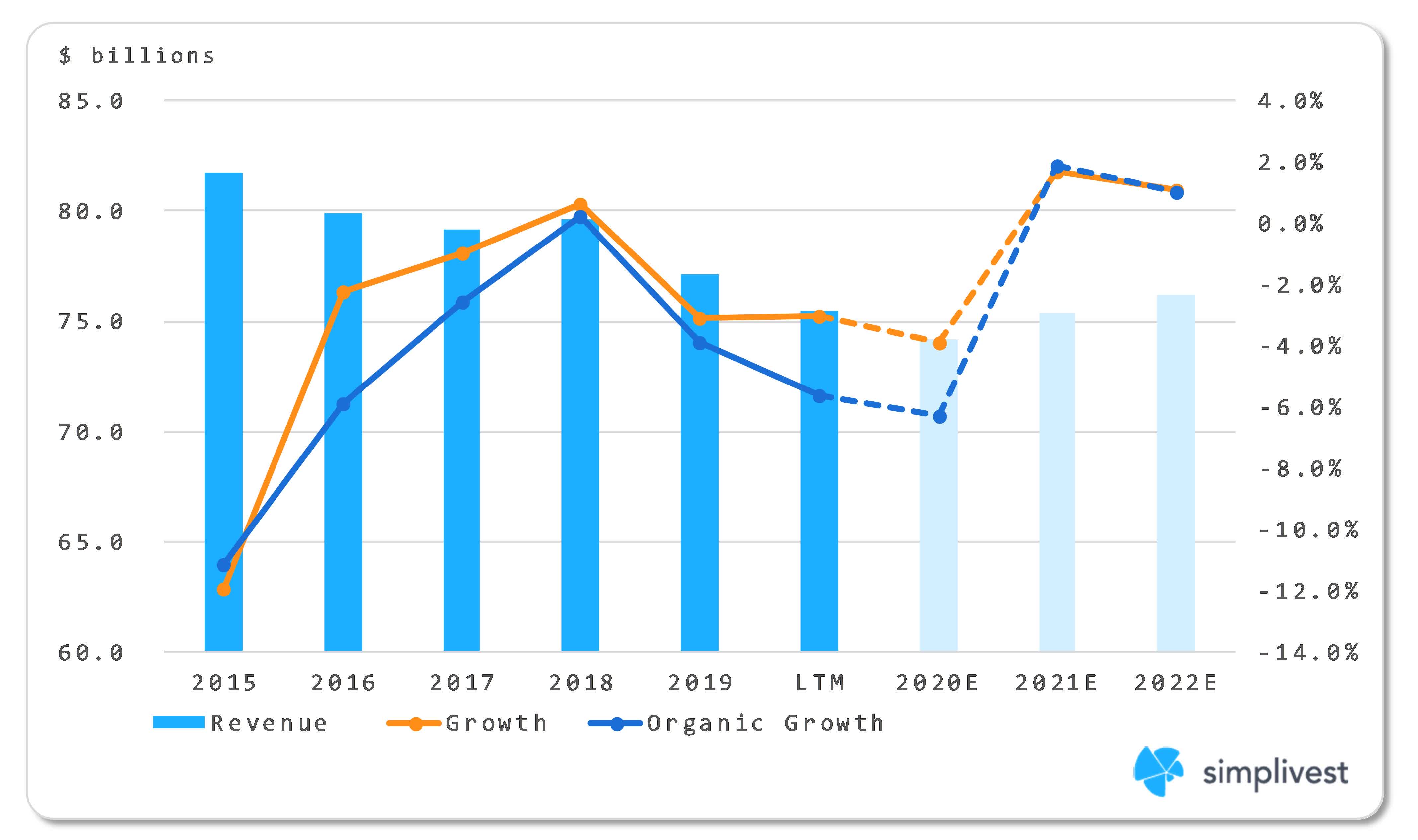

Annual Report 2020 27 MB 8-K 10-K Segment Recast. IBMs valuation is way below the market valuation of its sector. These tools are better known as ratio analysis.

International Business Machines Corporation Common Stock IBM Nasdaq Listed. 104 075 CLOSED AT 400 PM ET. 1 between the second and the third quartile.

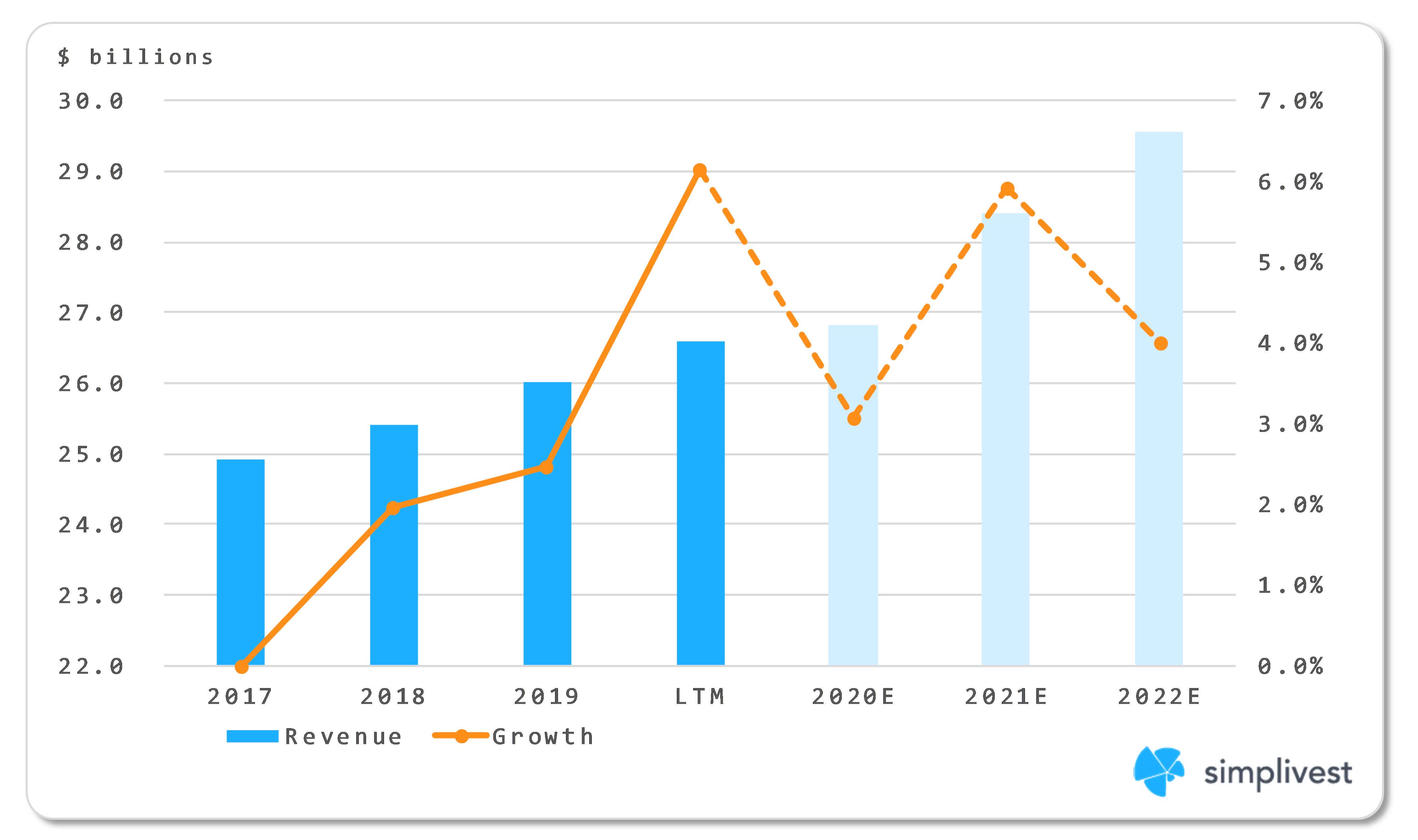

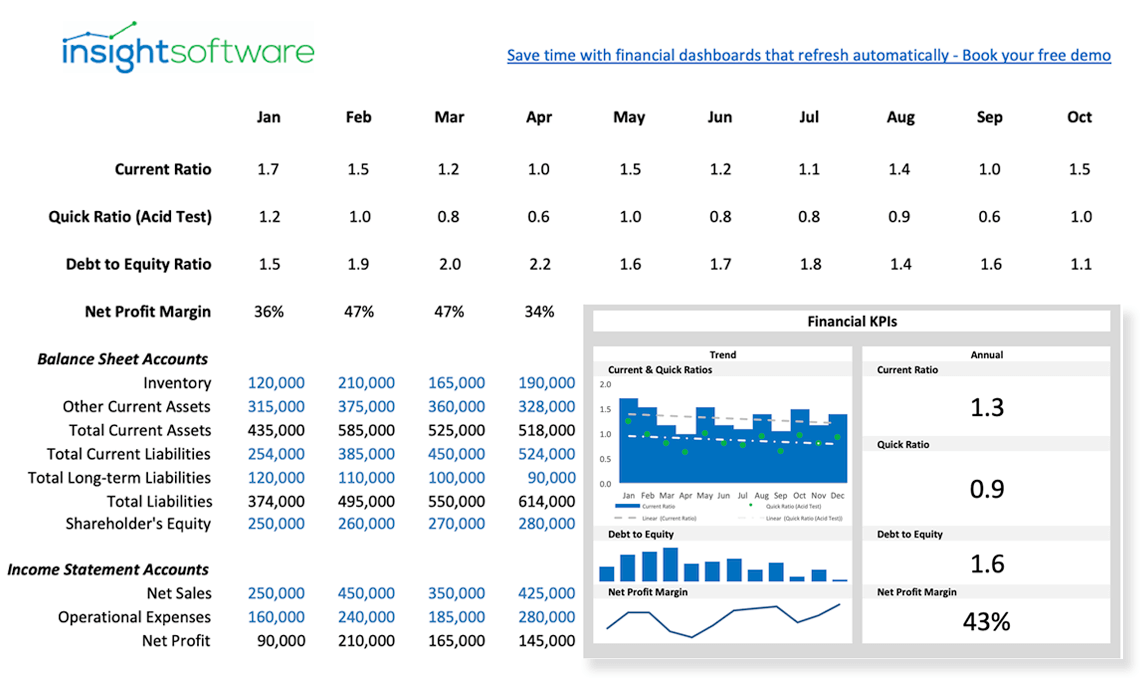

Historical IBM quarterly dividend rates and payable and record dates. IBMs financial ratios grouped by activity liquidity solvency and profitability. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile.

67 rows Current ratio can be defined as a liquidity ratio that measures a companys ability to pay. As noted previously the gold standard for the current ratio is 10. IBMs current ratio ended in 2015 at 124.