Cool Goodwill Impairment Double Entry

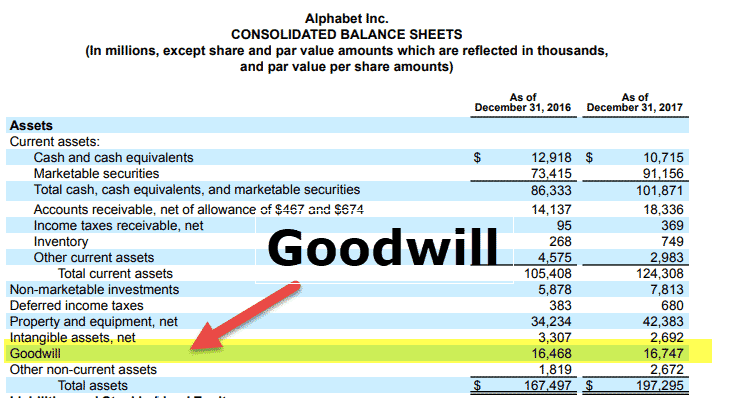

Goodwill impaired for the drop in the market value of assets acquired by the acquisition of ABC Co If in subsequent years the fair value decreased further then it is recognized to the extent of only 5.

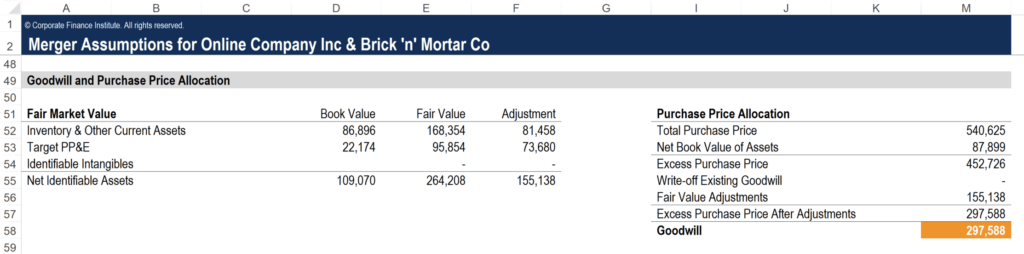

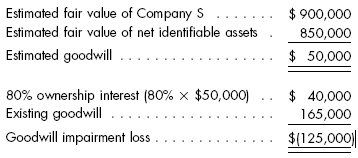

Goodwill impairment double entry. When company buys the goodwill and pays the amount for goodwill Sometime vendor of company will demand excess value business than market value difference will be goodwill. Once the acquisition is complete. The impairment loss will be applied to write down the goodwill so that the intangible asset of goodwill that will appear on the group statement of financial position will be 270 300 30.

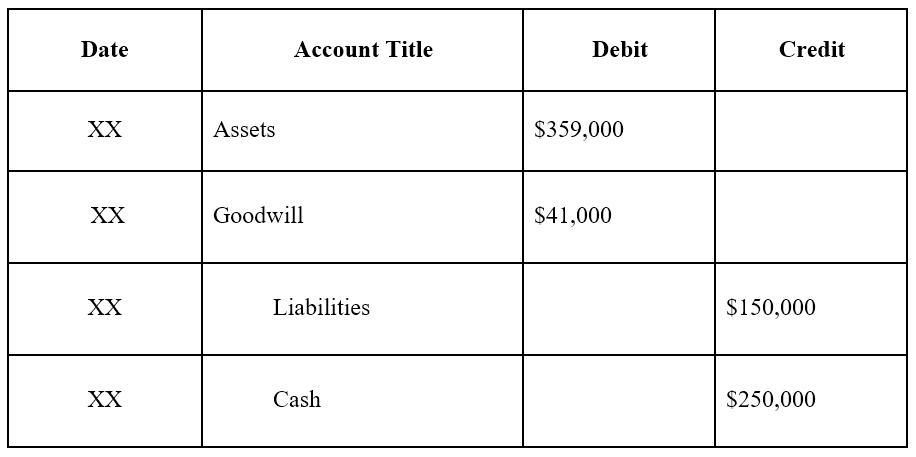

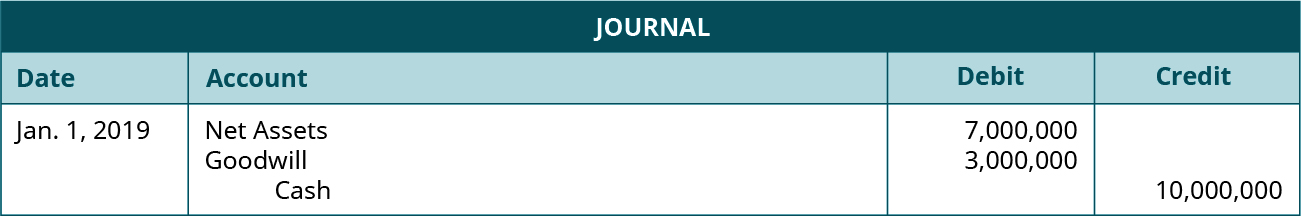

There are numerous examples of intangibles including the following items. Basic bookkeeping or double entry for taking up or writing off goodwill in the books of account of a businessWhen goodwill is ACQUIRED. To record the journal entry Vet Corporation should debit Loss on Goodwill Impairment for 100000 and credit Goodwill for 100000.

If the goodwill account needs to be impaired an entry is needed in the general journal. An impairment loss is recognised immediately in profit or loss or in comprehensive income if it is a revaluation decrease under IAS 16 or IAS 38. In this example goodwill must be impaired by 100000.

The double entry for this is therefore to debit the full market value to goodwill credit the share capital figure in the consolidated statement of financial position with the nominal amount and to take the excess to share premiumother components of equity also in the consolidated statement of financial position. The purchase of B by A is eliminated on consolidation. It is intangible asset but we have to record it by passing following journal entry.

Dr Impairment losses ac PL account Cr Asset account ac Balance sheet account If the asset is carried at revalued amount impairment loss is treated as a reduction in revaluation gain. Debit Profit or loss or Capital Account. Goodwill is tested at least once a year for impairment o Compare assets carrying amount to its recoverable amount Fair value cost to sell OR Value in use o Goodwill emerges during consolidation elimination entry so impairment loss is done on consolidation adjustment entry Journal entry o Dr Impairment loss.

The double entry for recording the loss is. Value of investee business 220000 25 880000 Book value of underlying assets 770000 Goodwill 880000 - 770000 110000 Investor share 25 x 110000 27500. Dr Revaluation surplus BS account.