Beautiful Work Income Tax Treatment In Cash Flow Statement

Income tax paid Net of tax refund received D xxx Cash flow before extraordinary items C-D E xxx.

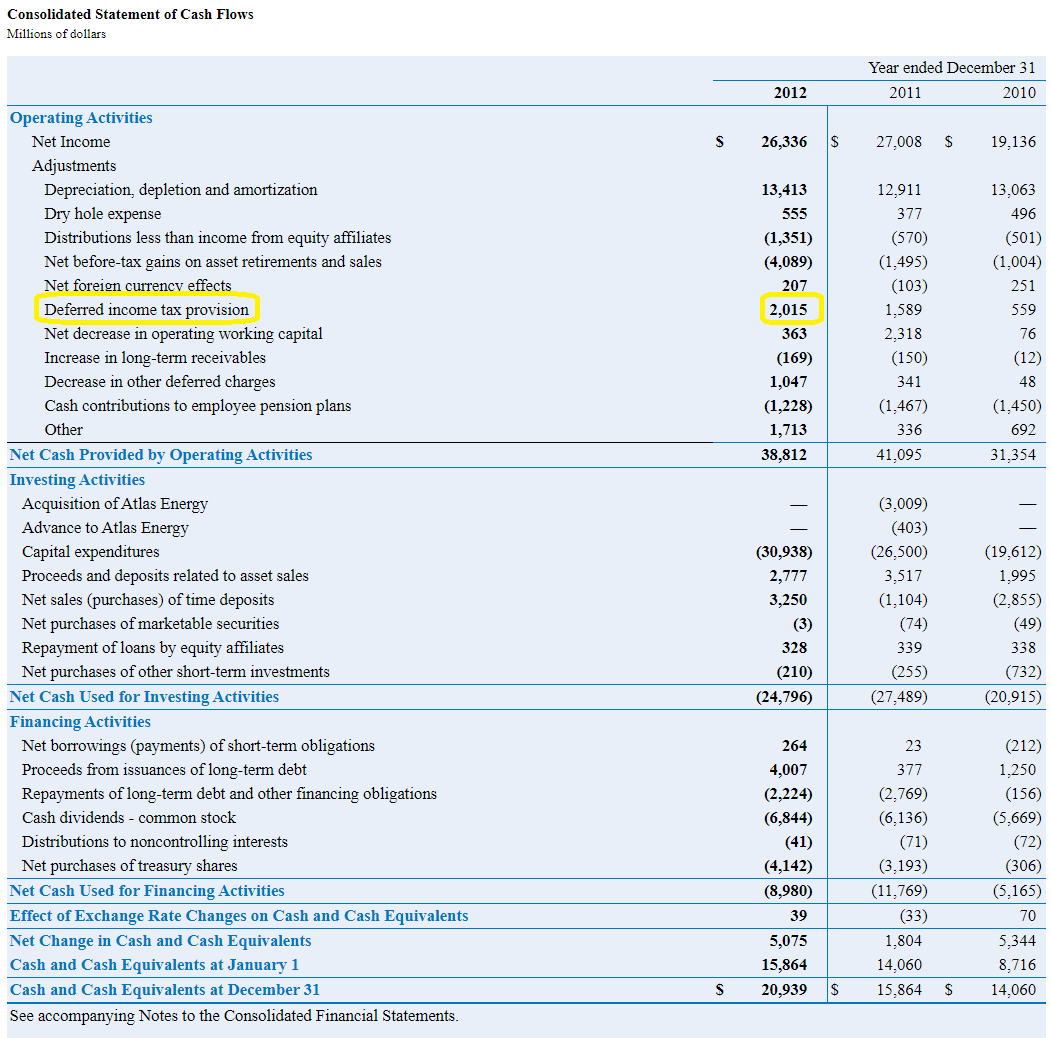

Income tax treatment in cash flow statement. A cash flow statement discloses net increase or decrease. Hence refund of income tax is shown under cash from operating activities. Increase in deferred tax asset will result as cash outflow so it will adjust as negative side.

The tax paid in the year can be calculated by taking the opening balance of tax payable in the statement of financial position adding the tax charged in the income statement and deducting the closing balance of tax. On SOPL Loss before tax 4300 Income tax 500 Loss for the year 3800 Other comprehensive income Revaluation surplus on PPE 2000. Deferred Tax on Statement of Cash Flow.

Similarly deferred tax is a non-cash item and shall be treated accordingly in the operating activities section of the cash flow statement. Provisions of AS 3 on Treatment of Certain Items. However as the ending balance is only CU 16000 we can conclude that the amount of income tax paid must have been CU 25000.

Income and Cash Flow Statements The income statement or profit and loss statement also lists expenses related to taxes. Provision for Tax in Cash Flow Statement 1 If the provision for taxation account appears only in the balance sheet. As prescribed by the AS 3 there are two methods which can be used to prepare cash flow statement Indirect method and Direct method.

A companys EBIT --also known as its earnings before. As prescribed by the AS 3. If we prepare a statement of cash flow using the direct method the deferred tax will not show in operating activities as it is not a cash transaction.

A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference. Also for statements of cash flows only use the actual amount of tax paid or received. 2any other tax expenses paid ie capital gain paid or DDT paid should be shown as part of that related activity.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)