Recommendation Loss On Disposal Of Non Current Assets

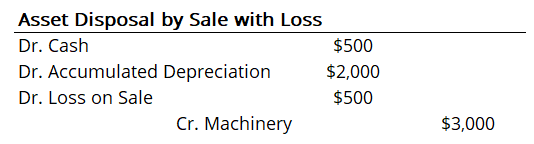

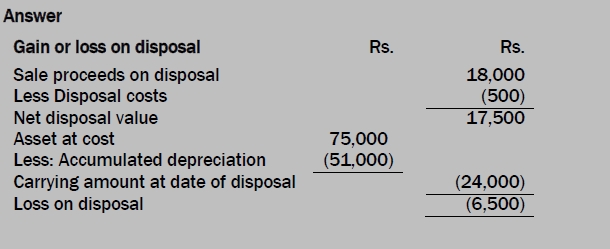

The company also experiences a loss if a fixed asset that still has a book value is discarded and nothing is received in return.

Loss on disposal of non current assets. Lets consider the same situation as in scenario 2 but the selling price was only 500. 521 Gains losses on non-current assets held for sale not classified as discontinued transactions. It is not necessary to keep an asset until it is scrapped.

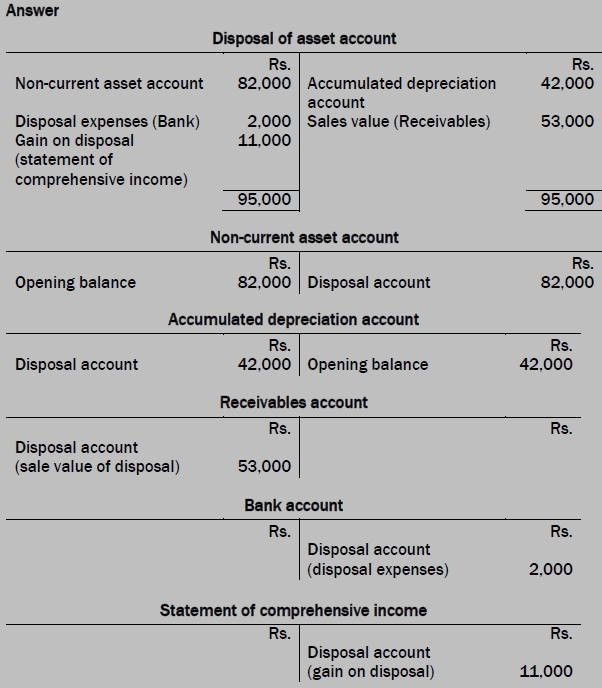

Gains Losses in Non-current Assets Held for Sale. Part exchange allowance Instead of receiving sales proceeds as cash a part exchange allowance could be offered against the cost of a replacement asset. Thus there was a loss on the sale.

Here are the options for accounting for the disposal of assets. All goods are sold at prices calculated at 15 times the cost of goods sold. On the disposal of asset accounting entries need to be passed.

No proceeds fully depreciated. 9 Disposal of non-current assets. In accordance with prudence and matching concept.

The assets used in the business can be sold anytime during their useful life. Depreciation is the loss of noncurrent assets and is charged to spread the cost of an asset over its useful life. Find profit or loss on depreciation and make journal entries to record the disposal.

It had been acquired three years ago at a cost of 180 000. The journal entries should be adjusted accordingly. The depreciable amount is the cost of the asset less its residual value.