Fine Beautiful Restaurant Industry Financial Ratios

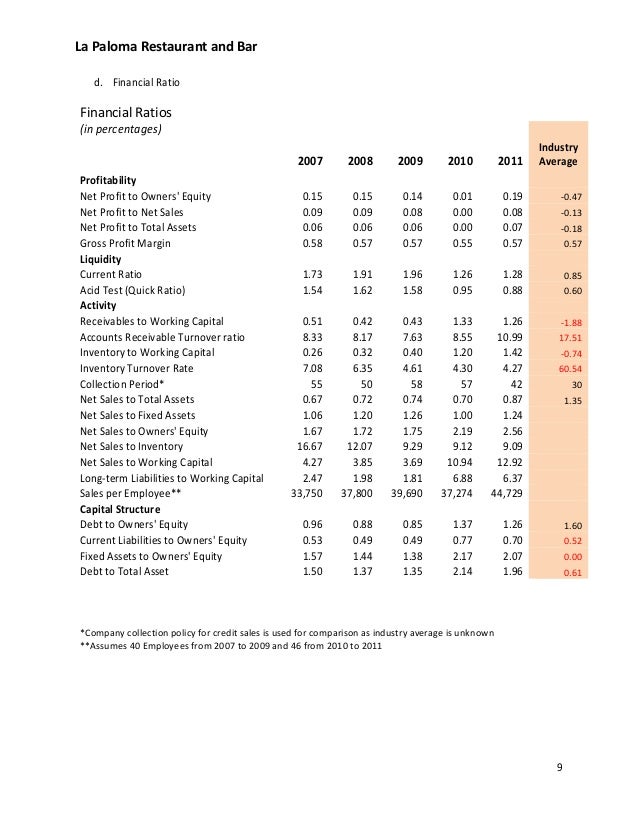

22 rows Debt-to-equity ratio.

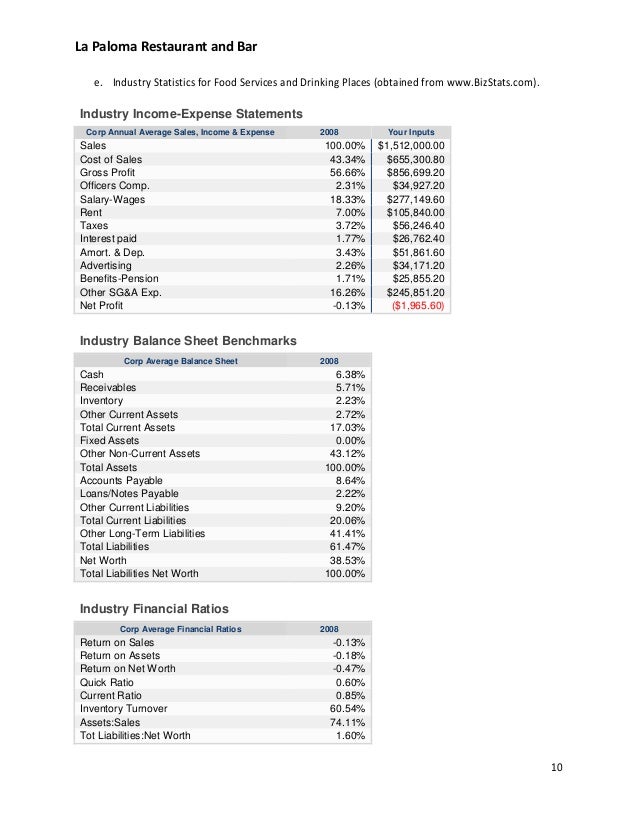

Restaurant industry financial ratios. It looks at valuation ratios profitability ratios dividend yields Growth rates and Returns. The restaurant industry is projected to employ 153 million people in 2019 about one in 10 working Americans. OPERATIONS RESTAURANT BENCHMARKS Food cost percentage.

From the left column select Reports Ratio Comparison Report for company industry sector and SP 500 ratios. 22 rows Solvency Ratios. This ratio ideally is between 35-45 depending on the involvement of the managers in the activity of the restaurant.

The first and most fundamental restaurant rule of thumb is every independent restaurant is unique However rules of thumb regarding the financial and operational aspects of restaurants can provide a valuable starting point for evaluating and understanding the financial feasibility and performance of proposed and existing restaurants. More than 9 in 10 restaurants have fewer. 8 days ago Quick Ratio Comment On the trailing twelve months basis Restaurants Industrys Cash cash equivalent grew by 7721 in the 4 Q 2020 sequentially faster than Current Liabilities this led to improvement in Restaurants Industrys Quick Ratio to 062 in the 4 Q 2020.

Instant industry overview Market sizing forecast key players trends. Ad Download Restaurant Industry Reports on 180 countries. The restaurant industry is expected to add 16 million jobs over the next decade with employment reaching 169 million by 2029.

On the trailing twelve months basis Despite sequential decrease in Current Liabilities Quick Ratio detoriated to 067 in the 2 Q 2021 above Restaurants Industry average. Please note NOT all company snapshot page has detailed financial results especially if the company you are looking at is UNLISTED. Full service restaurant 6 or less Quick service restaurants 5 or less Prime cost equal total food and beverage cost and labor costs Full service restaurants 65 or less Quick service restaurants 60 or less Controllable expenses 18 or less.

In the restaurant industry the current ratio reached a median of 072 FY 2019 for publicly traded companies in the US and for three-quarters of the industry the current assets are not enough to cover all short-term debt. Interest coverage ratio. Remember that not every restaurant is the same and some of these KPIs will not relate to some restaurants.

/GettyImages-1035408114-660f2907ceff45728346925a4b8c18a9.jpg)