Perfect Reverse Acquisition Financial Statements

Issued Financial Statements Are Required to Be Retrospectively Adjusted 43 1638 Measuring Significance When a Business Acquisition Is Consummated or a Probable Business Acquisition Is Contemplated After a Reverse Acquisition or a Reverse.

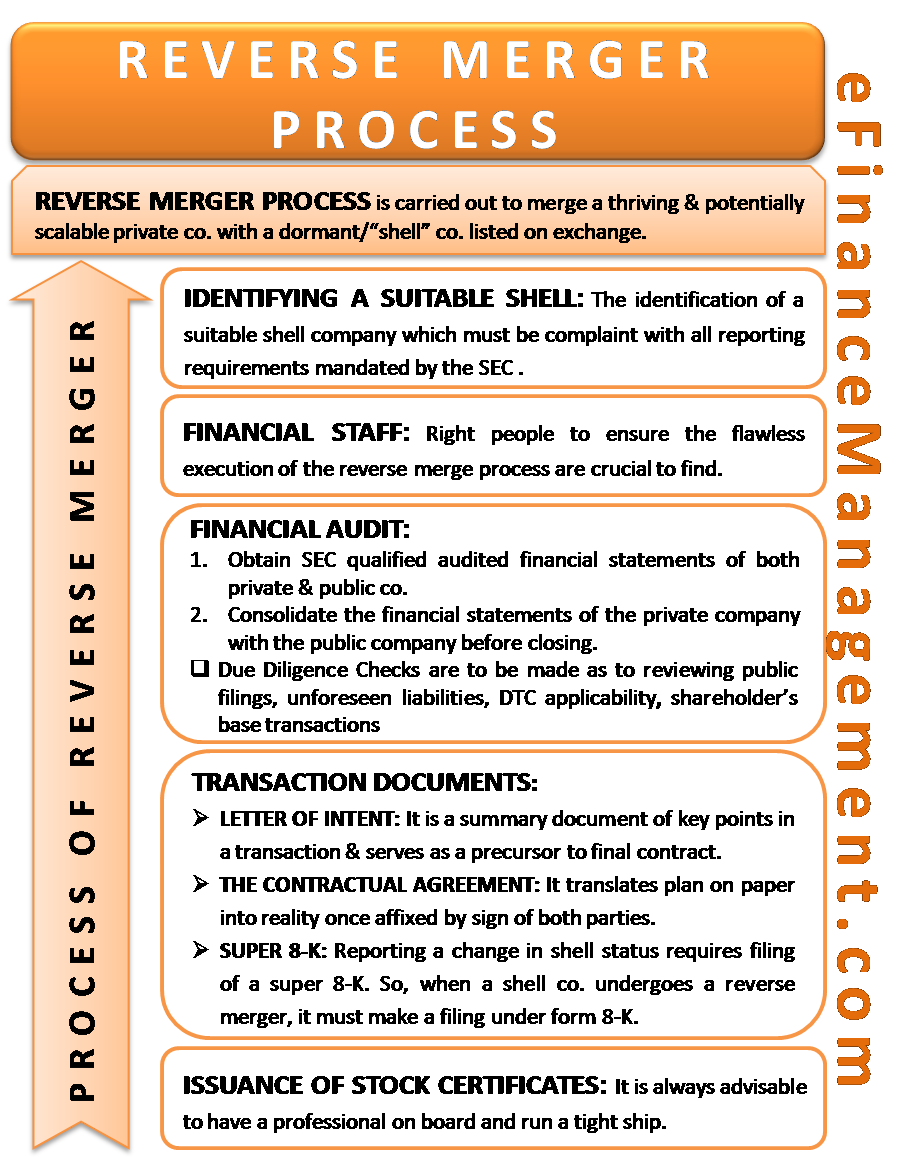

Reverse acquisition financial statements. If an acquisition closes after year-end but. Accordingly IFRS 10 requires it to prepare consolidated financial statements. Financial statements of the accounting acquirer the legal acquiree and S-X Article 11 pro forma financial information giving effect to the reverse acquisition should be filed in an Item 901 Form 8-K when available but no later than 71 calendar days after the date that the initial Form 8-K reporting the transactions must be filed that is the date which is 4 business days after the transaction is.

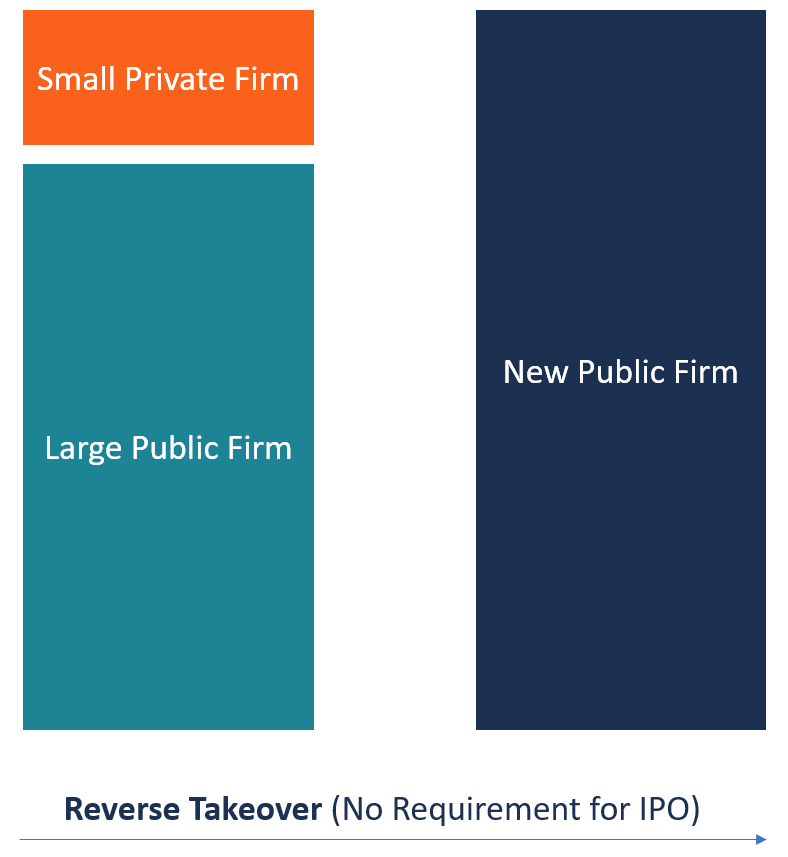

A reverse acquisition arises in a business combination where the acquired entity or its owners controls the combined entity and is identified as the acquirer under IFRS 3. Acquirer in a reverse acquisition. Item 303 of Regulation S-K which governs the disclosure requirement for Managements Discussion and Analysis of Financial Condition and Results of Operations requires as part of this disclosure that the registrant identify any known trends or any known demands commitments events or uncertainties that will result in or that are reasonably likely to result in the registrants liquidity.

In the included scenario a private operating entity arranges for a public entity to acquire its equity interests in exchange for the equity interests of the public entity. November 10 2011 at 859 AM statements for a full fiscal year commencing on a date that is after the date of the filing of all information required to be filed about the reverse merger. Option to retest significance if new 10-K is filed before 8-KA.

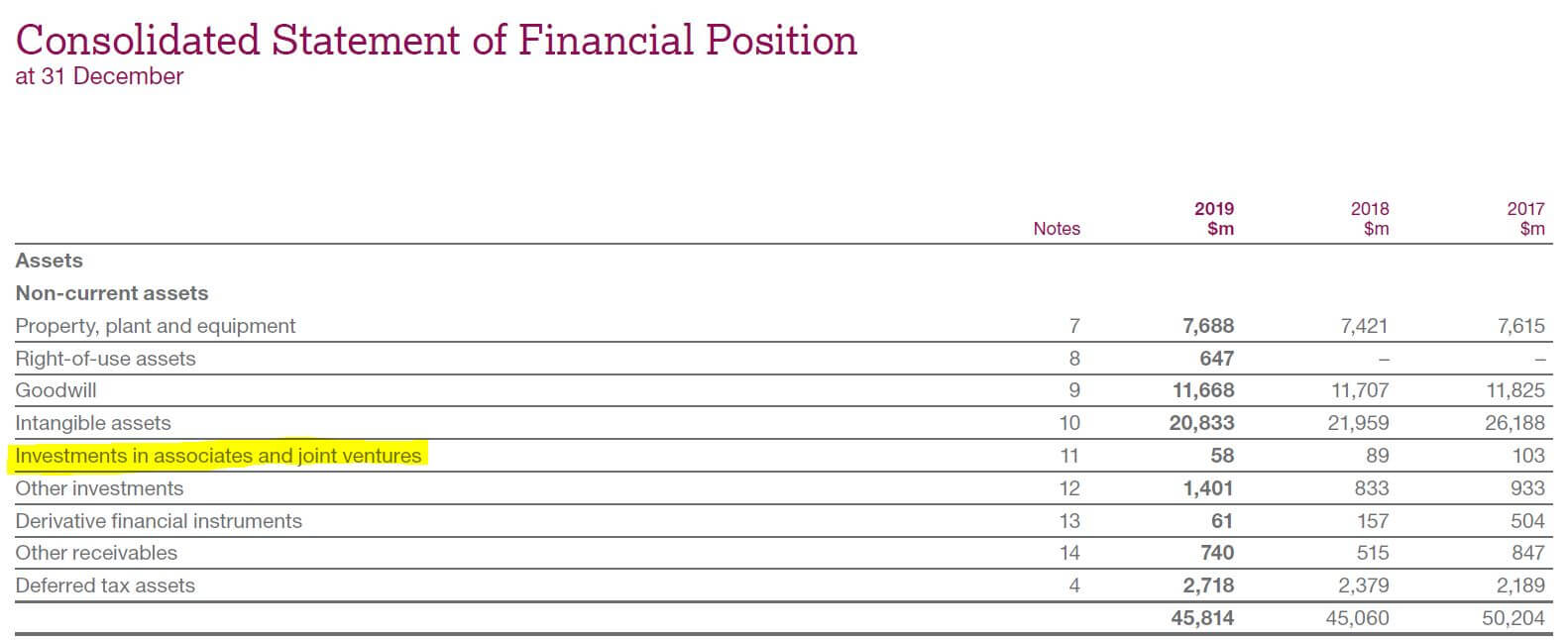

Consolidated financial statements prepared following a reverse acquisition are issued under the name of the legal parent accounting acquiree but described in the notes as a continuation of the financial statements of the. In our view these consolidated financial statements should be prepared using reverse acquisition methodology but without recognising. In our view these consolidated financial statements should be prepared using reverse.

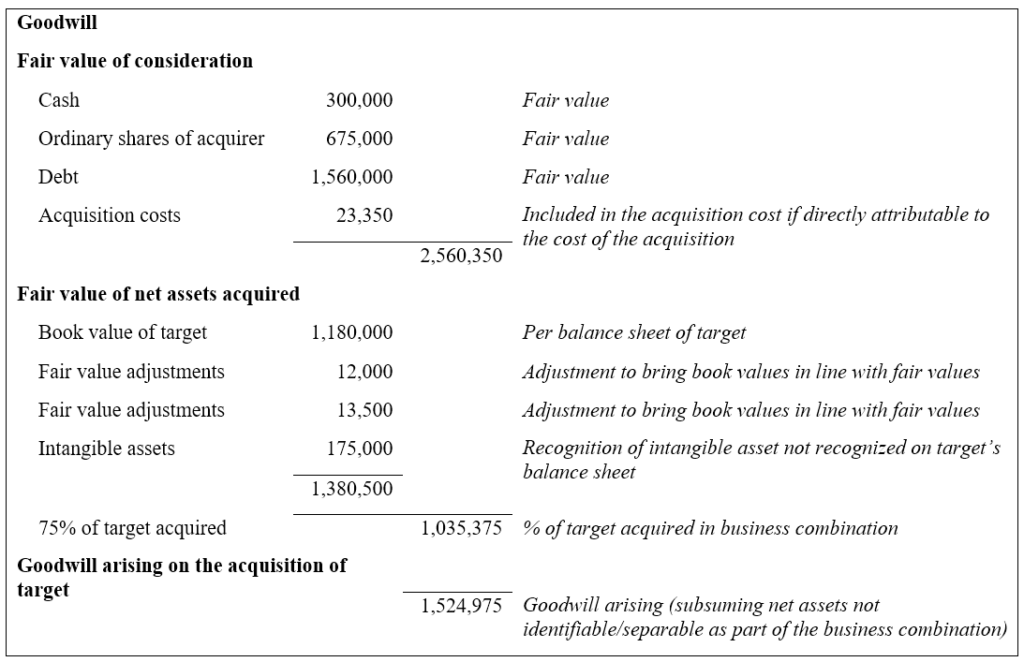

The acquisition closed on February 5 2010 at which time 100 of the outstanding shares of ACS common stock were converted into a combination of 4935 shares of Xerox common stock and 1860 in cash for a combined value of 6040 per share or approximately 60 billion based on the closing price of Xerox common stock of 847 on date of closing. In our view these consolidated financial statements should be prepared using reverse acquisition methodology but without recognising goodwill. Accounting when the transaction is a business combination.

When the listed company is the accounting acquiree and is also a business for IFRS 3 purposes IFRS 3s reverse acquisition approach applies in full. Accordingly IFRS 10 requires it to prepare consolidated financial statements. Financial statements give effect to the merger of a wholly-owned subsidiary of the Company with and into JPI in a transaction accounted for as a reverse acquisition with JPI being deemed the acquiring company for accounting purposes.

:max_bytes(150000):strip_icc()/dotdash_INV_final_An_Introduction_to_Reverse_Convertible_Notes_RCNs_Jan_2021-01-f791fb23904d43a18587ad732101bbb0.jpg)