Heartwarming The Summary Of Significant Accounting Policies Should Disclose The

Both IFRS and US.

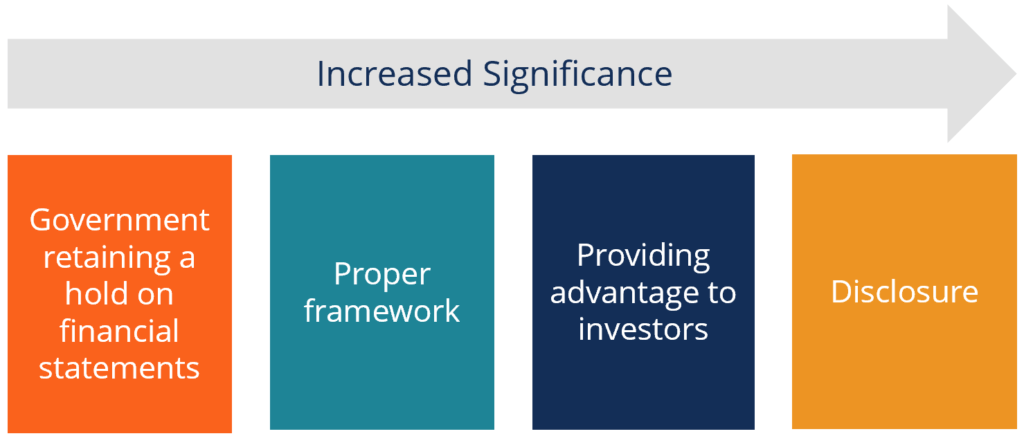

The summary of significant accounting policies should disclose the. Provide accounting policy disclosures that are more useful to primary users of financial statements. 122An entity shall disclose in the summary of significant accounting policies or other notes the judgements apart from those involving estimations see paragraph 125 that management has made in the process of applying the entitys accounting policies and that have the most significant effect on the amounts recognised in the financial statements. Likewise both IFRS and US.

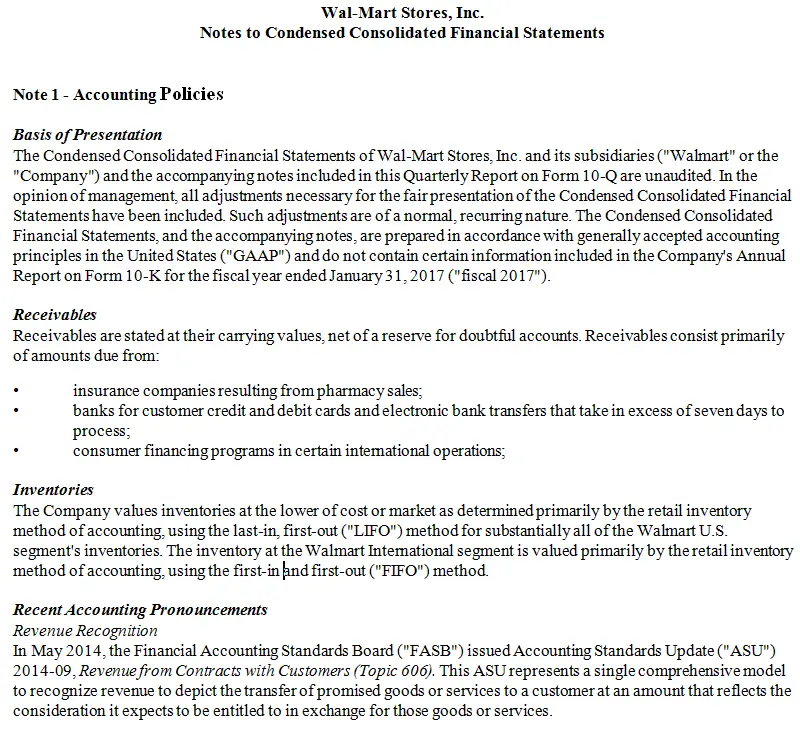

The summary of significant accounting policies should disclose the. TF ASC 235 states that the composition of plant assets should be included in the summary of significant accounting policies. Future minimum lease payments in the aggregate and for each of the five succeeding fiscal years.

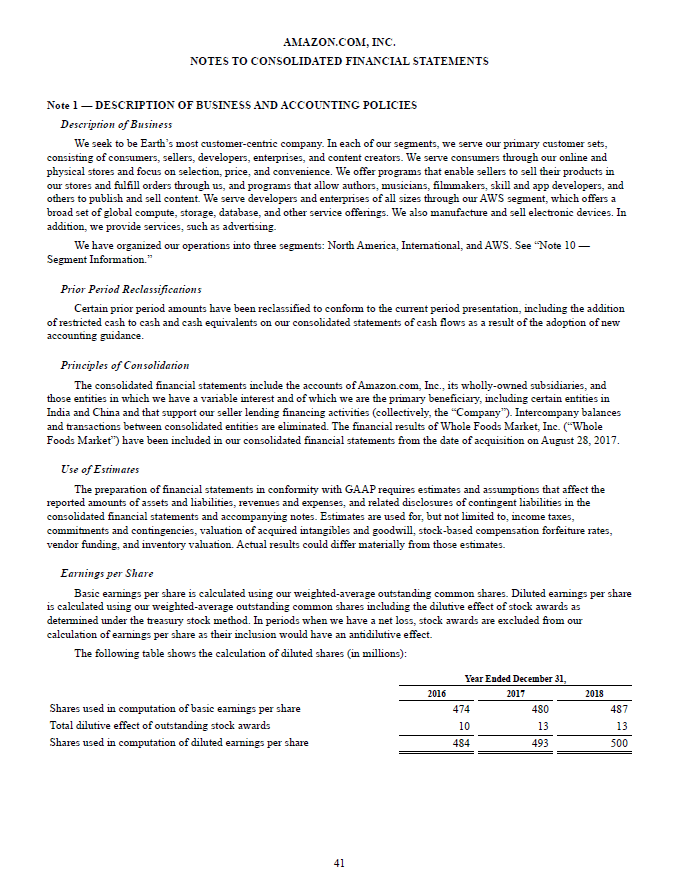

Allowance for uncollectible accounts7. Pro forma effect of retroactive application of an accounting change. Both for-profit and non-for-profit organization should disclose the details of their significant accounting policies that are important in determining the financial position changes in the financial position or results of operations of the organization.

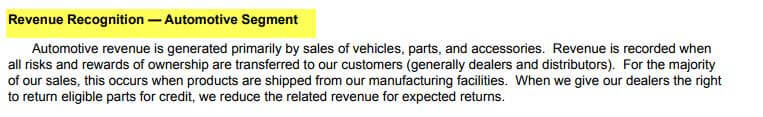

A the measurement basis or bases used in preparing the financial statements. In deciding whether a particular accounting policy shall be disclosed management considers whether disclosure will assist users in understanding how transactions other events and conditions are reflected in the reported financial performance and financial position. A summary of accounting policies preferably should be included in a separate section preceding the notes or in the initial note.

In the long-term construction contracts area GAAP allows both the completed contract and percentage of completion methods. IAS 1 requires entities to disclose their significant accounting policies. This summary is usually placed at or near the beginning of the footnotes.

What to disclose Disclosures need to identify the specific judgements that management has made in a manner that enables the reader to understand their impact. Accounting Policies Changes in Accounting Estimates and Errors to develop and apply an accounting policy. GAAP require the disclosure of estimates made in the preparation of financial statements.

/paper-with-title-international-financial-reporting-standards--ifrs---850740234-6e303822ed5e4800b523b0ac24db396c.jpg)