First Class Coca Cola Financial Analysis 2019

Moreover Coca-Cola and Fanta have a huge fan following than other beverage names in the industry.

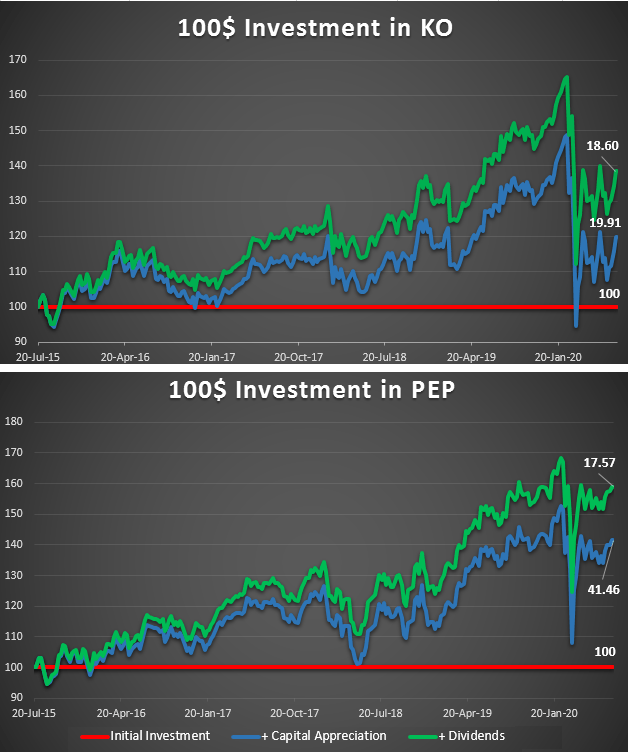

Coca cola financial analysis 2019. Ad Find Coca Cola Coca Cola. Disaggregation of ROE ROA and Net Profit Margin. Coca-Cola has maintained its 2019 outlook with expectations of organic sales growth of at least 5.

Income from continuing operations before income taxes Amount of income loss from continuing operations including income loss from equity method investments before deduction of income tax expense benefit and income loss attributable to. A financial analysis for Coca-Cola. An approach to decomposing Coca-Cola Cos return on equity return on assets and net profit margin ratio as the product of other financial ratios.

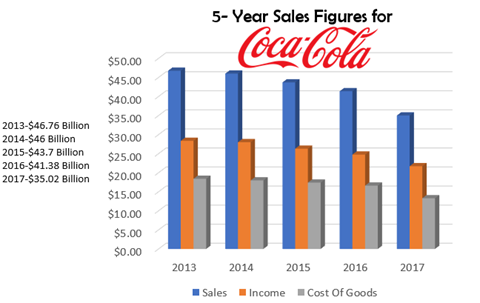

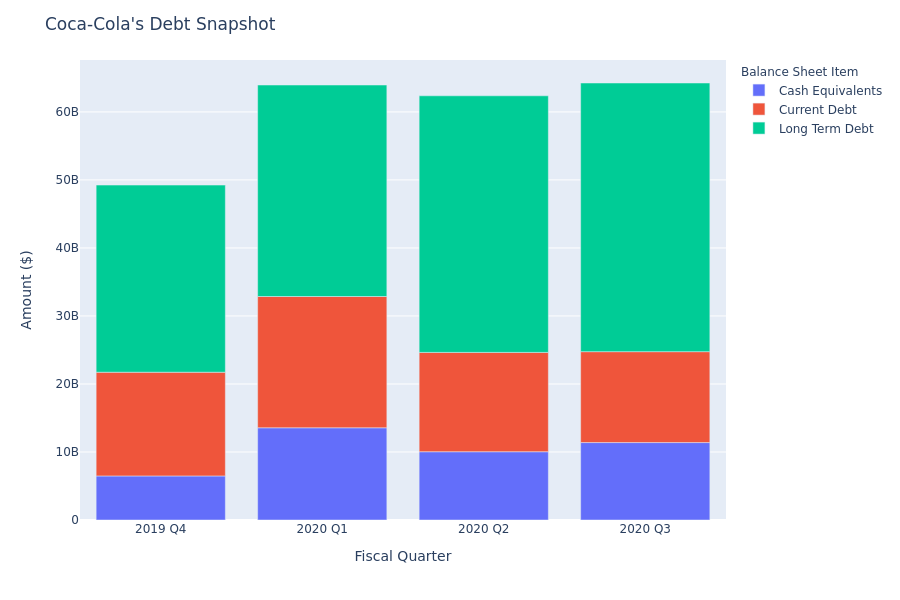

2016 2017 2018 and 2019 in order to conduct a financial analysis using the liquidity activity debt and profitability ratios. Important financial ratios calculated includes the current ratio cash ratio quick ratio net working capital ratio total asset turnover ratio fixed asset turnover ratio days sales outstanding inventory turnover accounts receivable turnover working capital turnover accounts payable turnover return on assets return on equity profit margin gross profit margin and several more common ratios used by investors and students alikeCoca. Analysis of Financial Statements Coca Cola Company 2019 A.

Having an estimated brand value of 7996 billion it. Largest Brand Valuation Coca-Cola is listed as the 3rd Best Global Brand on Interbrands annual ranking. Financial Data of Coca Cola Company.

Ad Find Coca Cola Coca Cola. Company profile financial statement liquidity ratio current ratio cash ratio quick ratio profitability efficiency short term activity long term activity solvency DuPont analysis and historical enterprise value HEV. In this summarized report the author researched Coca-Colas Coke 10k Coca-Colas 2020 10k annual report.

Ten years of annual and quarterly financial ratios and margins for analysis of CocaCola KO. Coca-Cola 2020 Financial Statements and Financial Ratios. 95 increase in gross profit69 increase in operating income75 increase in EBIT76 increase in income before income taxes72 increase in consolidated net income72 increase in net income attributable to shareholders.