Ace Income Statement Accounts Are Also Known As Temporary Accounts

Income statement accounts are also known as which of the following.

Income statement accounts are also known as temporary accounts. Nominal accounts also known as temporary accounts are the accounts that will close at the end of accounting period. As a result the nominal accounts are also referred to as temporary accounts. The Dividend account is an.

All of the income statement accounts are classified as temporary accounts. Taking the example above total revenues of 20000 minus total expenses of 5000 gives a net income of 15000 as reflected in the income summary. Journal entries are made to transfer the dividends to retained earnings.

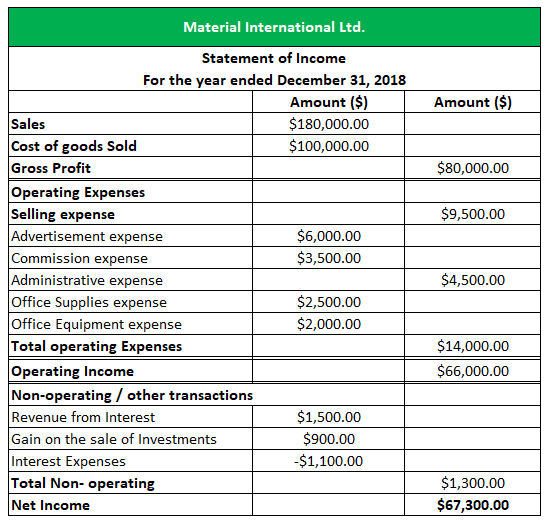

An income statement or profit and loss account also referred to as a profit and loss statement PL statement of profit or loss revenue statement statement of financial performance earnings statement statement of earnings operating statement or statement of operations is one of the financial statements of a company and shows the companys revenues and expenses during a particular period. In accounting for a corporation the Retained Earnings account is closed at the end of each accounting period. It is an account used to record income gains expenditure and losses in a particular accounting period of time.

It includes all accounts in the income statement including owners withdrawal. The nominal account is an income statement account expenses income loss profit. The balances in these accounts should increase over the course of a fiscal year.

Temporary accounts are income statement accounts such as revenue accounts expenses gains dividend accounts and loss accounts. Likewise How can you determine if a given account is permanent or temporary. Examples of Temporary Accounts.

Temporary accounts are also referred to as nominal accounts. Balance sheet accounts are also known as which of the following a Nominal from ACCTG 3600 at University of Utah. Revenue expense and dividend accounts are temporary accounts.