Top Notch Types Of Financial Statement Frauds

Recording expenses in the wrong period.

Types of financial statement frauds. Understanding some of the different types of financial fraud can help watchful individuals identify fraudulent schemes and report them to the proper authorities. Inadequate provisions for sales and returns. Conflict-of-Interest Related Party Transaction.

Probably the most common financial statement fraud is the manipulation of sales revenue figures. One of the most basic forms of financial statement fraud is the overstatement of revenue. Fraud over Financial Reporting.

There are different forms of financial statement fraud that companies might commit. Here are three of the most common types of financial statement fraud to be on the alert for. Insider trading is a kind of financial fraud.

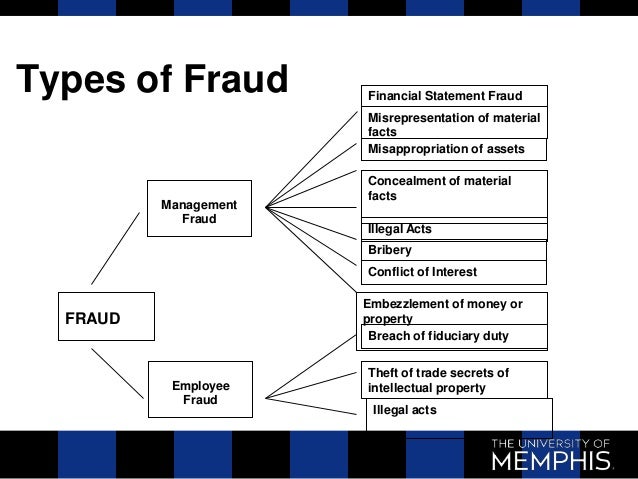

TYPES OF FRAUD The forensic accountant could be asked to investigate many different types of fraud. There are different types of financial statement fraud taking place in organizations briefly according to Kwok 2005 they can be categorized as follows. Skimming Sales Receipts Cash Frauds.

There are many ways that management could manipulate the figure in the Financial Statements. How to Detect and Prevent Financial Statement Fraud 123 Percentage analysis including vertical and horizontal analysis Ratio analysis Cash flow analysis Percentage AnalysisVertical and Horizontal There are traditionally two methods of percentage analysis of financial statements. Fraud Over the Financial Statements is done by management manipulating the financial figure in the financial statements.

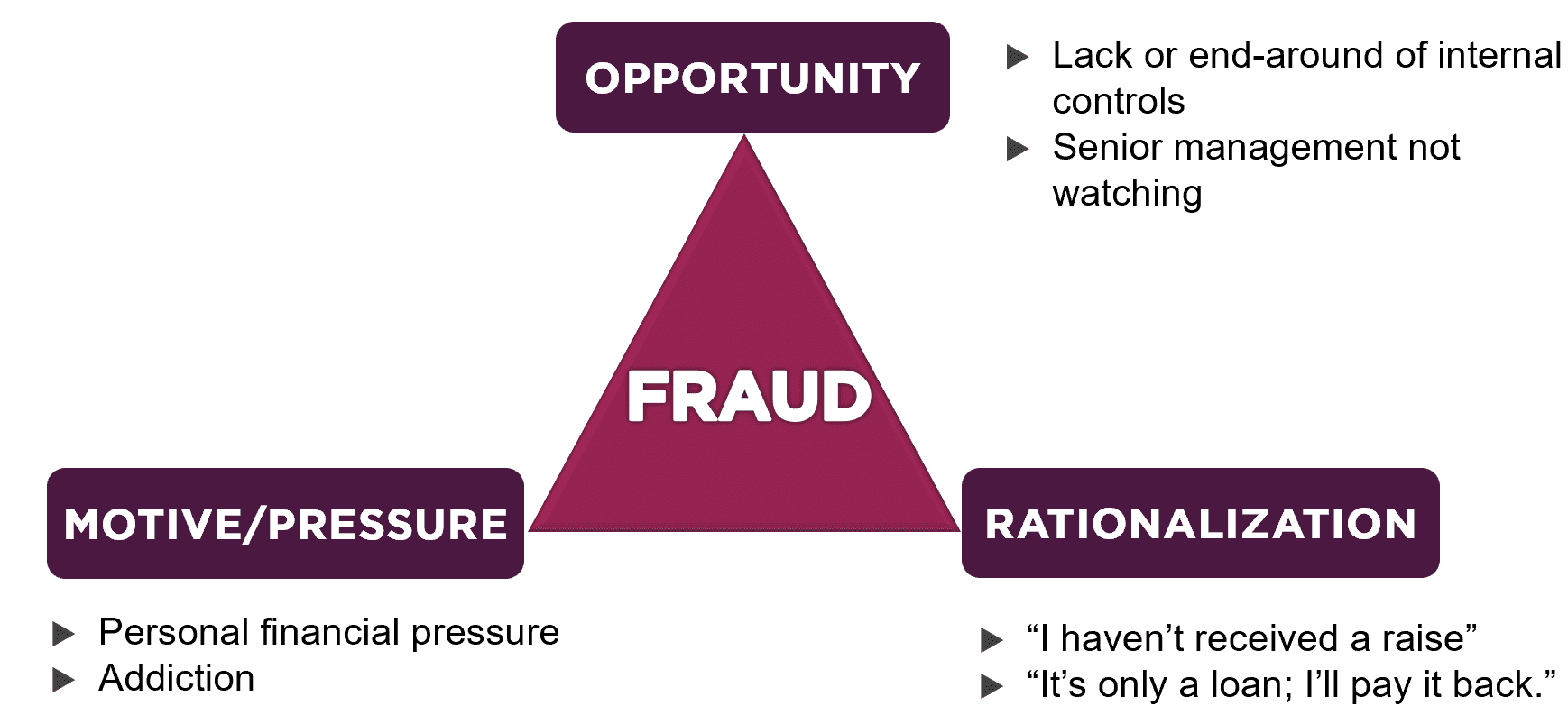

Overstating revenues by recording future expected sales Inflating an assets net worth by knowingly failing to apply an appropriate. The errors in general may be of following types. Fraud comes in many forms including bribery kickbacks billing fraud payroll fraud and more.