Unbelievable The Statement Of Cash Flows Classifies Cash Receipts And Payments

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

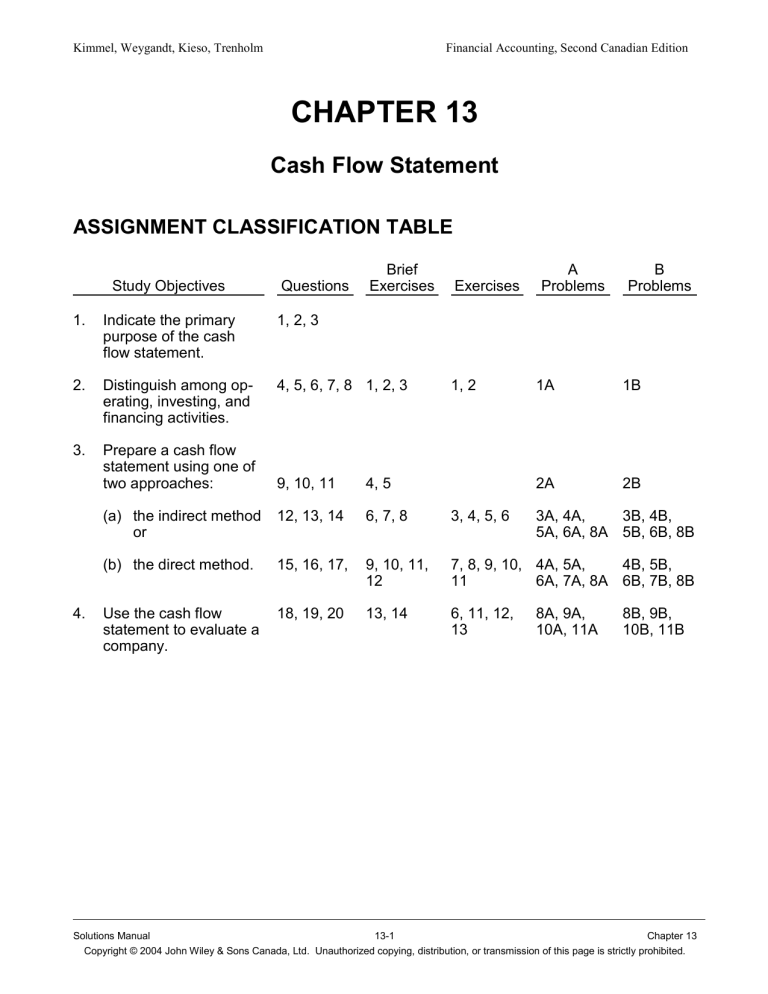

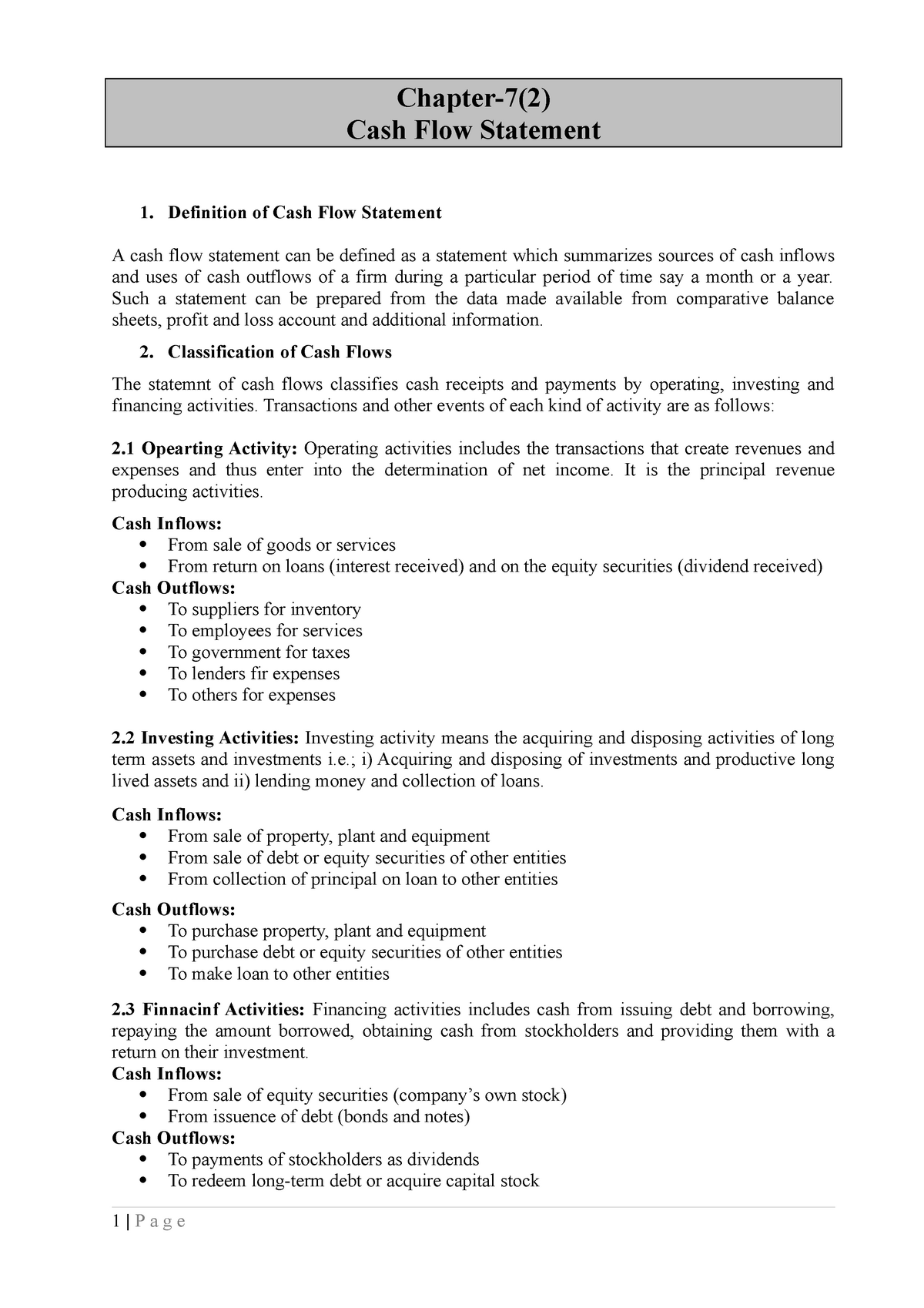

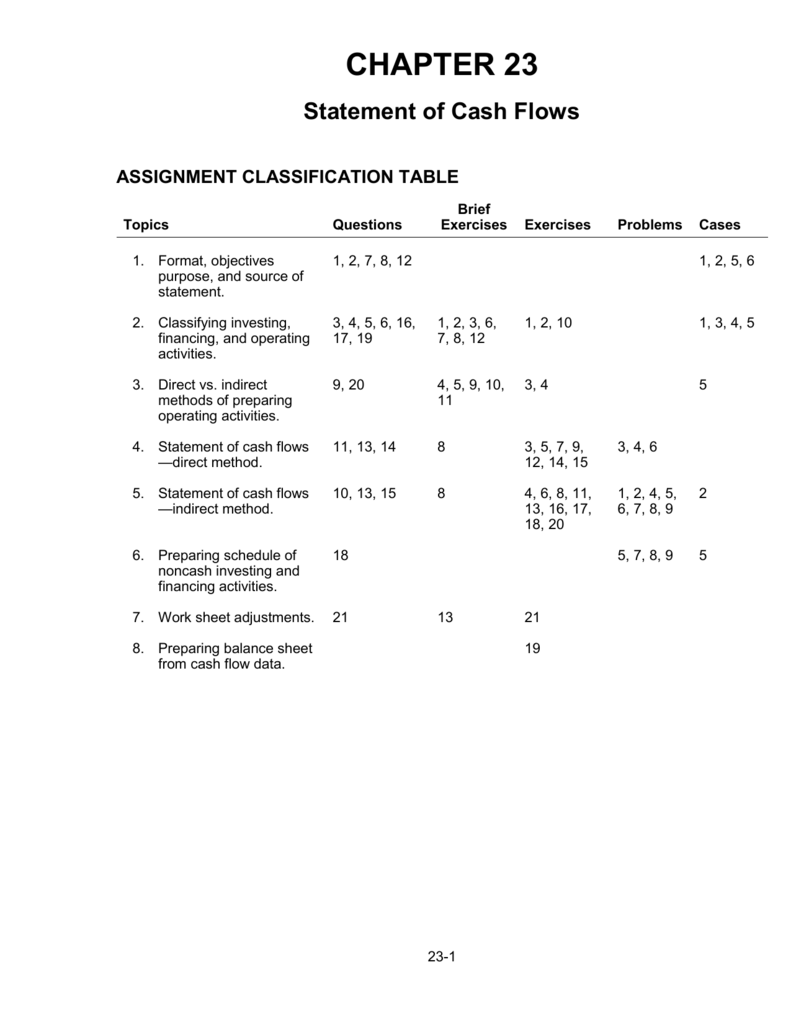

Look at Exhibit 2 to see how activities can be classified to prepare a statement of cash flows.

The statement of cash flows classifies cash receipts and payments. With either method the investing and financing sections are identical. 3 Main Components in Statement of Cash Flows. Capital and related financing.

The direct method shows the major classes of gross cash receipts and gross cash payments. Statement of cash flows provides important information for users to assess the companys ability to generate cash and cash equivalents. The Statement of Cash Flows classifies cash receipts and cash payments by these activities financing operating and nonoperating.

The statement of cash flows classifies cash receipts and payments as operating nonoperating and extraordinary activities. The statement of cash flows classifies cash receipts and cash payments by these activities. 23Examples of cash receipts and payments referred to in paragraph 22a are.

The main purpose of the statement of cash flows is to provide financial information to the users regarding the cash receipts and cash payments of the company. Investing financing and nonoperating. Which is an example of a cash flow from an operating activity.

False TF The sale of land for cash would be classifies as a cash inflow from an investing activity. The statement of cash flows classifies cash receipts and disbursements as operating investing and financing cash flows. Investing financing and operating.

The sale of land for cash would be classified as a cash inflow from an investing activity. The only difference is in the operating section. The statement of cash flows classifies cash receipts and cash payments as resulting from investing financing or operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)